Power Law in Cryptocurrency

In general, Power Law is a relationship between two quantities in which a change in one causes a proportional change in the other. In this case, the relationship is expressed using a power function. The most striking example: the relationship between the length of a side of a square and its area. So, if the first parameter is increased by five times, the second will increase by 25 times, that is, five to the second power.

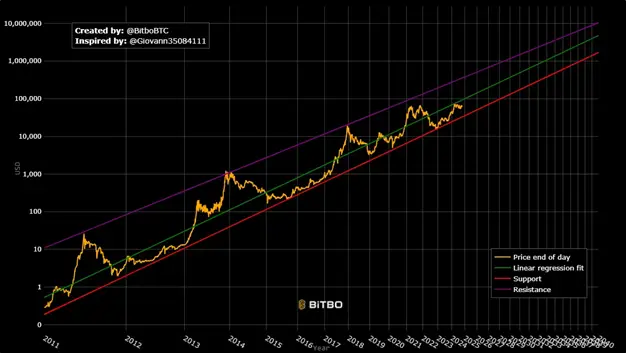

In Bitcoin, Power Law is used in relation to the relationship between price and time. It was first identified in 2018 by physicist and financial analyst Giovanni Santostasi. The results were published on Reddit.

Interestingly, in his studies, Santostasi used a logarithmic scale (that is, the length of the segments on the graph reflects the logarithm of the ratio of values, and not their difference), for both the X and Y axis, which is quite non-standard. Santostasi believed that Power Law was also applicable to assessing other parameters of Bitcoin, such as hashrate and the number of addresses.

How to put Power Law into practice

A schedule is created for this. Three lines are drawn on it: the central regression line, which is a reflection of the power law, the upper resistance line and the lower support line. The last two are an exact copy of the central line. They almost perfectly capture all the lows and highs of Bitcoin – there was only one exception, in 2013.

Source: charts.bitbo.io/long-term-power-law/

The central line is calculated according to the formula developed by Giovanni Santostasi:

Settlement price = A * number of days from genesis block

-

A is a constant (constant value) equal to 10-17;

-

genesis block – the first block of Bitcoin, generated on January 3, 2009;

-

n – 5.8.

In this way, it is possible to identify the minimum and maximum possible, as well as fair prices of Bitcoin at a certain point in time. For example, on October 16, the real value of BTC is a little more than $67,000. This is well within the Power Law boundaries: the lower one is $34,812.99, and the upper one is $353,916.44. At the same time, the fair price for Santostasi on October 16 is $92,821.66.

Long-term BTC price forecast

At the beginning of 2030, the price of Bitcoin should range from $174,500 to $1.49 million. Thus, in just six years, the minimum price will be more than double the all-time high of October this year. By the beginning of 2040, the price of Bitcoin may even reach $10 million, and should not fall below $1.6 million.

However, Giovanni Santostasi himself says that Power Law should not be used for a long-term forecast of the Bitcoin price. In 16 years, the situation should change greatly, and it will be impossible to predict what will happen.

Disadvantages of Power Law

According to the power law, the price of Bitcoin should rise almost forever, but this has never happened to any commodity in history. Santostasi himself does not argue with this, and admits that over time the Power Law regarding cryptocurrency will need to be modified.

In addition, the power law makes an assumption about the future price based on the past. The fact that this has so far given positive results may indicate not only that the model is correct, but also that the sample at 15 years old remains small. Moreover, the price variations that Power Law gives over time are becoming larger and larger, which cannot but be alarming.

Another problem is that not many people are familiar with the double logarithmic scale. It is more often used in physics than in economics. In this case, a single logarithmic scale is much more often used, but time is usually calculated linearly.

It is also worth noting that the power law only focuses on price and time and ignores economic variables such as supply and demand. Due to this, the data may be distorted.

Conclusion

So far, Power Law has been fairly accurate in describing Bitcoin’s price fluctuations. However, there are still a number of questions about how the values for the formula were selected, not to mention the fact that a constant increase in the price of BTC is impossible.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.