GBP/USD Perspective: The cable is softened after the weak IPC data but still lacks clearer management signs

The cable fell to a minimum of two weeks on Wednesday due to the February inflation data in the United Kingdom, which were softer than expected, which feeds the expectations of a rate cut by the BOE in May.

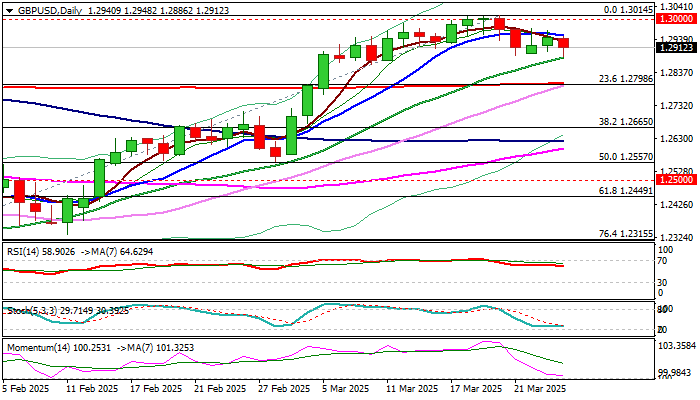

The new weakness puts the support in 1,2883 (20DMA / minimum last Friday) at risk, whose break would open the way for a deeper correction (the descents from the new maximum of several months in 1,3014 have been so far superficial) and would exhibit the following significant support in 1,2798 (200DMA / FIBO 23.6% of the rebound of 1,2099 / 1,3014). Read more …

GBP/USD Forecast: Esterlina pound seems vulnerable after the weak inflation data

The GBP/USD is maintained under bearish pressure during the European session on Wednesday and quotes around 1,2900. The torque could be extended down in case the 1,2880 support area fails. The sterling pound weakens in front of its main rivals after the weak inflation data of the United Kingdom.

The National Statistics Office announced early Wednesday that the consumption price index (CPI) rose 2.8% year -on -year in February. This reading followed the 3% increase recorded in January and was below the market expectation of 2.9%. The underlying IPC, which excludes volatile food and energy prices, increased 3.5% in the same period, below the estimation of analysts of 3.6%. Read more …

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.