- META posts a 20% gain after beating fourth-quarter earnings on Friday.

- Meta Platforms raised its forecasts for the first quarter to $37 billion.

- US nonfarm payrolls for January are good, reducing the possibility of a rate cut in March.

- Mark Zuckerberg presents a buyback policy of $50 billion and a quarterly dividend of $0.50.

The actions of Meta Platforms (META) They rose 20.3% on Friday, to within one cent of $475. The large-cap social media giant saw its shares rebound like small-caps after posting a rise in advertising revenue in the fourth quarter and announcing a new dividend as well as a $50 billion buyback plan.

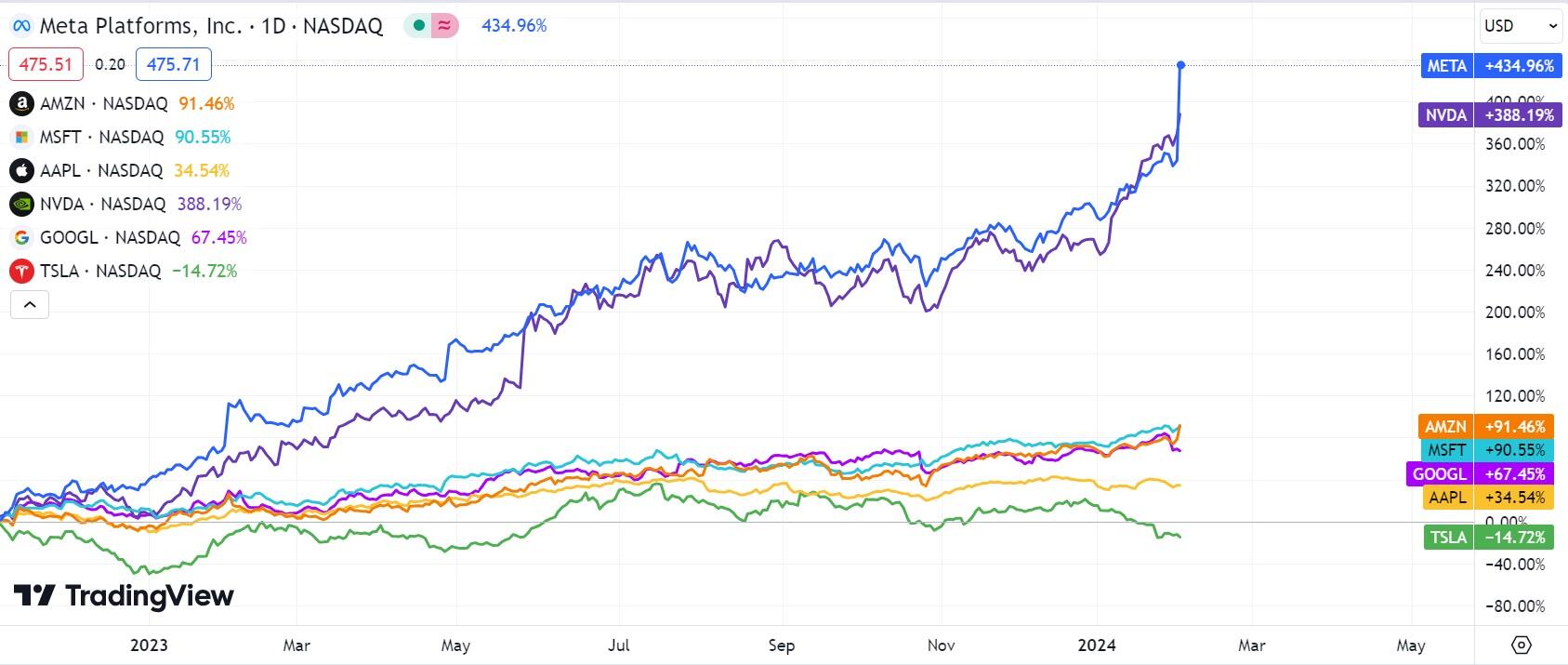

Meta is now by far the best-performing “Magnificent Seven” tech stock since bottoming on Nov. 3, 2022. With CEO Mark Zuckerberg's triumph in releasing fourth-quarter earnings to late Thursday time, shares soared as much as 22% on Friday, and META shares have gained 435% since their nadir 15 months ago. This performance even exceeds that of Nvidia (NVDA)which until now had been in a league of its own.

The broader market was much less optimistic on Friday morning due to a red-hot January nonfarm payrolls (NFP) report. The US Bureau of Labor Statistics reported that the US economy had created a seasonally adjusted 353,000 jobs, far exceeding the 180,000 figure economists had expected.

The Russell 2000, and especially the Dow Jones, reacted poorly to the tight labor market in the morning session on Friday, as it reduced expectations that the Federal Reserve (Fed) will begin cutting interest rates in March. However, most equity indices, including the S&P 500 and Nasdaq Composite, shot higher later in the day on recoveries in Meta Platforms and Amazon (AMZN). The S&P 500 gained 1.07%, while the Nasdaq Composite rose 1.74%.

Meta Platforms becomes the most magnificent of all jeans

CEO Mark Zuckerberg couldn't have dreamed of a better quarter for the social media titan. Owner of Facebook, Instagram and Whatsapp, the advertising segment of Meta Platform, which finances the entire company, brought in $38.7 billion, 24% more than a year ago.

Meta posted GAAP earnings per share (EPS) of $5.33 in the fourth quarter, beating the Wall Street consensus by $0.39. Profits of $40.1 billion beat analysts' expectations by $940 million.

Daily active users of the Meta family of apps increased 8% year-over-year to 3.19 billion in December, while monthly active users increased 6% to 3.98 billion.

However, META stock soared as it did, based largely on its guidance for the current quarter or the first quarter of 2024. Management said they now expected earnings of between $34.5 billion and $37 billion, which placed the floor of the range above the previous consensus of $33.87 billion.

Meta Platforms distributed its first quarterly dividend of $0.50 per share, which contributed to shareholder appreciation and demonstrated that management was confident in its financial balance sheet. In addition, the company increased its allocation for share buybacks by $50 billion. These two announcements have made Meta now appear much more favorable to shareholders than in previous years, when management focused entirely on investment and growth.

Nasdaq FAQ

What is Nasdaq?

Nasdaq is an American stock exchange that began as an electronic stock ticker. At first, the Nasdaq only offered over-the-counter (OTC) stock listings, but it later became an exchange as well. By 1991, the Nasdaq had grown to represent 46% of the entire US stock market. In 1998, it became the first US exchange to offer online trading. The Nasdaq also produces several indices, the most comprehensive of which are the Nasdaq Composite, which represents the more than 2,500 Nasdaq securities, and the Nasdaq 100.

What is the Nasdaq 100?

The Nasdaq 100 is a large-cap index composed of 100 non-financial companies on the Nasdaq Stock Exchange. Although it only includes a fraction of the thousands of stocks on the Nasdaq, it explains more than 90% of the movement. The influence of each company in the index is weighted based on market capitalization. The Nasdaq 100 includes companies highly focused on technology, although it also includes companies from other sectors and from outside the United States. The Nasdaq 100's average annual return has been 17.23% since 1986.

How can I trade the Nasdaq 100?

There are several ways to trade the Nasdaq 100. Most retail brokers and spread betting platforms offer Contracts for Difference (CFD) betting. For long-term investors, exchange-traded funds (ETFs) operate like stocks that mimic the movement of the index without the investor having to buy all 100 companies that comprise it. An example of an ETF is the Invesco QQQ Trust (QQQ). Nasdaq 100 futures contracts allow you to speculate on the future performance of the index. Options provide the right, but not the obligation, to buy or sell the Nasdaq 100 at a specific price (strike price) in the future.

What factors drive the Nasdaq 100?

There are many factors that drive the Nasdaq 100, but primarily it is the aggregate performance of its component companies, revealed in their quarterly and annual earnings reports. US and global macroeconomic data also contribute, influencing investor sentiment, which if positive, drives earnings. The level of interest rates, set by the Federal Reserve (Fed), also influences the Nasdaq 100, as it affects the cost of credit, on which many companies largely depend. Therefore, the level of inflation can also be an important factor, as well as other parameters that influence the Federal Reserve's decisions.

Forecast on Meta Platforms

Shares of Meta Platforms are up 435% since closing near $88 per share on Nov. 3, 2022. Friday's rally in META stock's value has even propelled it above Nvidia's performance in that period of time. Apart from Tesla (TSLA)which is down 14% in that period, most of the “Magnificent Seven” have performed quite well.

This is funny for investors who remember how much Zuckerberg was criticized in 2022 for his massive investments in the metaverse. You don't hear much about that sector anymore, since Meta has returned to its social media advertising model.

Magnificent Seven Daily Chart: META, AMZN, MSFT, AAPL, NVDA, GOOGL and TSLA

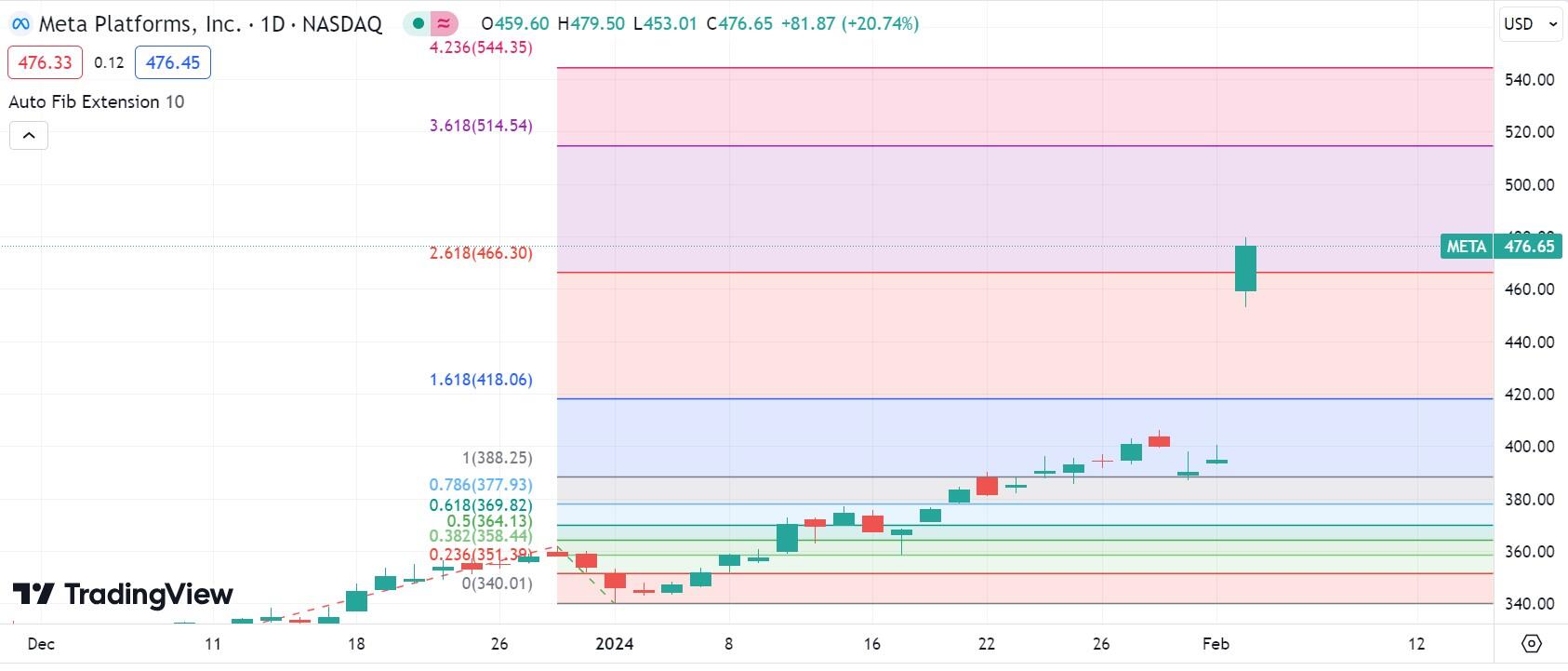

When a stock hits a new all-time high like this, it can be difficult to predict where it will go next. This is why analysts often rely on Fibonacci extension charts like the one below.

It shows that META found support at the 100% level ($388.25) just two days ago, before breaking above the 161.8% Fibonacci ($418.06) and trading either side of the 261.8% Fibonacci ($466.30) on Friday. ). If it manages to hold at this level, META stock could attempt to reach the 361.8% Fibonacci at $514.54.

META daily chart – Fibonacci Extension

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.