Bitcoin

Bitcoin from August 1 to August 8, 2025 increased by 3.1%. At the beginning of the seven -day, the largest cryptocurrency in capitalization was cheaper. Back on Sunday, August 3, BTC traded below $ 112,000. However, Monday began to rise in price.

Source: TradingView.com

One of the main catalysts that brought Bitcoin in a plus at the end of the week was the signing by American President Donald Trump at once two regulatory acts regarding the crypto industry. The first of them

will allow Pension funds are invested in various alternative assets, including cryptocurrency. Second, declarative, about

provision Americans of bank guarantees. Credit organizations must provide services, despite what kind of customers have political or religious preferences.

The law regarding pension funds is released by multi -trillion capital, which can be invested in digital assets. And the act related to the activities of banks will allow you to receive services of credit organizations to cryptocurrency companies. Prior to this, cases of bank failures of cryptocurrencies were a fairly frequent phenomenon.

Bitcoin splash stock funds demonstrate negative dynamics for the second week in a row. The outflow of funds was recorded again. This time, the amount of funds withdrawn amounts amounted to $ 157.13 million. In total, more than $ 969 million have not been read from the beginning of August to Bitcoin.

Source: sosovalue.com

The story with the reserves of bitcoins continues to develop, not only at corporate, but also at the state level. On August 5, it became known that the authorities of Indonesia are considering the possibility of accumulating bitcoins. Already now they converge in

opinionWhat needs to be paid more attention to increasing literacy in relation to BTC. The inclusion of the largest cryptocurrency in the national reserve (now it consists of gold, American dollars and government bonds) will be a great breakthrough on the path of development of digital assets in the entire Asian region.

From the point of view of technical analysis, bitcoin remains in the upward trend. In favor of this, the price, which is above the 50-day sliding average (indicated by blue), speaks. Stochastic signals also talk about growth: the %K line (marked with purple) is above 50, and also recently crossed %D (marked with orange) from the bottom up. The nearest levels of support and resistance to daily graphics: $ 112,000 and $ 123,236, respectively.

Source: TradingView.com

Index

Fear and greed Compared to last week, it grew by nine points. The current value is 74. This still indicates the predominance of greed over fear in the moods of crypto-investors.

Ethereum

Air from August 1 to 8 added 12.59%at once. The dynamics of ETH was similar to the BTC: the fall in the first half of the week and the growth in the second. On Friday, August 8, the broadcast reached its maximum price in 2025 – $ 3 968.9.

Source: TradingView.com

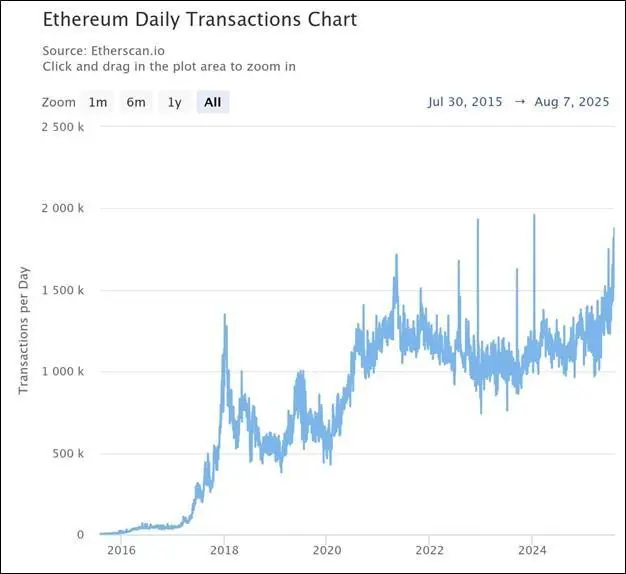

The network activity of the etherium is gradually restored. In any case, for individual indicators. For example, the number of transactions per day on August 5 reached 1.878 million. This is the second in the number of operations day in the entire history of Ethereum. More transactions in the Ethereum network were recorded only on January 14, 2024 – over $ 1.96 million.

Related With the activity of corporate investors, as well as with USDT and USDC stablecoo translations.

Source: Etherscan.io

In addition, the number of covered broadcasts exceeded 36 million coins. This happened against the background

statements The US Securities and Exchange Commissions on August 5 that liquid stake in most cases does not fall under the law on securities. That is, people will be able to continue to use Defi Protokols and earn without looking at the regulator. This can be done due to the release of new tokens during liquid stake, reflecting the value of the coveted assets.

Source: Dune.com

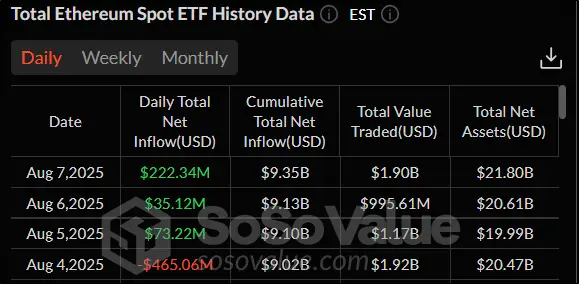

On August 4, the explorer ETF was recorded on the air of a record daily outflow of funds from the moment of the start of trading by these instruments – $ 465.06 million. The rest of the week was observed by cash receipts. True, in total they could not cover the losses of August 4.

Source: sosovalue.com

From the point of view of technical analysis, the trend of the ether is ascending. This is evidenced by excess at the cost of a 50-day sliding average (indicated in blue). The RSI indicator also testifies in the favor of the bears: it is growing and is higher than 50. The next level of resistance on the daily graph is a mark of $ 4,100, and the support level is $ 3,355.9.

Source: TradingView.com

Ripple

Ripple cryptocurrency from August 1 to 8 added a little more than 12%. Having descended at the beginning of the month below $ 3, from August 6, cryptocurrency again moved to growth. Most of the weekly impulse came on one day – Thursday, August 7, when XRP grew by 11.01%immediately.

Source: TradingView.com

The main news, which again led Ripple to the movement up – the end of the trial with the SEC, which lasted since 2020. The parties agreed to abandon mutual claims. Recall that the main claims of the regulator department against Ripple were a violation by the company’s legislation-it sold the XRP affiliated companies. The penalty of $ 125 million, imposed on Ripple in 2023, was valid. Cryptoinestors

perceived The permission of the lawsuit as the victory of the crypto industry over state controllers, which resulted in a rapid increase in value.

But not only the victory over SEC limited himself to positive for Ripple in the week. It became known that the company intends to purchase for $ 200 billion the Rail Financial payment service. The main focus of the Rail Financial activity is aimed at integrating fiat money and payments in stablecoins. Ripple will be able to expand its presence in the market. Rail Financial now has a global infrastructure,

works With 12 banks around the world and carries out transactions for $ 10 billion annually.

And more about Asia. Financial conglomerate SBI Holdings

designated Plane plans for two ETFs at once on the Tokyo Stock Exchange. The first of them involves investments in gold (51%) and bitcoin (49%), and the second in XRP and bitcoin. If SBI Holdings manage to achieve the approval of regulators, these will be the first exchange crypto funds in the Japanese market. The company has chosen the current moment for a reason. In June, the financial services agency (FSA) proposed revising the attitude to crypto actures,

Offering consider them as “financial products”. Thus, digital assets will be regulated almost as securities and other traditional tools.

From the point of view of technical analysis, XRP remains in the ascending trend. This is evidenced by excess at the price of a 50-day sliding average (indicated in blue), as well as the positive value of the Momentum indicator. The nearest levels of support and resistance on the day schedule: $ 2.73 and $ 3.67, respectively.

Source: TradingView.com

Conclusion

The first week of August was successful for the largest cryptocurrencies. Bitcoin, ether and XRP grew in price. The main driving forces of the process were new American regulatory acts regulating the crypto industry, as well as the resolution of a long judicial litigation between a large issuer of cryptocurrencies and SEC.

This material and information in it is not an individual or other other investment recommendation. The view of the editorial office may not coincide with the opinions of analytical portals and experts.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.