Libra falls to a minimum of nine weeks, food inflation in the United Kingdom shoots

The sterling pound is down for the fourth consecutive day, since the US dollar shows strength against most of the main peers. The pound has decreased 1.5% in the current fall.

In the European session, the GBP/USD is quoted at 1,3338, with a 0.10% drop in the day. The pound fell to 1,3315 earlier, its lowest level since May 19. Inflation in the United Kingdom has been increasing, so it was not a surprise that the British Retail Consortium (BRC) store price index jumped 0.7% in July, a considerable increase from 0.4% in June and above the 0.2% forecast. Read more…

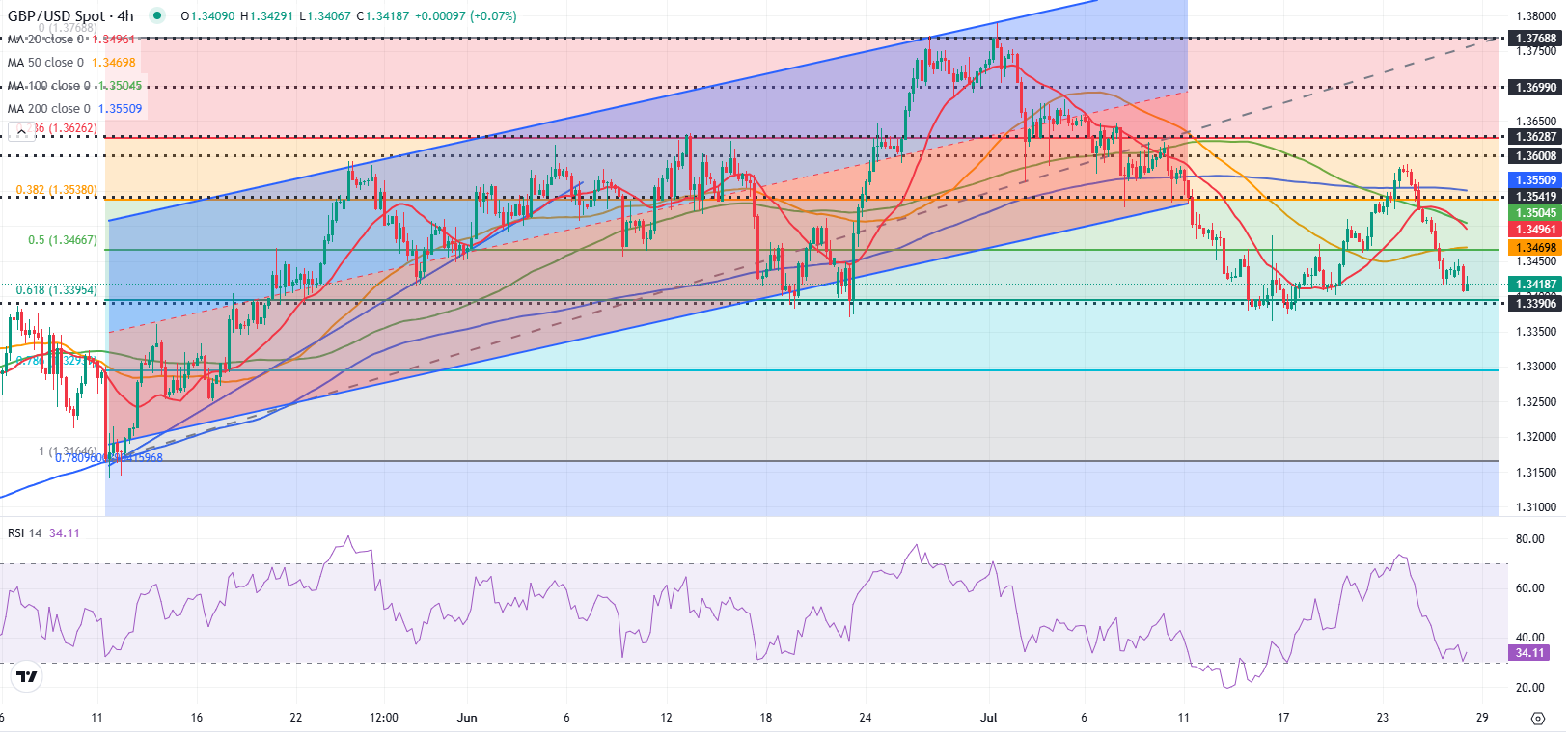

GBP/USD forecast: the sterling pound remains bassist despite the recent rebound

The GBP/USD is quoted slightly above 1,3350 after having touched its weakest level since the end of May below 1,3320 earlier in the day. The technical image of the PAR points to overall conditions, which suggests that there could be a correction before the following downward movement.

The US dollar (USD) began the week with a bullish tone and caused the GBP/USD to go south on Monday, since investors’ concerns about an economic recession in the United States (USA) were relieved after the US reached a commercial agreement with the European Union (EU). Read more…

GBP/USD forecast: Esterlina pound remains vulnerable to the USD general strength

After registering great losses on Thursday and Friday, The GBP/USD has difficulties to achieve a rebound on Monday and quote in negative territory, slightly above 1,3400. The technical perspectives of the torque suggest that the bearish trend remains intact in the short term.

The US dollar (USD) exceeds its rivals as fears are relieved about an economic recession in the United States (USA). The European Union (EU) and the US announced during the weekend that they have reached a Marco Commercial Agreement that establishes a 15% tariff on the goods traded between them. In addition, the president of the European Commission, Ursula von der Leyen, said they will not impose retaliation tariffs and said they will invest 600,000 million dollars in the USA in addition to existing expenses. Read more…

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.