In 2021, the digital assets market survived a sharp increase in the number of new crypto projects, which was associated with the availability of platforms for creating tokens such as Binance Smart Chain and Ethereum. The jump in interest in creating new digital assets can also be explained by the launch of the RUMP.FUN trading platform based on the SOLANA blockchain, which has simplified the process of creating tokens, which led to the stream of memissive costs.

In 2021, 428,383 projects were placed on the Geckoterminal, and by 2025 this number increased to almost 7 million, they paid attention to Coingecko.

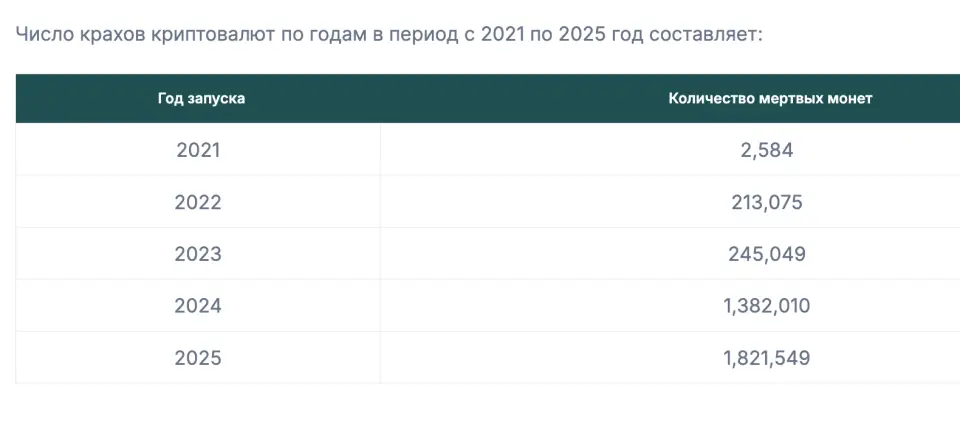

Many of these projects, including fraudulent Rug Pulls, where the developers disappear with the collected investors, could not attract sufficient liquidity or user audience. Almost 90% of the disappeared tokens had a daily trading volume of less than $ 1000, which indicates their initially low market viability.

Analyst Beincrypto Sean Lee (Shaun Lee) notedthat the market is oversaturated with projects that do not have real value, especially among memcoids and Defi. He recalled the success of individual crypto projects such as AAVE and Hyperlique, but emphasized that most new tokens cannot withstand competition due to poor liquidity and insufficient innovation.

A similar point of view was expressed by Donald Trump’s special adviser to cryptocurrencies David Sacks, who stated that “the ease of launching dubious tokens, low entrance barriers and the lack of adequate regulation led the cryptoine to overheating and flooding with garbage assets.”

Despite the massive collapse, which comprehended most of the new crypto projects, Coingecko experts believe that the established cryptocurrencies, such as bitcoin and ether, continue to strengthen their positions. However, the situation is a warning for investors that the digital assets market remains to a greater extent “gray and high -risk zone”, especially in terms of new and little -known cryptoinants.

Earlier, entrepreneur David Sax said that the extremely short -sighted look of the departed administration of Biden to Bitcoin led the United States to a loss of more than $ 17 billion.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.