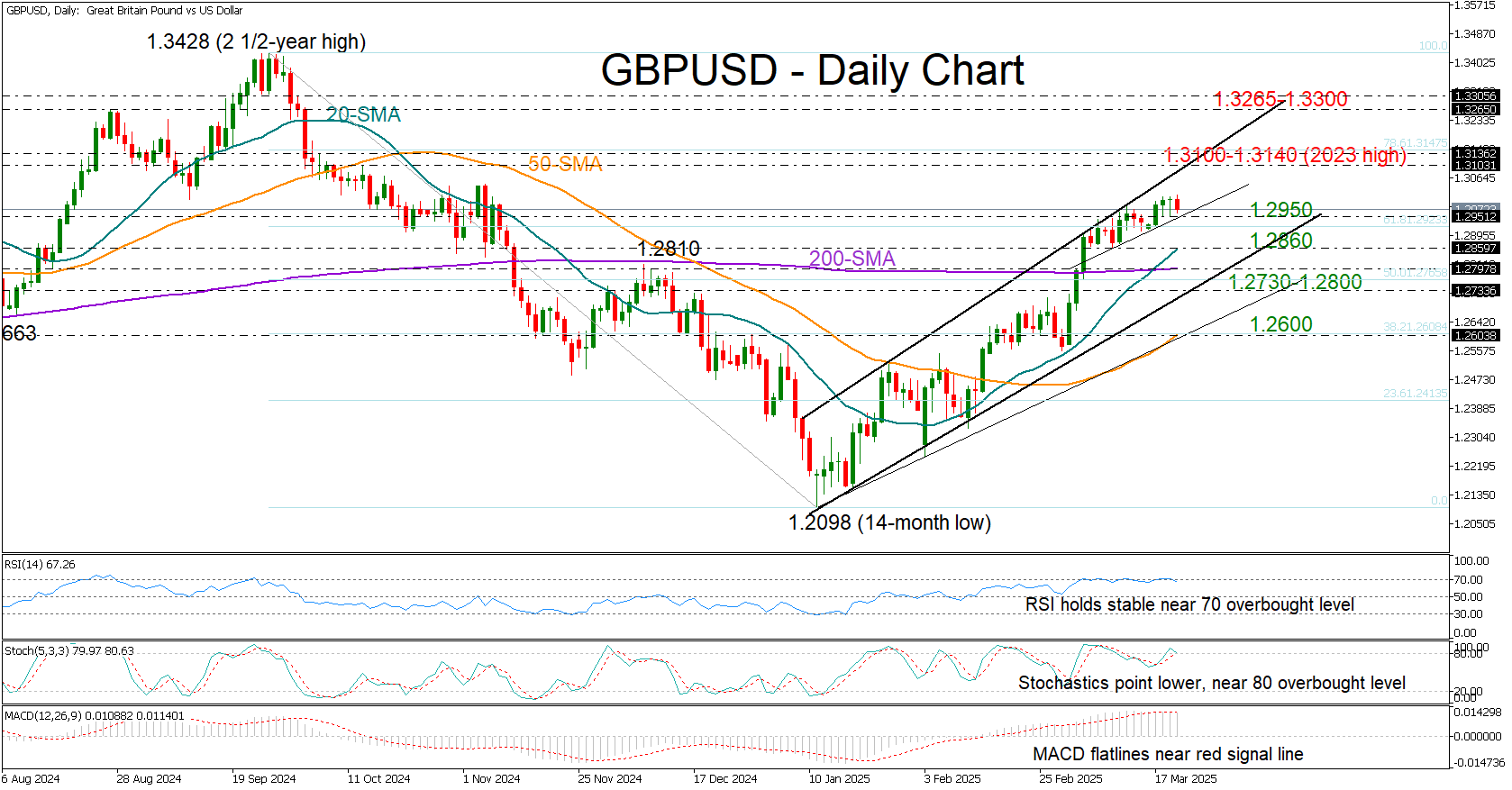

GBP/USD indicates caution while the BOE takes prominence

GBP/USD made a modest advance towards the 1.3000 area after the FOMC policy meeting on Wednesday, which held the door open for feats of rates in the midst of uncertainty about the US economic perspectives.

The Bank of England is near today’s calendar, and the torque is currently being moderately down in 1,2964 after unemployment applications in the United Kingdom increased unexpectedly in February. While the central bank is expected to maintain stable rates, any change in the tone of its communication in response to commercial and geopolitical risks could generate new volatility. Read more…

GBP/USD Forecast: The sterling pound fails to attract buyers before the BOE

GBP/USD remains at a disadvantage and quotes in negative territory below 1.3000 during the European morning on Thursday while the markets evaluate the latest published data from the United Kingdom, waiting for the policy ads of the Bank of England (BOE).

The Federal Reserve left the policy rate without changes in 4.25% -4.5% after the March meeting, as expected. The Summary of Economic Projections (SEP), also known as the points graph, showed that those responsible for policies still project a total reduction of 50 basic points (BPS) in the rates in 2025. Although the US dollar (USD) fought to gain strength with the immediate reaction, managed to find a support point during the press conference of the president of the FED, Jerome Powell. Read more…

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.