- NVIDIA reports its earnings at the close of the American session, the market expects it to exceed expectations.

- Moderna and Analog Devices drive the technology index.

- Investors will be attentive to the release of the Fed minutes.

The index began the European session with a daily low of 18,674 and rebounded to a daily high of 18,758 in the American session. Currently, the Nasdaq 100 is trading at 18,717, gaining 0.02% on the day. Among the companies posting gains today are Moderna (MRNA), trading at $157.43, gaining 9.63% on the day, and Analog Devices (ADI), marking a gain of 8.83%, trading at $235.11 on the day.

Fed minutes, NVIDIA earnings report draw investors' attention

After recent speeches by Fed members, the minutes of their last meeting will be published. Investors are looking for more certainty in the interpretation of inflation data and rate cuts by authorities.

Based on analyst consensus, NVIDIA is expected to exceed the $24.53 B in revenue projected for this quarter. If confirmed, a movement in the stock between 9%-13% is highly probable

Technical levels on the Nasdaq 100

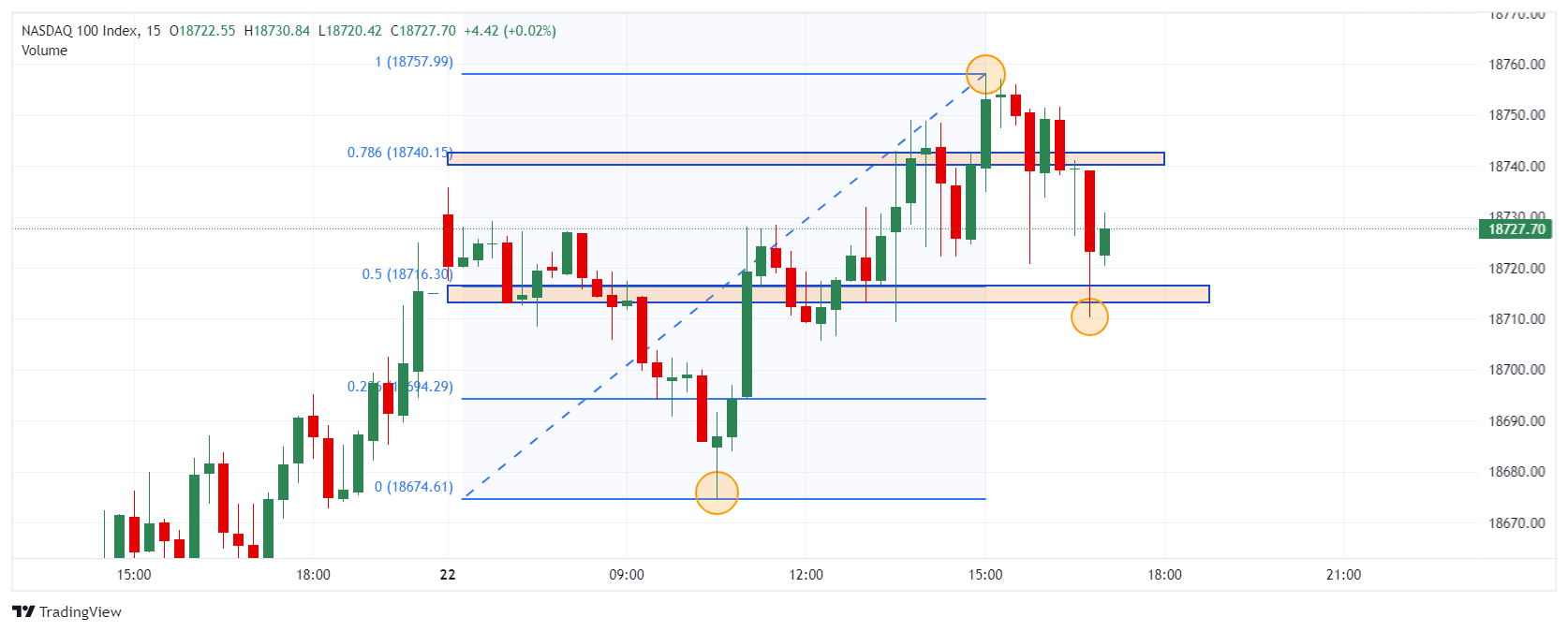

We observe the first support in the short term at 18,715, given by the 50% Fibonacci retracement. The second support is at 18,675, the low of today's session. The closest resistance is located at 18,758, the all-time high.

15-minute chart on the Nasdaq 100

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.