- Nasdaq 100 faces resistance just above 15,300 points on Thursday.

- The Nasdaq still needs to close above 15,332 points to extend the rise.

- The focus of investors will be on the statements of the president of the Federal Reserve, Jerome Powell.

The Nasdaq 100 index is struggling to extend the recent move and faces resistance just above 15,300 points on Thursday.

Looking at the Nasdaq daily chart you can see strong upward momentum since the beginning of last week, which saw the index record its best week of the year, up 5.54%. At the time of writing, the Nasdaq has recovered more than 1,200 points since falling to a low of 14,057 on October 26. Since that moment, the index has marked consecutive green candles until reaching the area of recent highs, at levels not seen since October 12.-638351319406056129.png)

Nasdaq daily chart

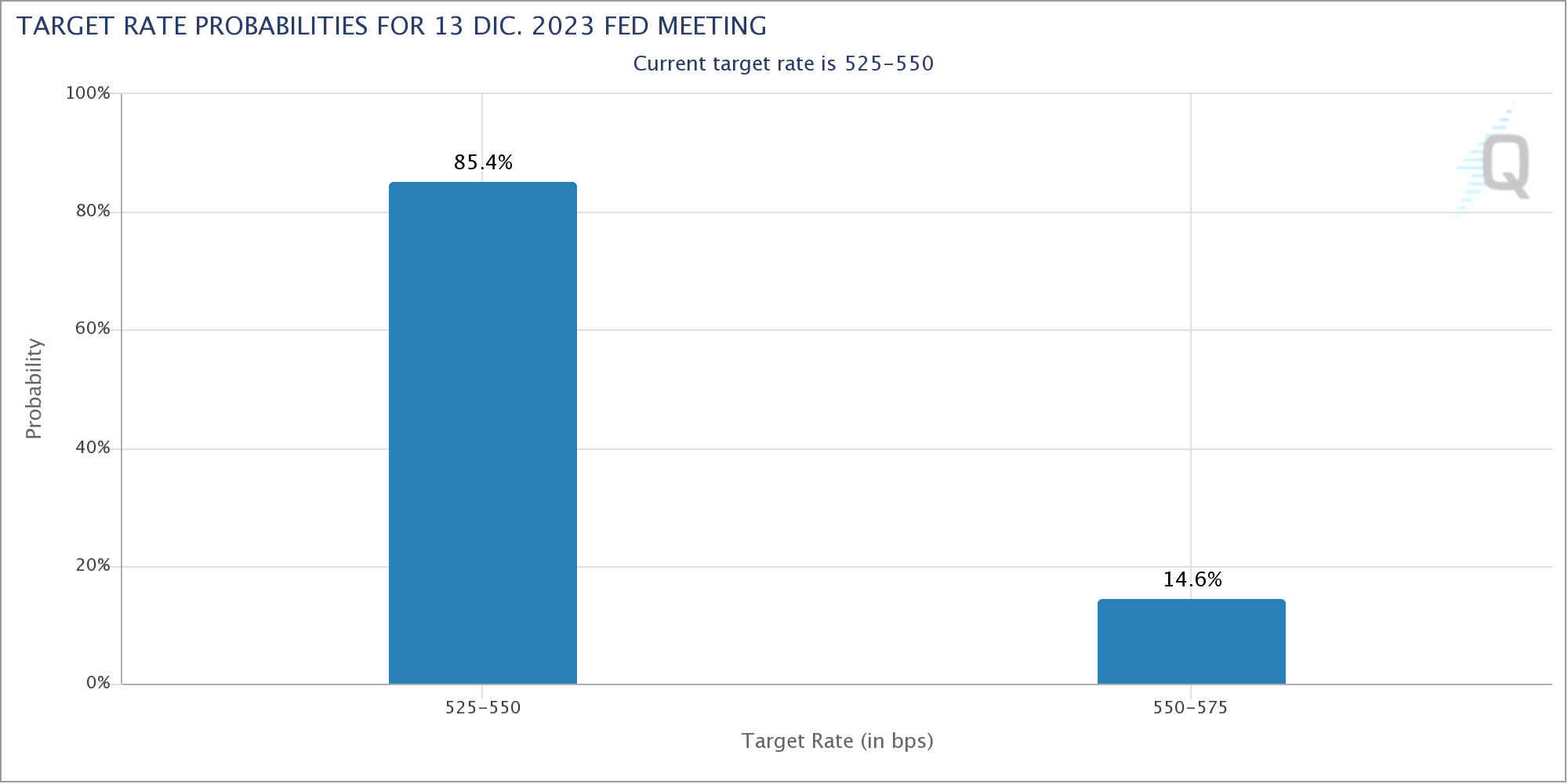

The recovery from the aforementioned minimum gained strength last Wednesday after the US Federal Reserve (Fed) decided to leave its interest rate unchanged in the range of 5.25%-5.50%, although its president, Jerome Powell , will leave the door open to new rate increases in the future.

The momentum continued on Friday, when the US nonfarm payrolls (NFP) report showed that 150,000 new jobs were added in October, below the 180,000 expected. This weaker-than-expected data was good news for markets, and expectations of a rate hike in December remain low. At the time of writing, the CME’s FedWatch Tool shows a 15% chance of another rate hike at the Fed’s December meeting.

The decision of the Federal Reserve last Wednesday and the slowdown in employment growth that emerges from the publication of non-farm payrolls for October unleashed euphoria in an equity market.

Since then, and in the absence of top-level economic publications in the US, investors’ attention has focused on the speeches of different members of the Fed this week, which have offered some contradictory messages.

Fed Governor Lisa Cook stated Monday that the central bank’s current target interest rate is adequate to return inflation to the central bank’s 2% target.

On the other hand, Neel Kashkari, president of the Federal Reserve Bank of Minneapolis, was a little more hawkish, saying he is not convinced the rate hikes are over. Kashkari noted that the Fed may have to do more to bring inflation down to its 2% target, given the recent run of resilient economic data.

Chicago Fed President Austan Goolsbee said the US central bank’s focus will be on how long to keep rates at their current level, if any. Fed Governor Michelle Bowman said the central bank will likely have to raise rates again in the short term.

Federal Reserve Bank of Philadelphia President Patrick Harker said Thursday that now is the time to take stock of the impact of previous rate hikes and added that the next interest rate decision could come at any time. direction depending on the data. In addition, the president of the Federal Reserve Bank of Chicago, Austan Goolsbee, told the Wall Street Journal on Thursday that it will be necessary to monitor the risks of overshooting interest rates.

For his part, Fed Chairman Jerome Powell did not comment on monetary policy or economic prospects on Wednesday, although he plans to speak again at another conference this Thursday. Powell will participate in an International Monetary Fund (IMF) panel titled “The Challenges of Monetary Policy in a Global Economy,” where investors await fresh comments on his view on interest rates.

Nasdaq FAQ

What is Nasdaq?

Nasdaq is an American stock exchange that began as an electronic stock ticker. At first, the Nasdaq only offered over-the-counter (OTC) stock listings, but it later became an exchange as well. By 1991, the Nasdaq had grown to represent 46% of the entire US stock market. In 1998, it became the first US exchange to offer online trading. The Nasdaq also produces several indices, the most comprehensive of which are the Nasdaq Composite, which represents the more than 2,500 Nasdaq securities, and the Nasdaq 100.

What is the Nasdaq 100?

The Nasdaq 100 is a large-cap index composed of 100 non-financial companies on the Nasdaq Stock Exchange. Although it only includes a fraction of the thousands of stocks on the Nasdaq, it explains more than 90% of the movement. The influence of each company in the index is weighted based on market capitalization. The Nasdaq 100 includes companies highly focused on technology, although it also includes companies from other sectors and from outside the United States. The Nasdaq 100’s average annual return has been 17.23% since 1986.

How can I trade the Nasdaq 100?

There are several ways to trade the Nasdaq 100. Most retail brokers and spread betting platforms offer Contracts for Difference (CFD) betting. For long-term investors, exchange-traded funds (ETFs) operate like stocks that mimic the movement of the index without the investor having to buy all 100 companies that comprise it. An example of an ETF is the Invesco QQQ Trust (QQQ). Nasdaq 100 futures contracts allow you to speculate on the future performance of the index. Options provide the right, but not the obligation, to buy or sell the Nasdaq 100 at a specific price (strike price) in the future.

What factors drive the Nasdaq 100?

There are many factors that drive the Nasdaq 100, but primarily it is the aggregate performance of its component companies, revealed in their quarterly and annual earnings reports. US and global macroeconomic data also contribute, influencing investor sentiment, which if positive, drives earnings. The level of interest rates, set by the Federal Reserve (Fed), also influences the Nasdaq 100, as it affects the cost of credit, on which many companies largely depend. Therefore, the level of inflation can also be an important factor, as well as other parameters that influence the Federal Reserve’s decisions.

Before Powell’s words, the US Department of Labor will publish the number of weekly initial claims for unemployment benefits. They are expected to increase to 218,000 from 217,000 the previous week. While this data alone is unlikely to trigger the next move in financial markets, it may give some insight into the direction of the U.S. labor market. A major disappointment in this data could cause Powell’s subsequent comments to be scrutinized with greater scrutiny by markets.

Although, as mentioned above, the Nasdaq 100 has recovered more than 1,200 points from the recent low, it still needs to surpass the 15,332 point level to create a higher high on the daily chart and break out of the accompanying overall downtrend. since mid-July (it peaked at 15,343 yesterday, but closed below that level).

Nasdaq

| Panorama | |

|---|---|

| Today’s Latest Price | 15312.93 |

| Today’s Daily Change | 0.20 |

| Today’s Daily Change % | 0.00 |

| Today’s Daily Opening | 15312.73 |

| Trends | |

|---|---|

| 20 Daily SMA | 14792.62 |

| SMA of 50 Daily | 14957.49 |

| SMA of 100 Daily | 15093.9 |

| SMA of 200 Daily | 14124.31 |

| Levels | |

|---|---|

| Previous Daily High | 15343.79 |

| Previous Daily Low | 15216.79 |

| Previous Weekly High | 15146.99 |

| Previous Weekly Low | 14174.61 |

| Previous Monthly High | 15332.45 |

| Previous Monthly Low | 14057.17 |

| Daily Fibonacci 38.2% | 15295.28 |

| Daily Fibonacci 61.8% | 15265.3 |

| Daily Pivot Point S1 | 15238.42 |

| Daily Pivot Point S2 | 15164.1 |

| Daily Pivot Point S3 | 15111.42 |

| Daily Pivot Point R1 | 15365.42 |

| Daily Pivot Point R2 | 15418.1 |

| Daily Pivot Point R3 | 15492.42 |

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.