The analyst and founder of MN Trading Michael Van de Poppe noted the “growing potential” for the growth of the crypto assets market against the backdrop of a decrease in bets and the weak dollar of the United States.

Ultimatly, Macro Environment is Changing Significantly.

– Gold Comes Down.

– Yields Are Falling.

– Pressure on the Fed IS Increasing.

– NASDAQ GOES UP.

– CNH/USD Goes Up.Momentum Is Building for #Crypto to succeed.

– Michaël van de Poppe (@cryptomichnl) May 1, 2025

Among other catalysts, he pointed to the growth of NASDAQ and a drop in gold prices, as well as increased pressure on the Fed.

In a commentary for Bloomberg, the research director of Ergonia, Chris Newhaus, on the contrary, suggested a decrease in the influence of macroeconomic factors on the actions of traders:

By the end of April, the 30-day linear correlation coefficient between the first cryptocurrency and gold reached 0.54, approaching the annual maximum at 0.73.

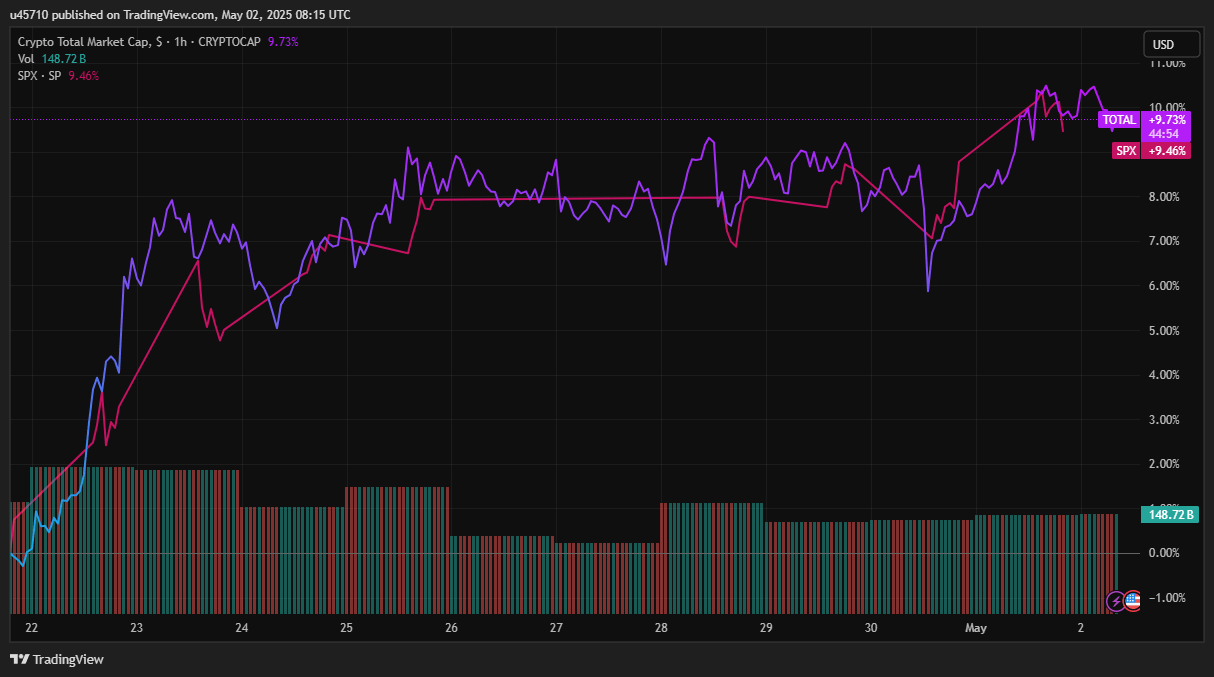

Over the past 10 days, the capitalization of the cryptorrhea has closely correlated with S&P 500, despite the consequences of the “release tariffs” of US President Donald Trump.

According to Nansen, in April there was an outflow of stablecoins from exchanges. The total value of assets on the balance sheet of trading platforms decreased from more than $ 66 billion to $ 61.5 billion.

Technical analyst at Ali Martinese noted that among open BTC positions on Binance, shorts dominate-63.76% of traders are inclined to bear mood.

At the time of writing, Bitcoin is traded about $ 96,700. The total capitalization of the cryptoine is $ 3.1 trillion.

On May 1, Bitcoin tested $ 97,000 against the background of the excitement of short -term investors – one of the signs that historically preceded the rally.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.