- Natural Gas Turns Positive Ahead of US Trading Session

- Storm Beryl is hitting Texas since today, Monday.

- The US Dollar Index is trading mixed and choppy following the French election results.

The price of Natural Gas (XNG/USD) is breaking its losing streak on the tenth day of the correction. Gas prices are up more than 1% just before the start of the US session due to concerns about supply and production as Storm Beryl hits Texas. Looking at the projected path the storm will take in the coming days, the region and further inland, several outages and disruptions could mean a short-term setback for gas exports and production in the region.

Meanwhile, the US Dollar Index (DXY), which tracks the value of the Greenback against six major currencies, is on a very choppy ride on Monday, with traders a little disoriented as to which direction to go next. Bond markets are cheering the formation of a government gridlock in France, with the yield spread between Germany and France receding, while the US Dollar has been falling, although it is now flat again in the European trading session. Looking ahead, the DXY could return to a clear pattern, with the US Consumer Price Index (CPI) for June being the main event this week.

Natural Gas is trading at $2.39 per MMBtu at the time of writing.

Natural Gas News and Market Factors: US Markets Rise

- Additional headline on Monday about Slovakia securing nearly 30% of its gas imports by signing an agreement with Poland. This reduces and limits the risk of disruptions to Russian gas pipelines and eliminates the country’s dependence on Russian gas.

- Recent energy component numbers from China reveal that hydrogen power is contributing a more significant share of electricity than expected ahead of summer. With rising temperatures, the need for electricity increases to keep air conditioning cooling, and typically sees an increase in gas consumption. This is being partially offset by hydrogen power taking its place in the energy pie, according to Bloomberg.

- European gas imports are not at peak levels and are expected to rise from 18% in 2021 to 43% by 2025-2030, Bloomberg predicts.

- Reuters reports that the Freeport Liquefied Natural Gas (LNG) facility in Texas has successfully reduced its output to allow Storm Beryl to pass through the region. Output has been reduced by 86%.

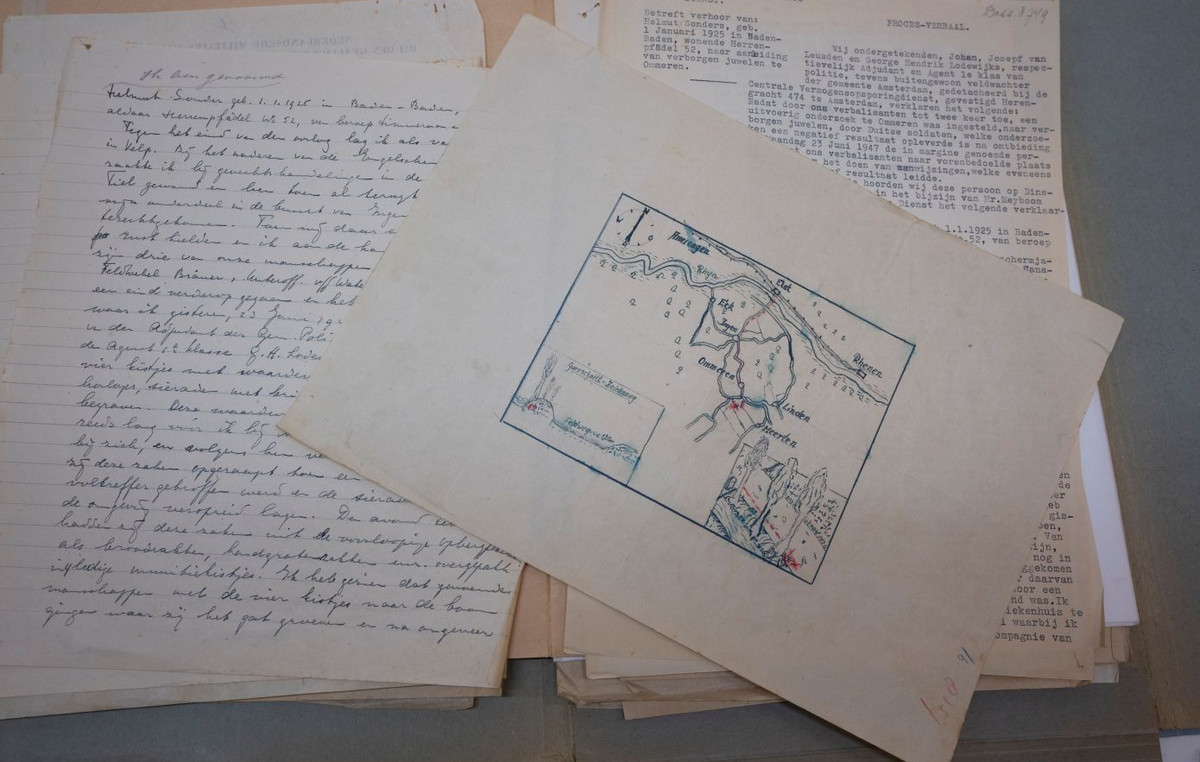

- The National Hurricane Center is warning of strong winds and flash flooding as Beryl hits the Texas coast on Monday and heads further inland over Arkansas, Tennessee and Missouri in the coming days.

Natural Gas Technical Analysis: The rebound is developing

Natural Gas price is bouncing right off the support level FXStreet mentioned in previous articles at $2.29, with the double springboard set in motion by the 100-day SMA along with the green ascending trend line. The bounce seems to be working for now, although any slight break below $2.29 could see a wave of sell orders. Therefore, bullish Gas traders will be trading this bounce with a tight stop-loss regime in case the double support area fails to hold.

The 200-day SMA is the first force to watch on the upside near $2.52, closely followed by the 55-day SMA at $2.61. Once above, the crucial level near $3.08 (March 6, 2023 high) remains a key resistance after its false breakout last week, which is still 20% away.

On the other hand, the support level, which could mean some buying opportunities, is $2.29, the 100-day SMA that coincides with the ascending trend line since mid-February. In case that level fails to hold as support, look for the crucial level near $2.13, which has acted as a ceiling and floor in the past.

Natural Gas: Daily Chart

Natural Gas

Supply and demand dynamics are a key factor influencing natural gas prices, which are influenced by global economic growth, industrial activity, population growth, production levels and inventories. Climate influences natural gas prices because more gas is used during cold winters and hot summers for heating and cooling. Competition from other energy sources influences prices as consumers may opt for cheaper sources. Geopolitical events, such as the war in Ukraine, also play a role. Government policies related to extraction, transportation and environmental issues also influence prices.

The main economic release that influences natural gas prices is the weekly inventory bulletin from the Energy Information Administration (EIA), a US government agency that produces data on the gas market in the United States. The EIA Gas Bulletin usually comes out on Thursday at 14:30 GMT, one day after the EIA publishes its weekly Oil Bulletin. Economic data from major natural gas consumers can influence supply and demand, including China, Germany and Japan. Natural gas is primarily priced and traded in US dollars, so economic releases that affect the US dollar are also factors.

The US dollar is the world’s reserve currency and most commodities, including natural gas, are quoted and traded in international markets in US dollars. Therefore, the value of the dollar influences the price of natural gas, since if the dollar strengthens, fewer dollars are needed to buy the same volume of gas (the price falls), and vice versa if the dollar strengthens.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.