GBP/USD Perspective: Libra remains constructive

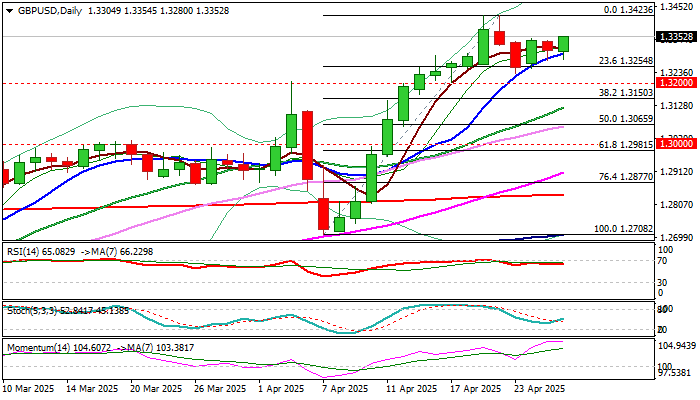

The Libra advanced slightly early Monday and presses the key barrier in 1,3350 (FIBO 61.8% of the correction of 1,3423 / 1,3232 / old recovery peak of April 24).

Higher minimum series from the minimum correction of 1,3232, with a new recovery being followed by the ascending 10DMA that adds to the short -term upward trendwith a sustained rupture of 1,3350 necessary to confirm that the corrective phase is over, and the largest bulls seek a new attack on the 1,3434 barrier (maximum of 2024). Read more…

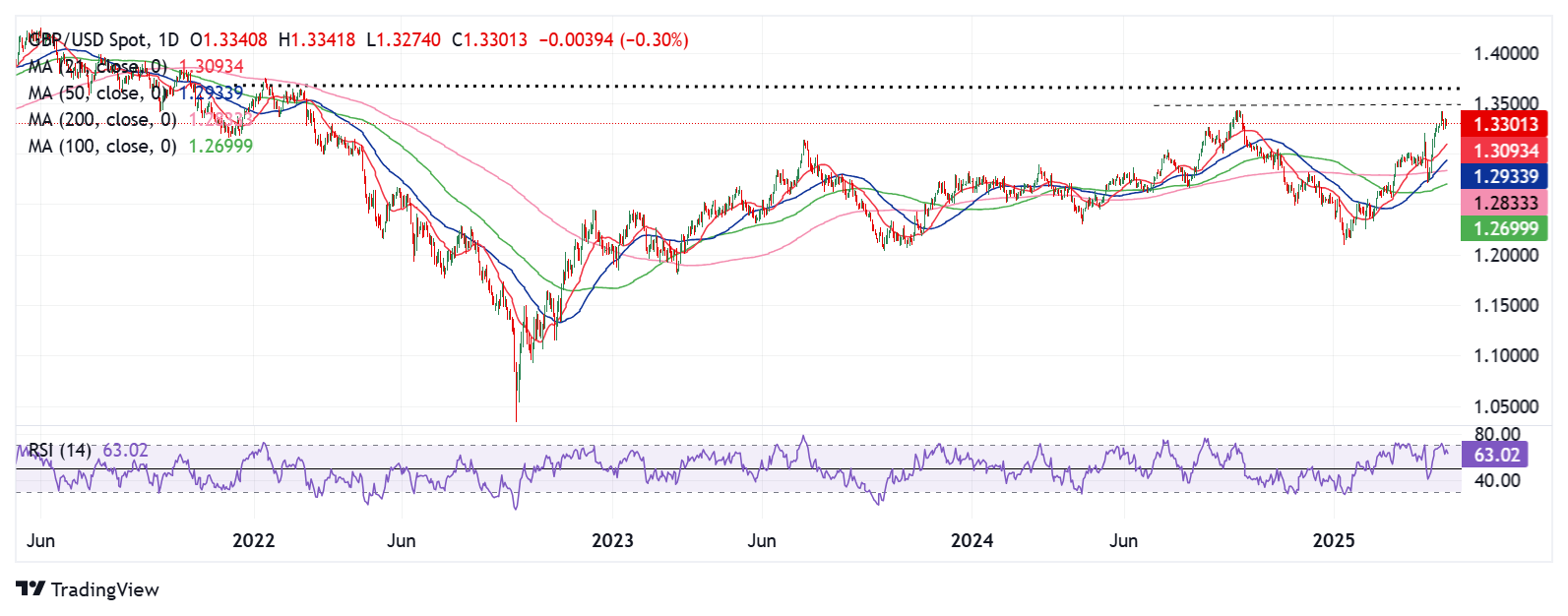

GBP/USD forecast: Sterling pound vendors are undecided at the uncertainty between the US and China

The GBP/USD closed slightly down on Friday but ended up registering small weekly profits. The pair remains firm in the European session on Monday and quotes above 1,3300.

The markets adopt a cautious posture to start the week in the middle of mixed headlines about the commercial conflict between the US and China. As a result, the US dollar (USD) struggles to overcome its rivals and allows the GBP/USD to maintain its position. Read more…

GBP/USD weekly perspective: The sterling pound remains resistant to Trump’s tariff play

The GBP/USD remained mainly at the mercy of the dynamics of the US dollar, induced by the erratic tariff movements of the US president Donald Trump and some flashes of optimism about the surprisingly resistant corporate results of the US.

The dollar had an erratic behavior this week, falling almost 1% compared to its main rivals at the beginning of the week on Monday after Trump threatened to say goodbye to the president of the Fed, Jerome Powell, for not lowering the interest rates quickly enough, only to recur a 1.5% one day later when Trump softened his rhetoric over China and the independence of the Federal Reserve of the US. Read more…

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.