Large companies, including Visa, RAMP, Amazon

And Walmart, Over the past six months, they announced the introduction of stablecoins in:

-

cross -border payments;

-

e -commerce;

-

Credit cards.

“Stebblecoins can become a counter -balance for dedollarization initiatives of the China authorities, where digital yuan is moving as the main payment instrument. Assets, especially dependent on the US dollar, are able to reinforce its dominance in the medium -term perspective in both the traditional and digital economies, ”Messari analysts suggested.

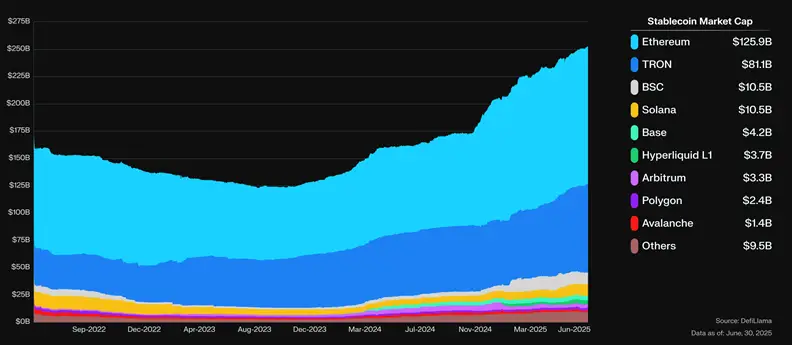

The market capitalization of the global market “Stable Coins” exceeded $ 250 billion, which contributed to a change in US legislation. Emitent Stablecoin USDT, company Tether, Continues to dominate centralized crypto -streaks and transfers in the markets of Africa and Asia, representatives said Messari.

Stablecoins will become more and more in demand in countries where annual inflation exceeds 10%, and the economic situation leaves much to be desired, Messari analysts summed up.

Earlier, the General Director of the American Crypto -Existing House Coinbase, Brian Armstrong) praised US President Donald Trump for the Genius law, which regulates the issue and turnover of stabiblcoins.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.