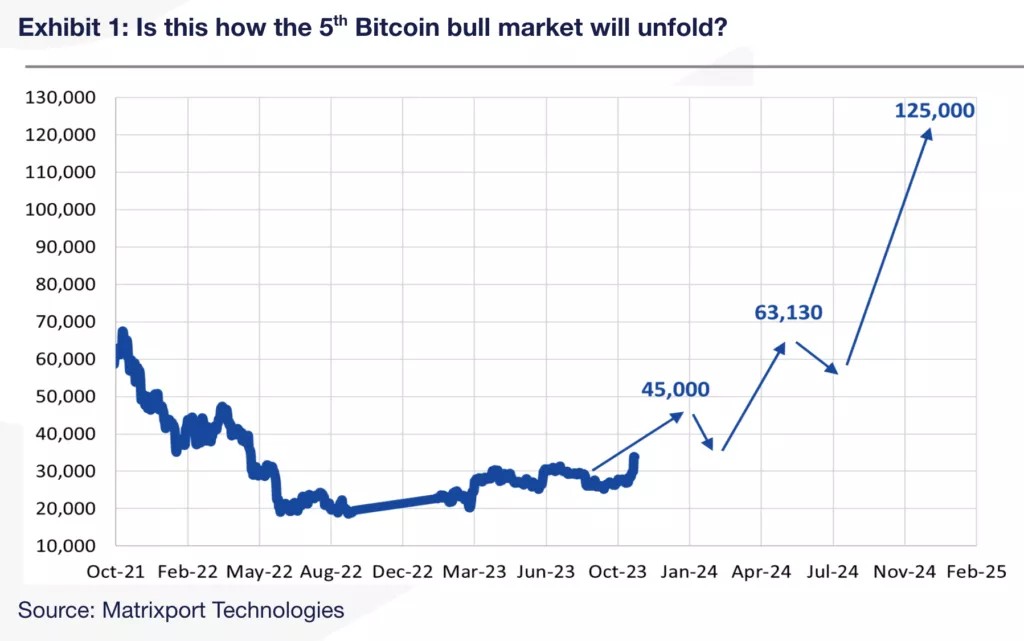

The fifth bull market for digital gold officially began on June 22, 2023, and by December 2024, quotes could reach $125,000. This is the conclusion of Matrixport analysts.

Matrixport analysis pointed out that the fifth Bitcoin bull market officially began on June 22, 2023. It is estimated that Bitcoin may reach $125,000 by December 2024. The fifth Bitcoin bull run was driven primarily by expectations of institutional adoption and was driven by an…

— Wu Blockchain (@WuBlockchain) October 26, 2023

Experts associated the start of a new growing trend with the update of the annual maximum (June 22, 2023).

According to their calculations, after this signal was triggered, the return on investment in Bitcoin averaged +310%. Based on these figures, analysts estimate that the price could reach $125,000 by December 2024.

They named the optimal entry point 14-16 months before the halving – in October 2022, when Bitcoin was trading at $17,000. At that time, experts recommended opening a long-term long.

As drivers of the expected growth, experts pointed to expectations of institutional adoption of the first cryptocurrency and the instability of the US debt-to-GDP ratio.

According to experts, institutions saw Bitcoin as a “safe haven asset” like gold and US Treasuries. They began to consider it to diversify their investment portfolio.

The first bull market in 2011 was sparked by the adoption of Bitcoin as a new payment mechanism. The second was triggered by China when digital gold gained acceptance as an alternative form of money.

The third cycle saw the rise of ICOs as a new means of creating and financing companies. Fourth — characterized by a “DeFi summer,” followed by a craze for NFT issuance.

Previously, Matrixport predicted an increase in the price of the first cryptocurrency to $42,000-56,000 as a result of approval SEC to launch a spot Bitcoin ETF. CryptoQuant received values of $50,000-73,000.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.