GBP/USD forecast: The sterling pound could extend its fall if the 1,3650 support fails

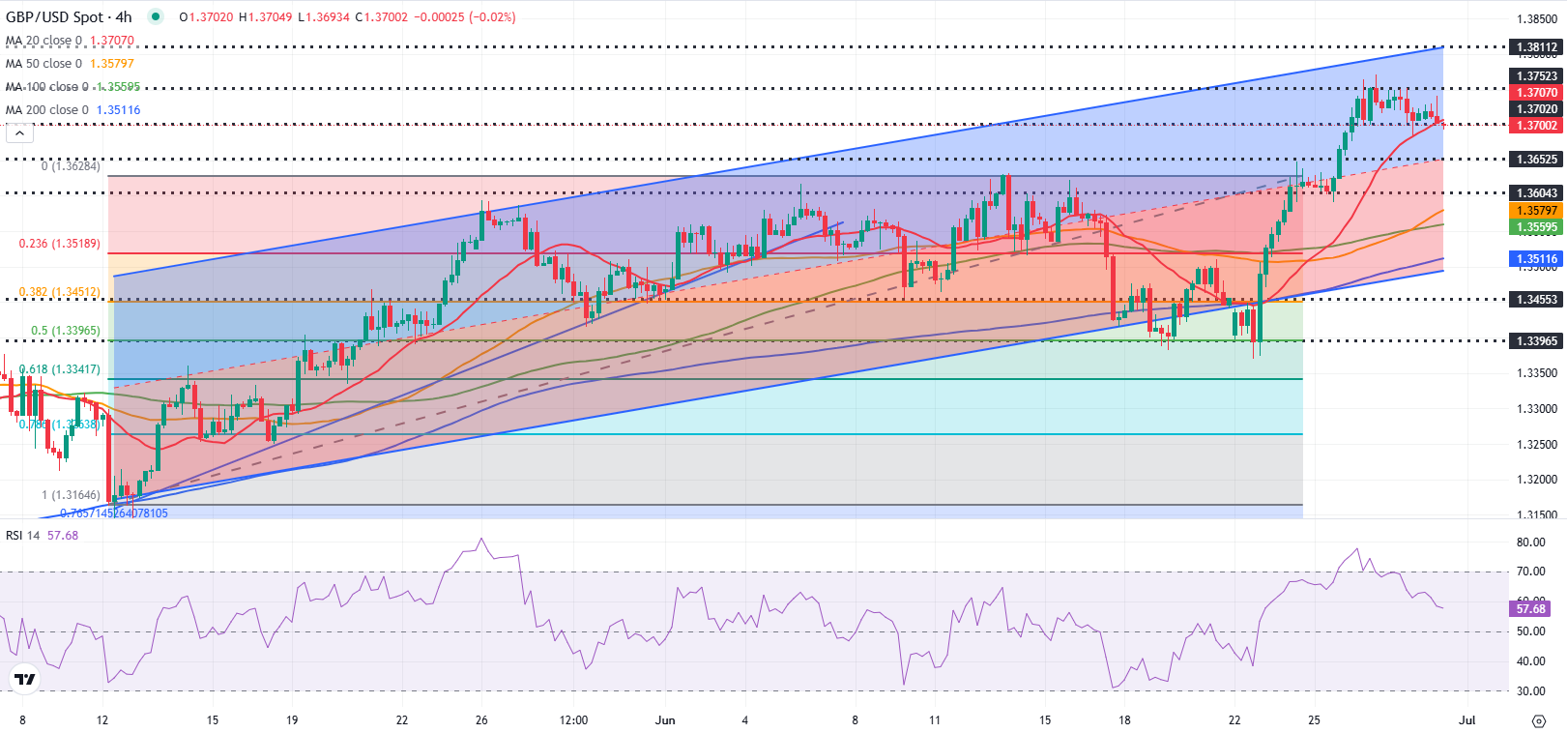

The GBP/USD corrects down and quotes around 1,3700 on Monday after winning approximately 2% last week. The technical perspectives of the PAR point to a loss of short -term bullish impulse.

The GBP/USD rose sharply last week due to the atmosphere of positive market market, due to the decrease in geopolitical tensions and the growing concerns about the loss of independence of the Federal Reserve (Fed), which weighed strongly over the US dollar (USD). Read more…

GBP/USD price forecast: rebounds to 1,3750 near top of several years

The GBP/USD pair goes back its recent losses from the previous session, quoting around 1,3730 during the Asian hours of Monday. The bullish bias persists since the technical analysis of the daily graph indicates that the torque moves up into the pattern of ascending channel.

The 14 -day relative force (RSI) index remains slightly below level 70, strengthening the bullish bias. However, a rupture above the 70th brand would indicate an overstock situation and a low correction soon. In addition, the GBP/USD pair rises above the nine -day exponential mobile average (EMA), suggesting that the impulse of the short -term price is stronger. Read more…

GBP/USD weekly perspective: The sterling pound awaits the conversations of the central banks at the NFP week

The recovery of the sterling pound (GBP) gained impulse against the US dollar (USD), leading to the PAR GBP/USD at the highest level since October 2021, above 1,3750.

It was a clear case of winning for the libra sterling of higher performance, since the US dollar gradually lost its appeal as a safe refuge amid a changing feeling around the policy perspectives of the US Federal Reserve. Read more…

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.