According to the analyst, from the moment of launch of the spot-bitcoin -etf, the asset course has become much more predictable. This, in turn, has a positive effect on the adoption of the first cryptocurrency by managing companies.

According to the expert, the governments and large corporations became key players who form the demand for the first cryptocurrency. Thanks to this, the price of bitcoin increased by more than 27%. Hawgan drew attention to the fact that bitcoin is traded near the historical maximum under a very conservative policy of the US Federal Reserve (Fed).

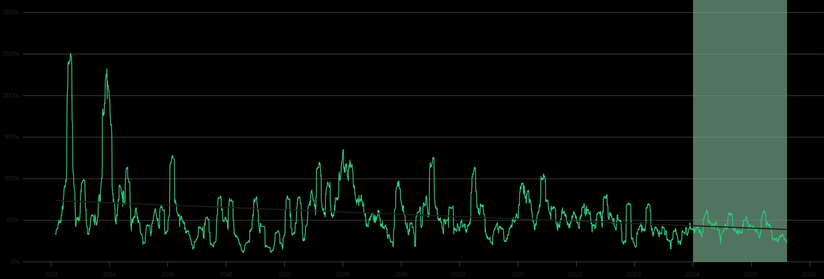

With a decrease in the interest rate in September and the subsequent weakening of the US dollar, the rising price trend of the first cryptocurrency will continue again. Since there are more and more large players in the market, the volatility of the coin will fall, and there will be no sharp corrections of quotations, the analyst believes.

He also noted that the markets are not growing on good news. They grow on good news that have not yet been taken into account in price. That is, if positive information is expected and is already reflected in current assets, then its publication will not lead to a market growth. Growth occurs only when the news is better than expected.

Hawgan believes that the market as a whole underestimates the scale of the bull cycle of cryptocurrencies, but it also overlooks some factors that can play a significant role in the formation of a bitcoin trend and other cryptocurrencies in the coming months.

Earlier, Matt Hawgan said that Bitcoin will demonstrate significant growth over the next few years, violating the classic four -year halving cycle.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.