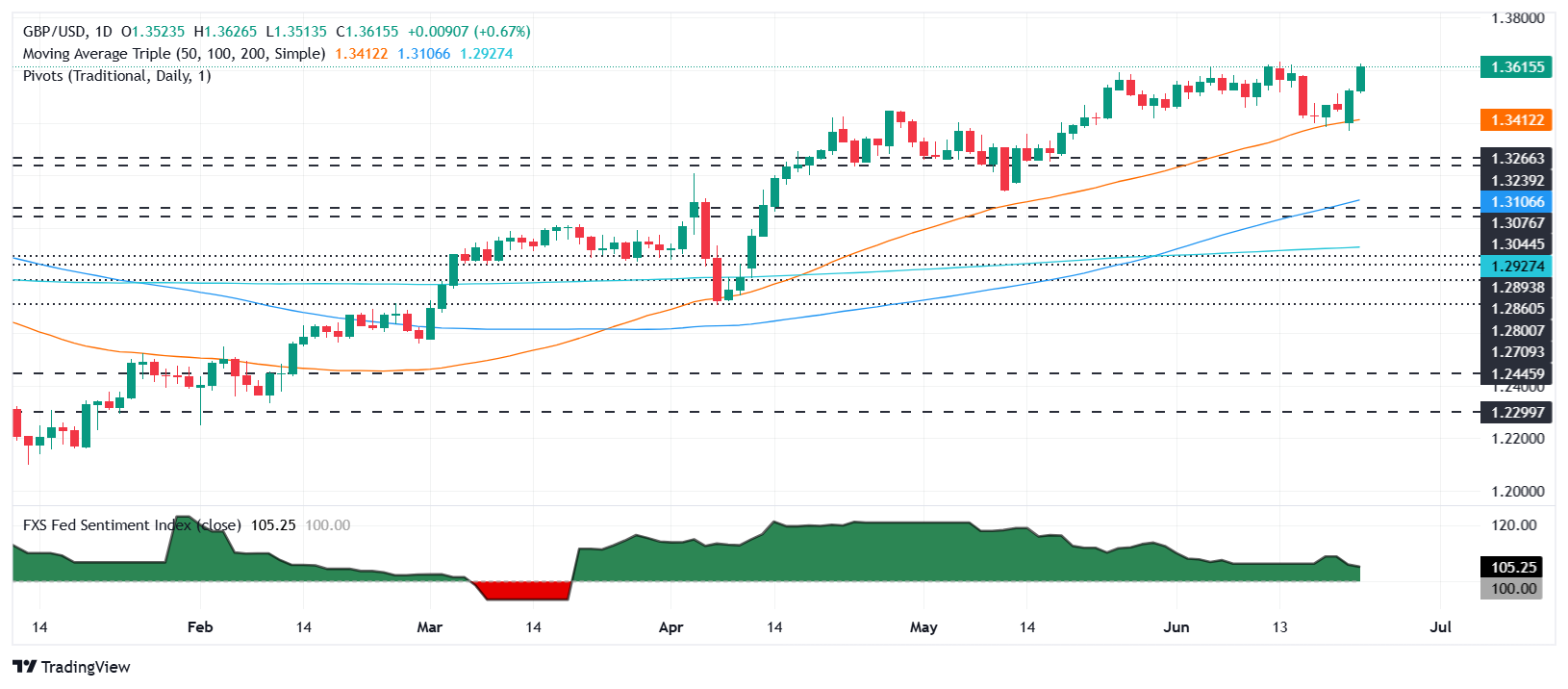

GBP/USD exceeds 1,3600 while the truce is uncertain, Powell moderates the expectations of rates cuts

The sterling pound extended its profits against the US dollar on Tuesday, since the proposed truce between Israel and Iran was raped by both parties, despite the warning of US President Donald Trump. However, the appetite for the risk remains strong, despite the ongoing developments in the Middle East. The GBP/USD quotes above 1,3600, winning more than 0.65%, after reaching a weekly maximum of 1,3626. Read more…

The pound sterling recovers a maximum of three years against USD after the truce between Israel and Iran

The pound sterling (GBP) extends its upward movement from Monday to about 1,3630 against the US dollar (USD) during the European negotiation hours on Tuesday. The GBP/USD torque is strengthened as a global rally due to the risk driven by the truce between Israel and Iran has reduced the demand for shelter assets such as the US dollar. Read more…

GBP/USD attracts some buyers above 1,3550 after the truce in the Middle East

The GBP/USD torque gains traction to around 1,3560 during the early European session on Tuesday, driven by the weakest US dollar (USD). The operators will closely observe the speech of the governor of the Bank of England (BOE), Bailey, together with the semiannual testimonies of the president of the Federal Reserve (Fed), Jerome Powell, later on Tuesday. Read more…

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.

.jpg)