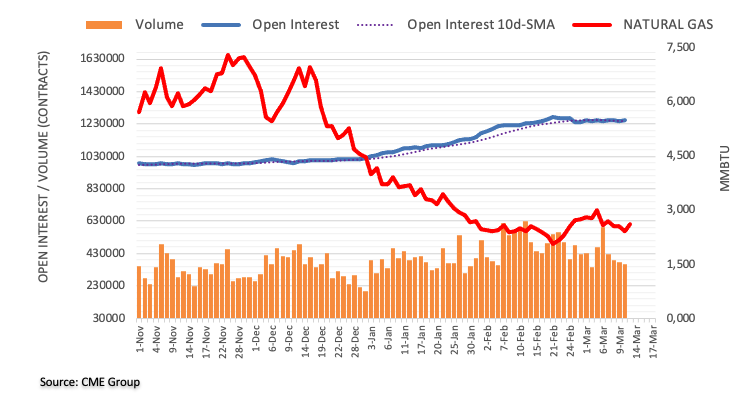

The price of natural gas seem to have found decent support in the $2.40/MMBtu region and manage to put behind three consecutive daily pullbacks earlier in the week.

Commodities are gaining some traction thanks to the cooler days ahead in the US, although the overall outlook continues to lean to the downside in the absence of a strong driver for the time being. In this sense, the figures for Friday in the natural gas futures markets seem to support the underlying negative outlook for the commodity, at least in the very short term.

Conversely, another test of the 2023 low in the sub-$2.00 area should not be ruled out, while $3.00 continues to cap the occasional upside for now. Above this zone, natural gas should find temporary resistance at the 55-day SMA at $3,145, just before the Fibo retracement of the Dec-Feb dip at $3,182.

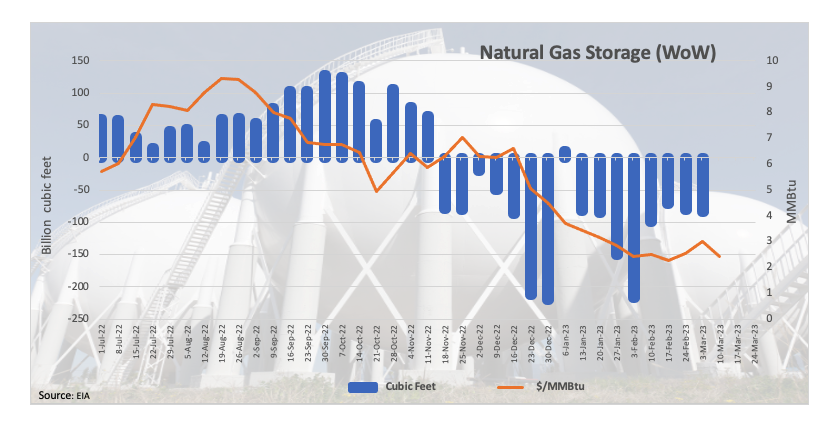

By the end of the week, the EIA will report on natural gas storage.

Natural Gas levels to monitor

At the moment, Natural Gas prices are up 6.87% at $2,594 and face the next bullish barrier at $3,009 (March 3 monthly high), followed by $3,145 (55-day SMA) and finally , $3,182 (Fibonacci level retracement). To the downside, a break below $1,967 (2023 low Feb 22) would expose $1,795 (21 Sep 2020 monthly low) and then $1,605 (20 Jul 2020 monthly low).

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.