The price of Litecoin increased by 5% and again reached $100. However, historical data suggests that as the halving approaches, the price of LTC is likely to decline.

Three weeks before the first ever Litecoin halving in 2015, the price of the asset hit a high of $7.54 on July 10 and then fell by 42% to $4.40. A similar pattern was observed in 2019. On June 23, LTC quotes soared to $142 and fell by 53% to $93 by the halving date. The downtrend continued for several more months, after which the coin started a new rally in January 2020.

Let’s see if history repeats itself this year.

Miners are getting rid of Litecoin

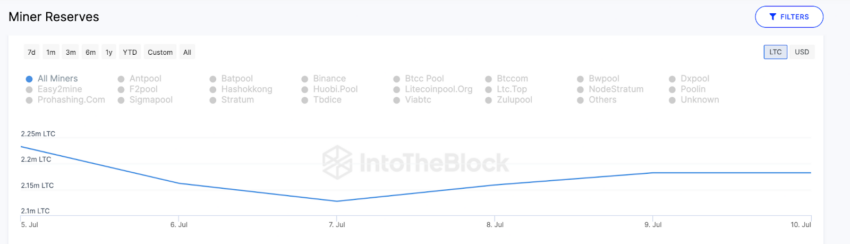

After buying 300,000 coins in June, miners started to get rid of their Litecoin holdings. Data IntoTheBlock show that they sold about 90,000 tokens from July 5th to July 11th.

Metrics Miner Reserves tracks changes in the balances of miners’ wallets and mining pools in real time. The chart below shows that they have taken a bearish position despite the recent price spike.

Historical data for 2015 and 2019 show that LTC fell twice immediately after the halving. Therefore, many miners are trying to unload some of the reserves as the important date approaches.

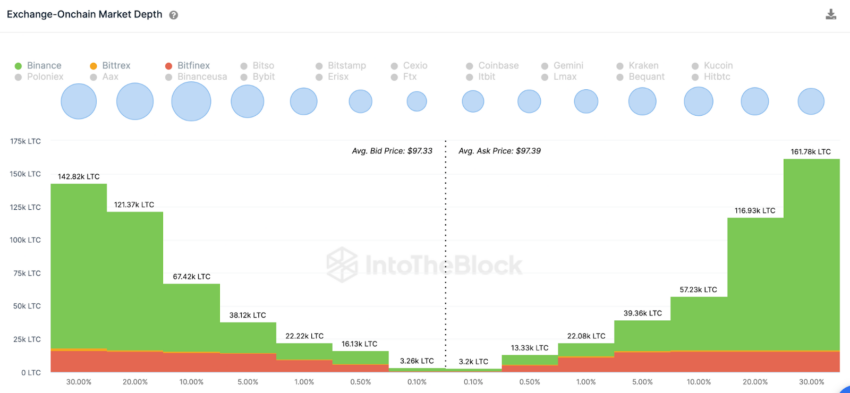

Traders open more and more orders to sell LTC

Platform market depth chart IntoTheBlock confirms the bearish forecast. According to his data, traders placed limit orders to sell 414,000 and buy 411,000 LTC.

Thus, the supply of Litecoin on the exchanges exceeds the demand by more than 3,000 coins.

If the bearish momentum builds up ahead of the halving, the price of the asset could face a serious correction.

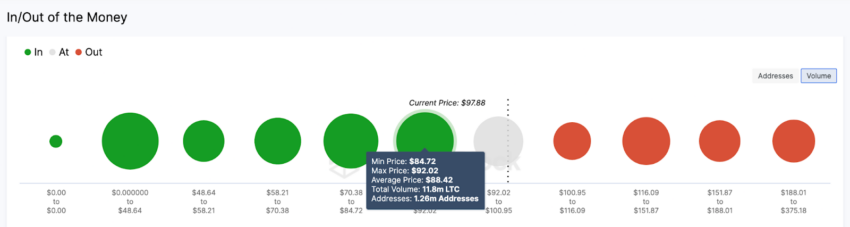

Litecoin price may drop to $80

Given the historical trends and the bearish factors described above, LTC is likely to correct to $80 in the coming weeks. However, the 1.26 million addresses that purchased 11.8 million coins at an average price of $88.42 could provide some support to the asset. If the selling pressure, as expected, will increase, Litecoin quotes may drop sharply below $80.

In case of fixing above $100, the bulls will take the initiative. However, a cluster of 572,000 wallets that bought 3.63 million LTC at a low price of $100.95 could exit positions at the breakeven point and slow further growth.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.