GBP/USD forecast: the sterling pound stabilizes but remains vulnerable

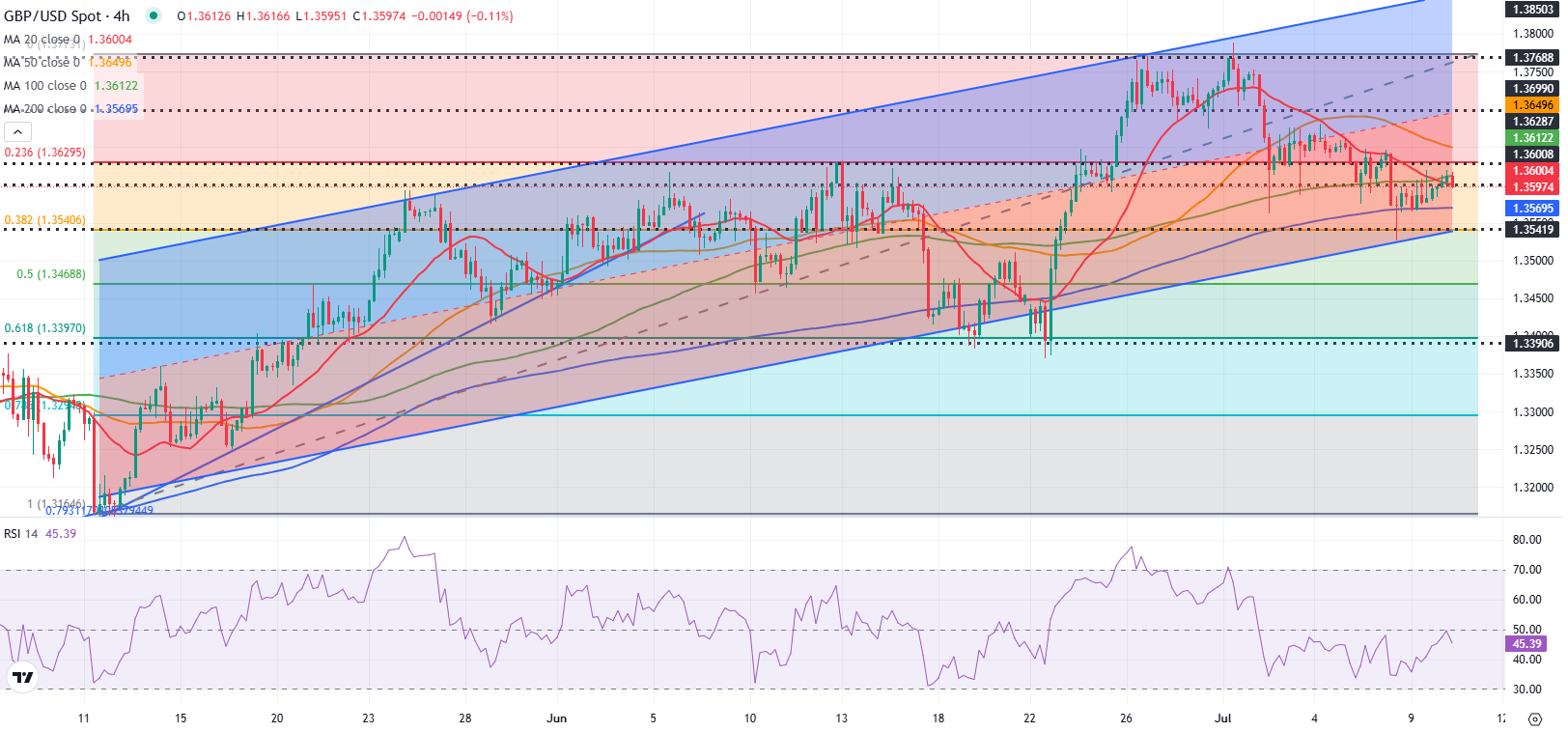

After the undecided action on Wednesday, The GBP/USD remains relatively calm in the European session on Thursday and continues to fluctuate around 1,3600. The sterling pound could have difficulty attracting buyers unless the feeling of risk improves remarkably.

US President Donald Trump reiterated his threat of imposing an additional 10% tariff on any country that aligns with the BRICS Group on Wednesday. Trump also shared a new set of tariff cards, revealing rates on imports from some minor business partners, such as Libya, Algeria and the Philippines. Read more…

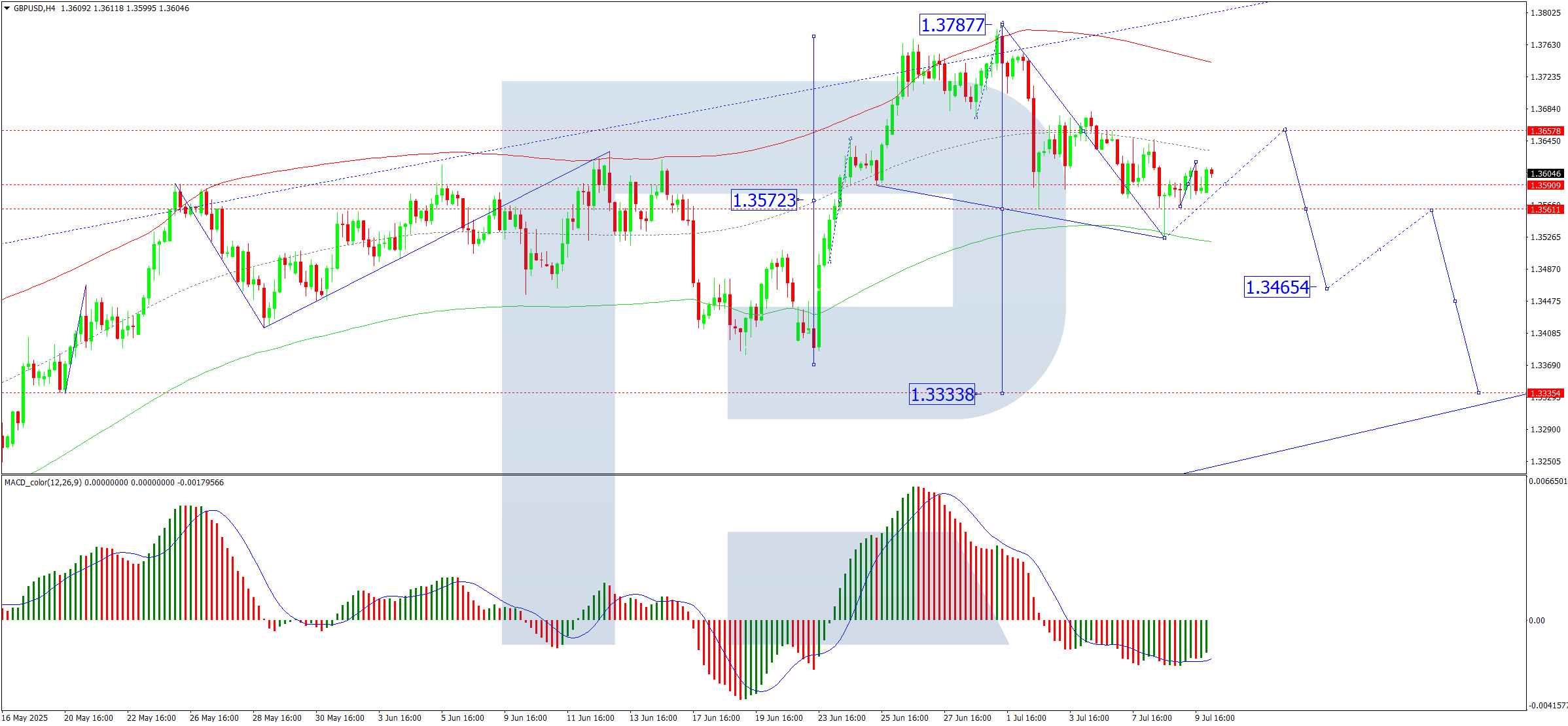

The GBP/USD reaches a minimum of two weeks as the pressure increases

The GBP/USD torque fell to 1,3602 on Thursdaymarking a minimum of two weeks in the middle of a strengthened US dollar and growing concerns about public finances in the United Kingdom.

The mass sale intensified after US President Donald Trump confirmed the imposition of 25% tariffs on goods from 14 countries, including Japan and South Korea, as of August 1. Until now, only the United Kingdom and Vietnam have ensured exemptions of these new tariffs, which add to existing rights over cars, steel and aluminum. Read more…

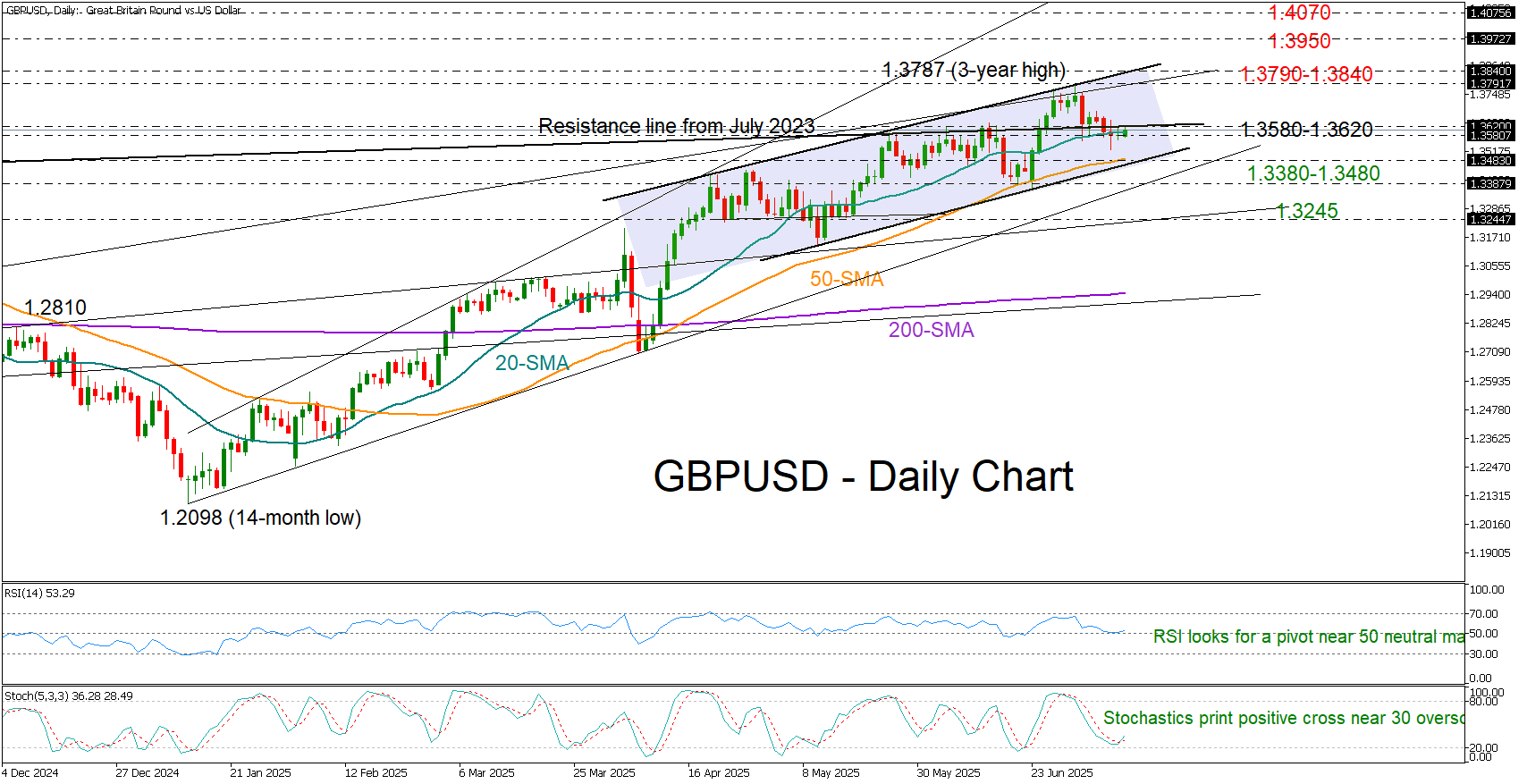

GBP/USD feel the bases for a pivot

The GBP/USD is attracting the interest of the buyers after falling briefly below their simple mobile (SMA) of 20 days and a week after going back from the maximum of three years of 1,3787.

The upward pressures can remain intact as the feeling of risk in global stock markets tends to feed the appetite for sterling pound. The technical indicators also support this narrative: the stochastic oscillator is prepared for a rebound, and the RSI is trying to avoid a fall below its neutral 50 brand. Read more…

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.