- The Nasdaq 100 extends Friday’s sharp rise and trades above 15,200 during the European session on Monday.

- The world’s top central bankers have confirmed that there is still some ground to go to tame inflation.

- Expectations of new rate hikes by the main central banks, in an environment of concern about global economic growth, weigh on market sentiment.

- The focus will be today on the US ISM Purchasing Managers’ Index (PMI) for the manufacturing sector.

The index Nasdaq 100 extends Friday’s sharp rise and trades above 15,200 during the European session on Monday. On Friday, the index broke strongly above 15,000 points and closed up 1.60% on the day after the release of softer-than-expected US inflation data. At the time of writing, the Nasdaq is trading at 15,214 points, up 0.28% on the day.

After reaching a new high since April 2022 at 15,280 on June 16, the Nasdaq began a correction. The downward move extended into early last week, setting a two-week low of 14,688 on Monday, June 26. Since then, the Nasdaq 100 has been recovering and is again approaching recent highs.

As reported by the US Bureau of Economic Analysis on Friday, Annual inflation in the United States, measured by the variation in the Personal Consumption Expenditure Price Index (PCE), fell to 3.8% in May from 4.3% in April. In the same period, the price index Core PCE, the Federal Reserve’s (Fed) favorite inflation gauge, dipped slightly from 4.7% to 4.6%.

During today’s Asian session it was reported that the index China’s Caixin manufacturing PMI in June fell 50.5 points, below the 50.9 in May, but above the forecasts that placed it at 50.2, which has slightly improved market sentiment.

It has subsequently been reported that the German manufacturing PMI fell to 40.6 points in June from 43.2 in May, reaching its lowest level in more than three years and below expectations for a retracement to 41 points. Also, the Eurozone manufacturing PMI fell to 43.4 points in the same month, from 44.8 in May and below the 43.6 expected. This result has been his lowest level in 37 months.

Nevertheless, the markets maintain the cautious tone amid expectations of further rate hikes by major central banks in an environment of concerns about global economic growthespecially from China.

The world’s leading central bankers confirmed last week at the European Central Bank (ECB) Forum held in Sintra that there is still ground to be covered to tame inflation and They are betting on new rate hikes in the coming months. The Chairman of the Federal Open Market Committee (FOMC), Jerome Powell reminded markets that the vast majority of policymakers expect two or more rate hikes from the Fed by the end of the year..

In addition, the final estimate from the US Bureau of Economic Analysis showed last week that US real Gross Domestic Product (GDP) grew at an annualized rate of 2% in the first quarter, above market expectations of 1.3%. A stronger than expected GDP shows that the US economy remains firm, which will increase expectations of rate hikes from the Fed and will weigh on market sentiment.

The markets’ attention will focus today on the Purchasing Managers’ Index (PMI) for the US ISM manufacturing sector.which is expected to rise to 47.2 points in June from 46.9 the previous month.

It is worth noting that US stock and bond markets will close early on Monday and remain closed on Tuesday due to the Independence Day holiday.

Later in the week, market participants will pay attention to the FOMC minutes, due to be released on Wednesday, data from the ADP private sector jobs report and the US ISM services PMI from the Thursday and the official employment data (NFP) from the US on Friday.

Market Drivers Summary: What’s Affecting the Nasdaq?

- The main central bankers of the world confirmed in Sintra that there is still ground to cover to tame inflation and they are betting on new rate hikes in the coming months.

- Jerome Powell reminded markets that the vast majority of monetary policy makers expect two or more rate hikes by the end of the year.

- He People’s Bank of China (PBoC) cut its prime lending rates by 10 basis points and reminded markets of the loss of momentum in global economic growth, especially in China.

- PMIs for Germany, the Eurozone in general and the United Kingdom fall, showing the loss of momentum in business growth.

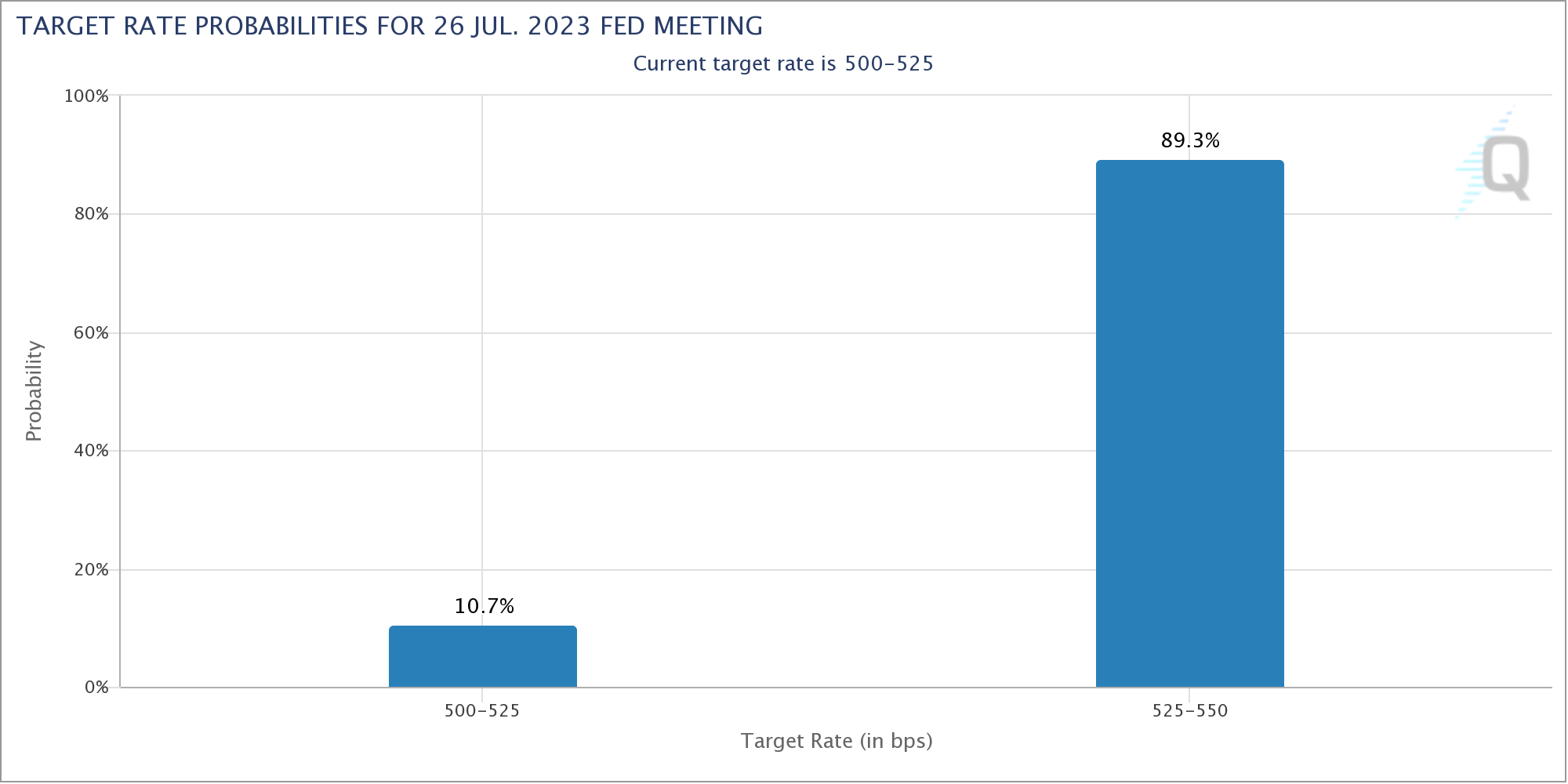

- The CME Group’s FedWatch tool aims to a near 90% chance of a 25 basis point rate hike in July.

Nasdaq Technical Analysis

At the time of writing, the Nasdaq 100 is rallying above the 15,200 points. a break of 15,280 (maximum of more than a year reached on June 16), could point to the area of the 15,500 points before going up to test the region of the 15,700 points.

On the other hand, if the Nasdaq gives back early gains and turns negative, it could fall towards the 15,100 and 15,000 points. Further down, a break below 14,688 points (minimum of June 26), could point to the zone of 14,560 (minimums of June 12) and the zone of the 14,300-14,310 points

nasdaq daily chart

Frequently Asked Questions about the Nasdaq

What is the Nasdaq?

The Nasdaq is an American stock exchange that began as an electronic stock quote. At first, the Nasdaq only offered over-the-counter (OTC) stock listings, but it later became public as well. By 1991, the Nasdaq had grown to account for 46% of the entire US stock market. In 1998, it became the first exchange in the US to offer online trading. The Nasdaq also produces several indices, the most comprehensive of which are the Nasdaq Composite, which represents the more than 2,500 Nasdaq stocks, and the Nasdaq 100.

What is the Nasdaq 100?

The Nasdaq 100 is a large-cap index made up of 100 non-financial companies on the Nasdaq stock exchange. Although it only includes a fraction of the thousands of Nasdaq stocks, it explains more than 90% of the movement. The influence of each company in the index is weighted based on market capitalization. The Nasdaq 100 includes companies that are heavily focused on technology, although it also includes companies from other industries and from outside the United States. The average annual return of the Nasdaq 100 has been 17.23% since 1986.

How can I trade the Nasdaq 100?

There are several ways to trade the Nasdaq 100. Most retail brokers and spread betting platforms offer betting using Contracts for Difference (CFDs). For long-term investors, ETFs operate like stocks that mimic the movement of the index without the investor having to buy all 100 companies in the index. An example of an ETF is the Invesco QQQ Trust (QQQ). Nasdaq 100 futures contracts allow you to speculate on the future performance of the index. Options provide the right, but not the obligation, to buy or sell the Nasdaq 100 at a specified price (strike price) in the future.

What factors drive the Nasdaq 100?

Many factors drive the Nasdaq 100, but it’s primarily the aggregate performance of its component companies, revealed in their quarterly and annual earnings reports. US and global macroeconomic data also contributes as it influences investor confidence, which if positive boosts earnings. The level of interest rates, set by the Federal Reserve (Fed), also influences the Nasdaq 100, as it affects the cost of credit, on which many companies are highly dependent. Therefore, the level of inflation can also be an important factor, as well as other parameters that influence the decisions of the Federal Reserve.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.