GBP/USD Prognosis: The sterling pound could correct down in case the resistance 1,3750 is maintained

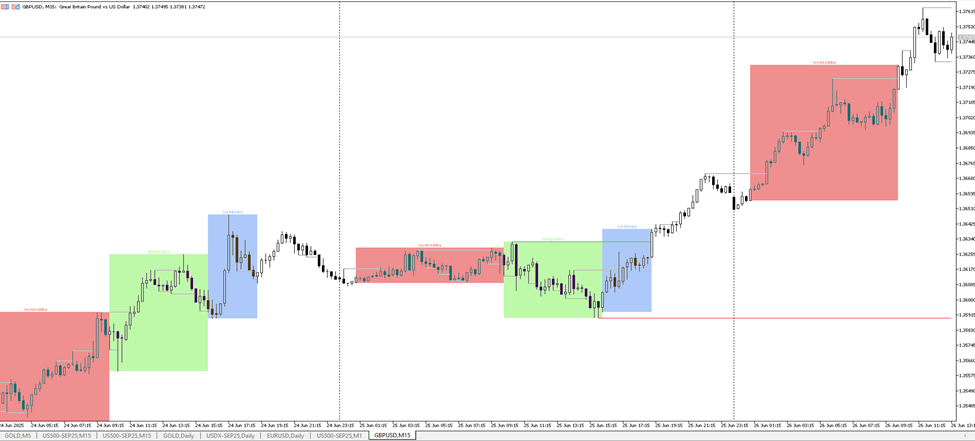

The GBP/USD extended its weekly rally and reached its highest level since October 2021 in 1,3770 on Thursday. The pair remains in a consolidation phase in the European session on Friday and fluctuates slightly below 1,3750.

The generalized selling pressure surrounding the US dollar (USD) promoted the rise of the GBP/USD on Thursday. News that suggest that the president of the United States (US), Donald Trump, plans to announce soon the replacement of the president of the Federal Reserve (Fed), Jerome Powell, to undermine him, triggered a sale of the USD. In addition, the publication of mixed macroeconomic data from the US weighed even more on the currency. Read more…

The GBP/USD movement has ‘gone too far’

The pound has risen 2% against the dollar so far this week, with the GBP/USD exchange rate (at least) quoting around its highest level since October 2021. However, we maintain that this movement has almost nothing to do with the prospects of the United Kingdom or the pound itself, and it is almost entirely a product of the boldness narrative of the dollar.

Apart from the figures of the June PMI, moderately more optimistic, there has been no important data publication this week that changes the market vision of the British economy, which seems very likely to slow down quite pronounced in the second quarter, after which it was a solid first quarter. Read more…

GBP/USD operators are attentive to the underlying PCE and Fed’s comments for clues about politics trajectory

The GBP/USD torque enters a consolidation mode while the markets are prepared for key US data and Fed comments. The focus is in the Personal Consumption Price Index (PCE) May, which will be published at 12:30 PM GMT, and that could reinforce or challenge the current expectations of fence cuts. The forecasts point to an increase of 0.1% monthly and 2.6% per year, coinciding with the April figures. As a preferred inflation measure of the Fed, any deviation could have an impact on currency markets.

The PCE price index (May) will be published at 12:30 pm GMT (07:30 am edt). Forecasts: +0.1% m/m, +2.6% A/A, coinciding with the April figures. Speeches and events of the Fed. The governor of the FED, Michael Barr, will speak at the Cleveland Fed Policies Summit (~ 1: 15 PM EDT), and then again ~ 4: 00 PM edt on Community Development/Regional Policy. Read more…

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.