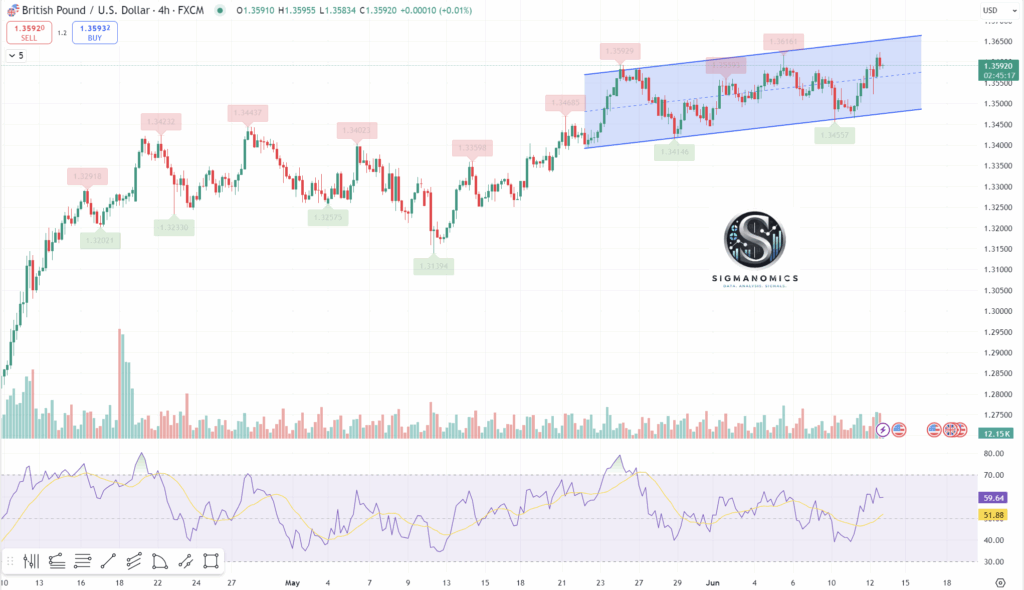

GBP/USD forecast: The sterling pound could expand the correction if the 1,3530 support fails

The GBP/USD remains down and trades about 1,3550 during the European session on Tuesday after registering small profits on Monday. The torque could extend its fall if the support level fails in 1,3530.

The improvement of the appetite for the risk made it difficult for the US dollar (USD) to remain firm in front of their peers on Monday and helped GBP/USD to rise. The Wall Street Journal reported that Iran was looking to put an end to hostilities with Israel and resume conversations about its nuclear program. The main stock indices ended the day decisively on the rise, reflecting an atmosphere of positive risk market. Read more…

GBP/USD reaches the highest level since February 2022

The dollar, commonly known as the wirehas reached its highest level against the US dollar since the beginning of 2022quoting at the psychologically significant level of 1.36 as of June 2025. This pair of foreign exchange has been influenced by divergent policies of central banks, different economic narratives and rates of inflation variables on both sides of the Atlantic. In detail, the dollar has fallen almost 10 percent due to disappointing work data in the USA along with the speculation of fed features in inflation. On the contrary, the United Kingdom has shown solid data with a 1.2 percent increase in retail sales in April, while inflation increased 3.5 percent year -on -year in April from 2.6 percent. This recent consumer price report has led to Bank of England To reconsider movements towards feat cuts.

In this report, we will examine economic situations in the United Kingdom and the United States, we will analyze its impact on the GBP/USD exchange rate and provide a detailed technical analysis through multiple time frames. Read more…

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.