The price of Bitcoin is under pressure from the moment on August 14 reached a record of $ 123,731. Now the BTC is traded at $ 113,167, decreasing by 10% since last week.

The fall in the price coincided with active sales by miners, which causes concerns about the further decline.

BTC miners sell reserves

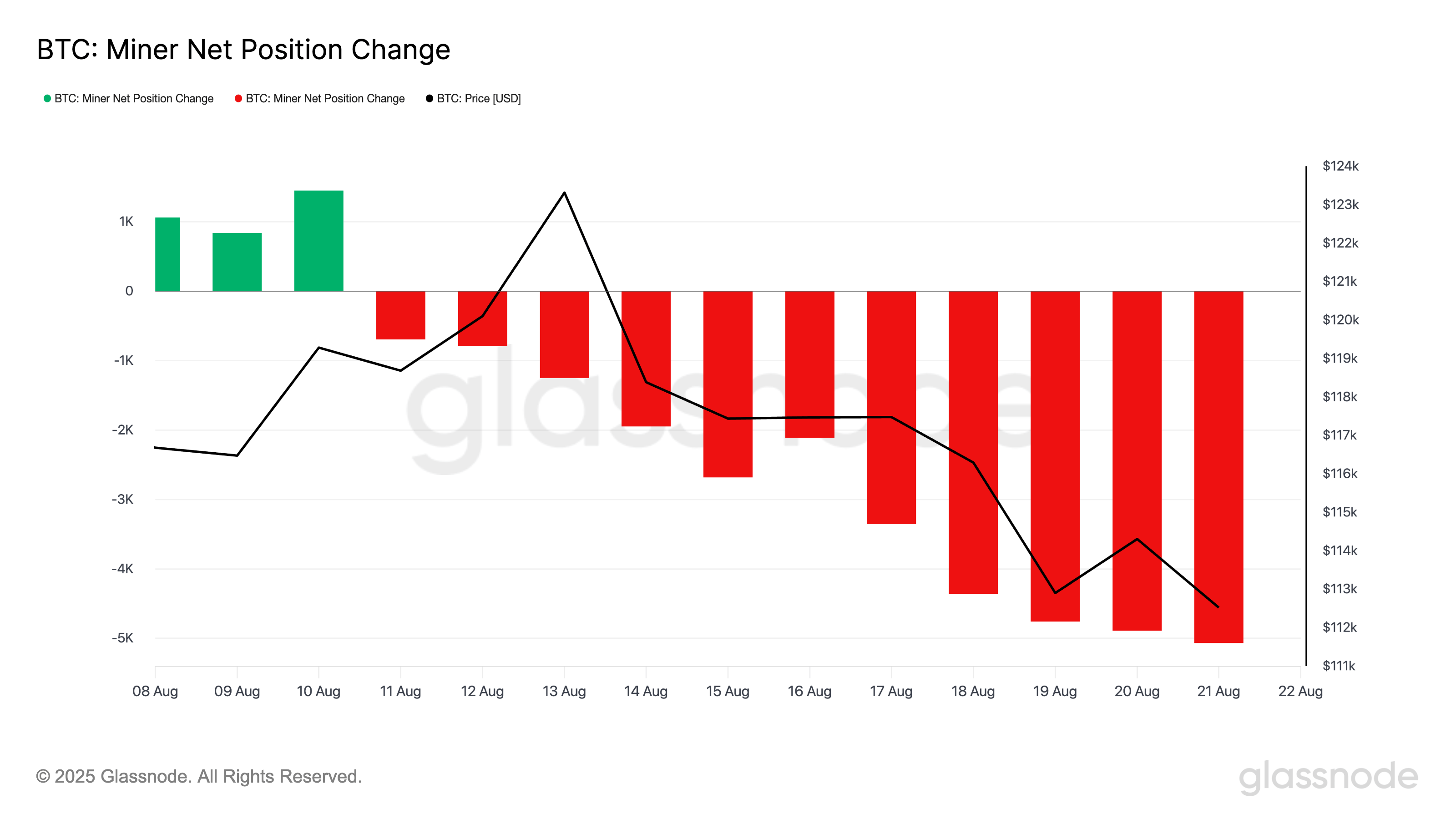

According to Glassnode, the pure position of Bitcoin miners fell to the lowest level per year. An indicator that tracks a 30 -day change in the amount of BTC at miner addresses, on August 21 decreased to -5,066 -this is the lowest value from December 2024.

A decrease in this indicator indicates an increase in sales by miners, one of the most influential groups on the market. Constant outfills from their wallets can put pressure on prices, especially when the market does not cope with an additional offer. This threatens to strengthen the descending trend and increase the likelihood of significant short -term corrections.

The outflow of funds from ETF reached $ 1.5 billion

Institutional investors using ETF for access to BTC increase pressure on the market. According to Sosovalue, in a week $ 1.51 billion was withdrawn from these funds, which can become a record weekly outflow from the end of February.

A decrease in the influx of capital from ETF creates additional difficulties for the asset. This can increase the impact of miners and slow down the recovery in the near future.

BTC Forecast: Perhaps a fall to $ 107,000

At the time of writing, the BTC is traded above the support level of $ 111,961. If miners continue to sell, and the influx of capital in BTC-ETF will decrease, the coin risks breaking this support and falls to $ 107,557.

However, the increase in demand for BTC is able to change this negative scenario. If traders and miners begin to accumulate coins by reducing their sale, BTC can recover and rise to $ 115,892.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.