- The Mexican Peso extended its losses for the second consecutive day while the USD/MXN reached a peak of 19.74.

- Banxico cuts rates to 10.50%, weakening the Peso as economic activity cools and inflation projections rise to 2024.

- US PCE inflation fell, but core PCE remains within the Fed’s comfort range of 2%-3%.

The Mexican peso lost strength on Friday against the US dollar after inflation data in the United States (US) fell and failed to support the Mexican currency. However, the recent decision by the Bank of Mexico — known as Banxico — to lower interest rates weakened the Peso. At the time of writing, USD/MXN is trading at 19.72, gaining 0.50%.

The Federal Reserve’s favorite inflation gauge, the Personal Consumption Expenditure (PCE) Price Index, was lower than expected in August, according to the US Bureau of Economic Analysis (BEA). The same report showed that the core PCE, which excludes volatile items such as food and energy, rose one tenth, but remains within the range of 2% to 3%.

Other data showed that Personal Spending and Personal Income showed signs of slowing, while the University of Michigan Consumer Sentiment for September, in its final reading, improved.

In Mexico, Banxico decided to cut interest rates from 10.75% to 10.50% in a split 4-1 vote on Thursday, with Deputy Governor Jonathan Heath dissenting after voting to keep rates unchanged.

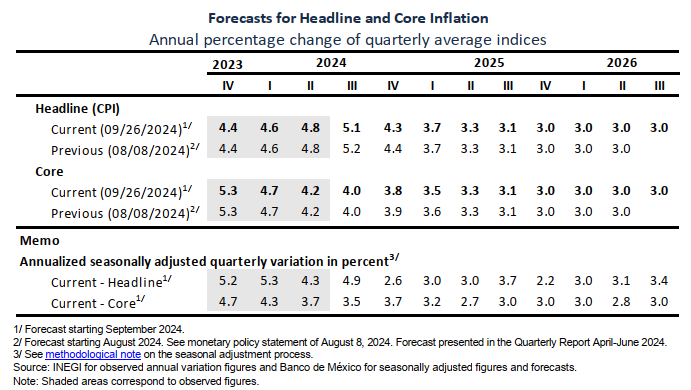

Officials acknowledged that economic activity is weakening, putting pressure on the labor market, which has shown signs of cooling. Banxico revised upwards its inflation expectations for headline and core figures in 2024, but maintained its estimate that inflation will reach the target by the end of 2025.

Despite checking inflation, the bank stated, “[L]to the nature of the shocks that have affected the non-core component and the projection that their effects on general inflation will continue to dissipate in the coming quarters,” adding that “although the inflation outlook still requires a restrictive monetary policy stance, its evolution implies that it is appropriate to reduce the level of monetary restriction.”

The Trade Balance showed that Mexico’s economy recorded a deficit five times larger than expected, putting pressure on the Peso.

Daily market summary: Mexican peso plummets due to Banxico decision and US inflation data

- Political turmoil in Mexico calms as market participants prepare for the change of president on October 1, a holiday in Mexico. President-Elect Claudia Sheinbaum’s speech will be watched for clues about her economic plan.

- Mexico’s Trade Balance recorded a deficit of -$4.86 billion in August, more than the -$0.5 billion expected by consensus.

- The US PCE in August was 2.2% year-on-year, down from 2.5% and one tenth less than expected by consensus.

- Core PCE rose modestly, as expected, from 2.6% to 2.7% in the same period.

- University of Michigan Consumer Sentiment in September improved from 69.0 to 70.1. Inflation expectations for one year fell from 2.8% to 2.7%, and for a five-year period they rose from 3% to 3.1%.

- Banxico is expected to reduce borrowing costs by 175 basis points by the end of 2025, according to swap markets.

- The US Dollar Index (DXY), which tracks the performance of the Dollar against a basket of six peers, is virtually unchanged at 100.50.

- Market participants have fully priced in at least a 25 basis point rate cut by the Fed. However, the odds of a 50 basis point easing are at 54.7%, lower than the 60% probability two ago. days, according to the CME FedWatch tool.

USD/MXN Technical Analysis: Mexican Peso Falls as USD/MXN Rises Above 19.65

The USD/MXN resumed its upward trend, reaching a daily high of 19.74, following the series of data in Mexico and the US. The Relative Strength Index (RSI) remains bullish, hinting that the momentum favors buyers.

Therefore, USD/MXN could be headed for further gains. The first resistance would be the current week’s high of 19.75. Once surpassed, the next stop would be the September 12 peak at 19.84, followed by the 20.00 level. If those two levels clear, the current yearly high (YTD) of 20.22 will be exposed.

On the other hand, if USD/MXN struggles to break 19.75, it could pave the way for lower prices. The first support would be the 19.50 level, followed by the September 24 low at 19.23, before the pair heads towards the September 18 low at 19.06. Once these levels are surpassed, the figure of 19.00 emerges as the next line of defense.

The Mexican Peso FAQs

The Mexican Peso is the legal tender of Mexico. The MXN is the most traded currency in Latin America and the third most traded on the American continent. The Mexican Peso is the first currency in the world to use the $ sign, prior to the later use of the Dollar. The Mexican Peso or MXN is divided into 100 cents.

Banxico is the Bank of Mexico, the country’s central bank. Created in 1925, it provides the national currency, the MXN, and its priority objective is to preserve its value over time. In addition, the Bank of Mexico manages the country’s international reserves, acts as a lender of last resort to the banks and advises the government economically and financially. Banxico uses the tools and techniques of monetary policy to meet its objective.

When inflation is high, the value of the Mexican Peso (MXN) tends to decrease. This implies an increase in the cost of living for Mexicans that affects their ability to invest and save. At a general level, inflation affects the Mexican economy because Mexico imports a significant amount of final consumption products, such as gas, fuel, food, clothing, etc., and a large amount of production inputs. On the other hand, the higher the inflation and debt, the less attractive the country is for investors.

The exchange rate between the USD and the MXN affects imports and exports between the United States and Mexico, and may affect demand and trade flows. The price of the Dollar against the Mexican Peso is affected by factors such as monetary policy, interest rates, the consumer price index, economic growth and some geopolitical decisions.

The exchange rate between the USD and the MXN affects imports and exports between the United States and Mexico, and may affect demand and trade flows. The price of the Dollar against the Mexican Peso is affected by factors such as monetary policy, interest rates, the consumer price index, economic growth and some geopolitical decisions.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.