After the publication of the data on the consumer price index on July 15, Bitcoin encountered a new wave of sales. The price of BTC has fallen from the recent maximum of $ 123,203 to $ 117 143, which is a decrease of 4.9%.

We figure out what is happening in the Bitcoin market (BTC) and what to expect from the price of cryptocurrency.

Sellers put pressure on bitcoin

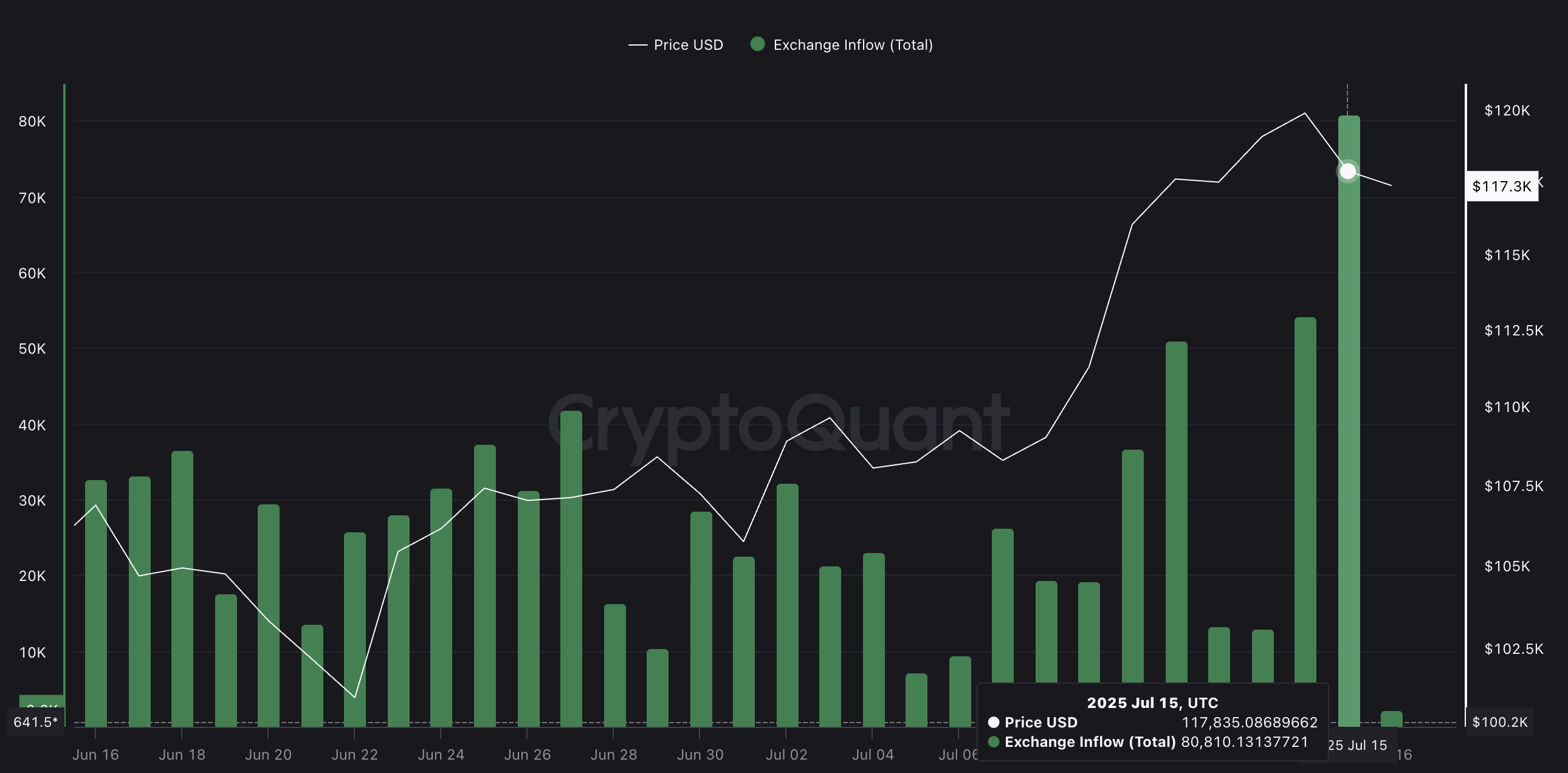

According to Cryptoquant, on July 15, more than 80 810 BTC was transferred to centralized exchanges. This is the largest one -day tributary in recent days – the total amount exceeds $ 9.4 billion.

Fronts on exchanges usually indicate an increased interest in the sale. When large volumes of BTC move from wallets to the exchange, this often indicates the readiness of the holders for sale, especially if this is accompanied by a weakening of price dynamics.

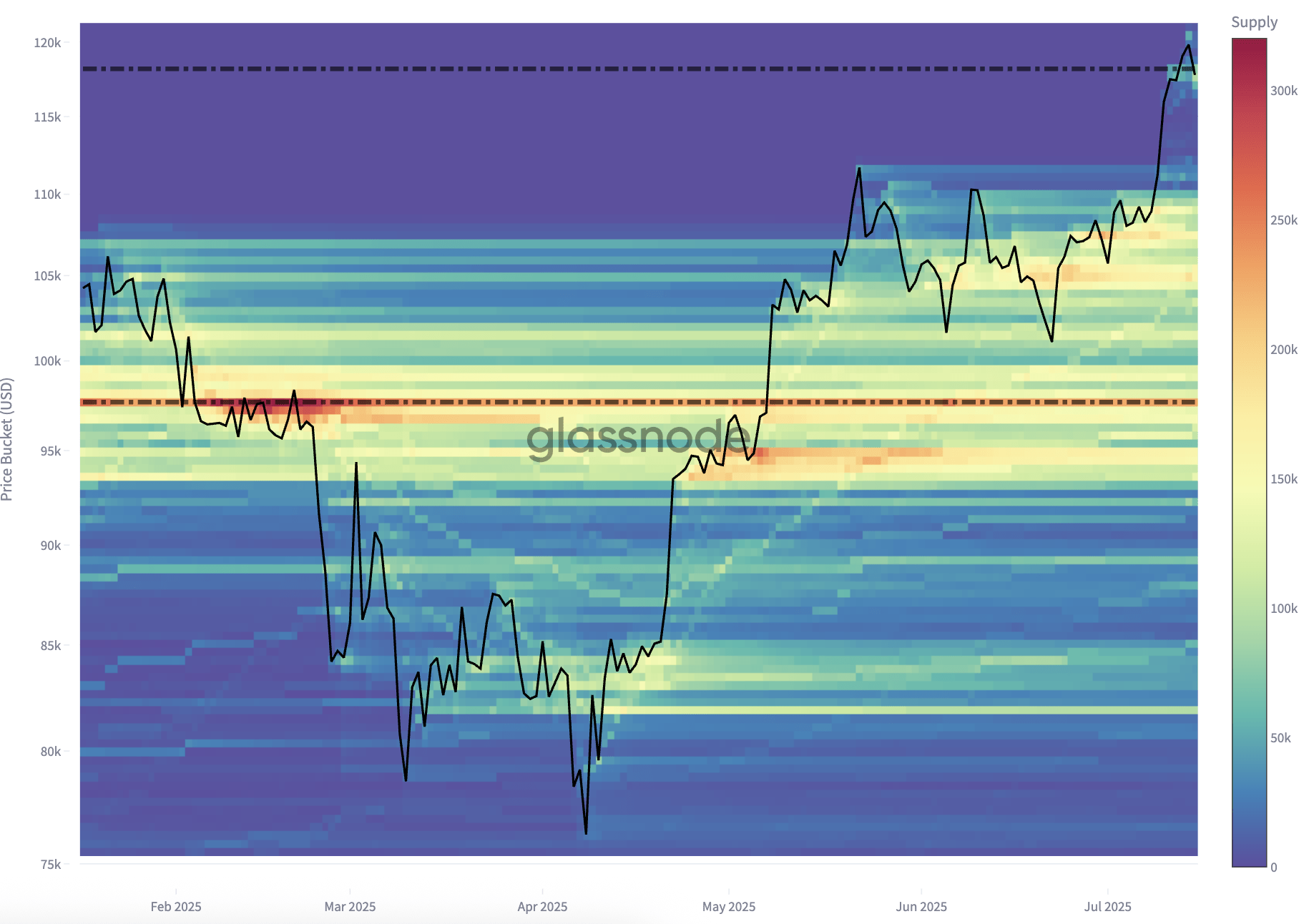

The Glassnode heat card shows the previous zones of active purchases in the ranges of $ 93,000 – $ 97,000 and $ 101,000 – $ 109,000. These are the levels where BTC demonstrated high activity of wallets, which means mass purchases of investors. This creates “accumulation clusters”, where the price usually finds support during kickbacks.

The range is $ 107,000 – $ 109,000 is especially important. Here, Bitcoin traded in the side trend for several days before the breakthrough. If coin continues to fall, buyers can be activated in this area.

BTC Forecast: Wait for Correction

At the time of writing this analysis, the BTC is traded at $ 117,143, decreasing from the historical maximum $ 123,203. This fall lowered the coin below the level of 0.236 Fibonacci correction by $ 117,293, which was the first key support zone after the top.

Fibonacci correction levels are built by measuring the distance between the recent minimum and the maximum of the market; In this case, from the June minimum about $ 98,160 to the historical maximum of $ 123,203. These levels help determine where the price can roll back during the trend.

The next important level on the ladder of Fibonacci is 0.618 correction for $ 107,726. This level is often called the “golden zone”, where assets are usually bounced during kickbacks. If the price of bitcoin falls to the level of 0.618, this will mean an additional drop by 8%.

However, this scenario will change if the price recovers above $ 117,293 when the influx of exchanges decreases. Sustainable recovery above this resistance can return a bull impulse and bring a coin closer to the peak $ 123 203.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.