What is Pendle

Pendle is a protocol for the tokenization of the future income. The project was founded in 2021 by a developer named TN Lee. Initially, the protocol was launched on the basis of the Ethereum network. Later it also became available on BNB, Brachain and other blockchains. Pendle is a control token that allows users to make decisions within the project. The maximum supply of the coin is a little more than 281.5 million.

It would seem that there is nothing unusual in the project. Let’s figure out what is the tokenization of the future income and how is it realized?

Income tokenization

Pendle produces a wrap of cryptocurrency, which brings income. There are a lot of coins: braa, USDE, USDC and others. When wrapping, they turn into the so -called tokens of standardized income SY (Standardized Yield tokens). SY are divided into two parts: PT (Principal Token) and Yt (Yield Token). Actually, the income tokenization process is over. In fact, he

Represents Separation into pt and yt. But a new question arises, what to do with them?

Tokens can be traded through the Pendle automatic market maker. Also, PT and YT can be kept before the expiration of a predetermined period. At the same time, at any time there is an opportunity to request your original asset back, getting rid of PT and YT. In addition, the owner of YT can request already accumulated income before the expiration of the deadline. After

expiration You can’t use YT, but you can get your original asset through PT.

The scheme is quite complicated. Somewhere even incomprehensible. So why did Pendle grow? What are the pitfalls here?

An agreement with Alchemy Pay

At the end of July, the Alchemy Pay payment platform announced the integration of Pendle into its ecosystem. Pendle Finance sees in

cooperation With Alchemy Pay, the opportunity to expand their recognition among crypto enthusiasts.

Partnership with Ethena

On August 7, it became known about cooperation between Pendle Finance and Ethena. As a result, the USDE steablecoin should be integrated into the Pendle ecosystem. This will open a fairly interesting scheme for users of the protocol. Clients will be able to purchase Principal Tokens for USDE, and they will have a fixed profitability. Further, under these Principal Tokens, you can borrow USDC on the AAVE network. The next step is to exchange USDC for USDE. After that, the whole chain is repeated. As a result of the operation, the profitability over the loan will be slightly less than 9%.

News about cooperation and the described scheme

CALL A huge influx of money in the Pendle ecosystem with a total of $ 4.3 billion (about 60% of the total USDE offer).

TVL growth

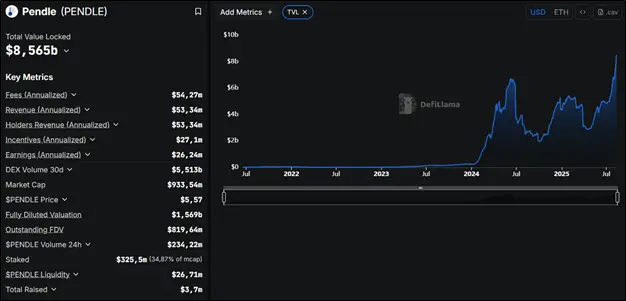

Since April 2025, the TVL indicator – the total number of assets blocked in the protocols of the Pendle network – has grown 2.96 times. Since the end of July, the indicator has invariably updated its historical maximums. For now the peak value is $ 8.565 billion.

Source: Defillama.com

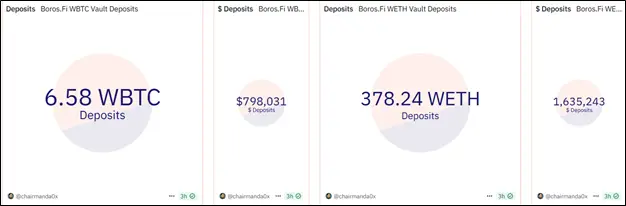

One of the TVL growth catalysts was the launch of the Boros protocol. With its help, crypto -prosecutors can make transactions for the purchase and sale regarding funding rates. For this, Yield Units were introduced, which can be traded on the network. Now Boros supports the trade in fanding only on bitcoin and ether. The declared plans for developers – later cover other cryptocurrencies. In the first four days, the protocol was able to attract 6.58 WBTC (slightly less than $ 800,000) and 378.24 Weth (more than $ 1.63 million).

Source: Dune.com

Technical analysis

The beginning of 2025 did not set by Pendle. From January 1 to March 11, the price of a crypto acting fell more than three times. However, after the rise began. By mid -August, token added more than 220%, simultaneously updating the maximums of the year. The beginning of Pendle growth coincided with token listing on the Coinbase cryptocurrency on March 27.

Indicators of technical analysis speak in favor of continuing the ascending trend. On August 6, the price surpassed a 50-day sliding average (indicated in blue) and has since been much higher. In addition, RSI went up to the level of 50, but did not reach the overwhelming zone, although he was close. It is likely that the price increase will continue to a resistance level of about $ 6.5. In the case of correction of the Pendle quotation, they can go down to the level of support near $ 4.8.

Source: TradingView.com

Conclusion

The successes of Pendle are associated with partnerships that have made possible potentially profitable speculative schemes. The greatest attention to the project was attracted by the launch of the Boros protocol, which ensured the possibility of selling funding rates on bitcoin and ether.

This material and information in it is not an individual or other other investment recommendation. The view of the editorial office may not coincide with the opinions of analytical portals and experts.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.