GBP/USD forecast: The sterling pound is still fragile despite the high inflation data in the United Kingdom

After a short -term recovery attempt in the early hours of the European session on Wednesday, The GBP/USD struggles to maintain its position and quote below 1,3400. The short -term technical image highlights over -sales conditions for the torque.

The data published by the National Office of Statistics (ONS) of the United Kingdom showed earlier on the day that annual inflation in the United Kingdom, measured by the variation of the consumer price index (CPI), rose to 3.6% in June from 3.4% in May. This figure exceeded market expectations of 3.4%. In the same period, the underlying IPC, which excludes volatile food and energy prices, increased 3.7%, compared to the 3.5% increase recorded above. With the immediate reaction, the GBP/USD rose slightly but failed to gain impulse. Read more…

The pound continues in decline, with little support from the Bank of England

The GBP/USD torque has slowed its decline, stabilizing about 1,3391. The previous day, the governor of the Bank of England, Andrew Bailey, addressed the main global economic challenges in a speech in Mansion House. He described the last wave of commercial tariffs as a systemic event capable of remodeling the dynamics of global trade. Bailey highlighted the growing internal imbalances in the US and the weak domestic demand in China, urging both nations to clarify their strategies to address these problems.

However, Bailey clarified that not all commercial imbalances are inherently problematic; Many come from productivity disparities between nations. However, he warned that the growing macroeconomic and political divergences are increasing systemic fragility. Read more…

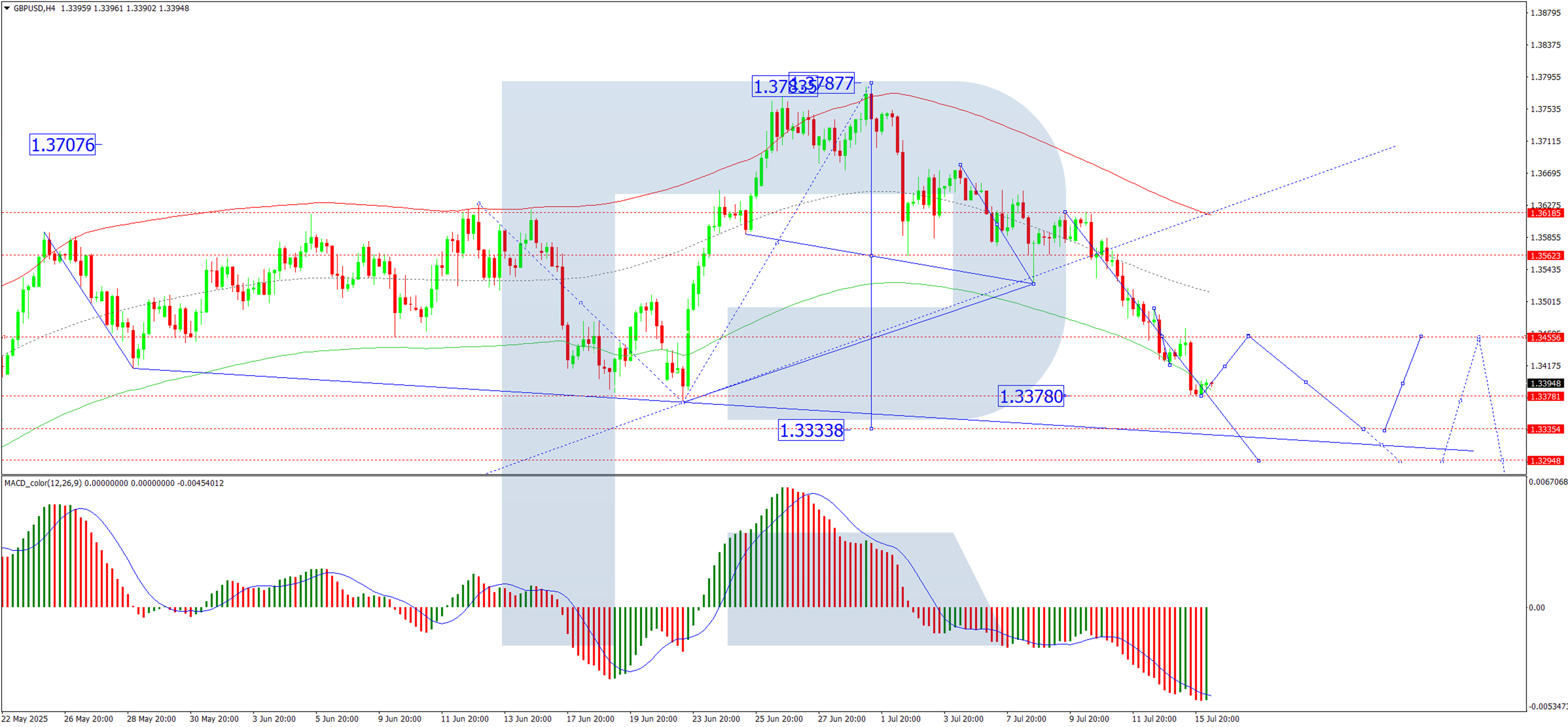

The cable is breaking a final diagonal

The cable is going down and has been one of the weakest coins during the last week Or more, and the main reason for this, of course, were the GDP figures of the United Kingdom reported last week, which showed that the economy has contracted, while at the same time, the Bank of England said it will be considering more features of rates in the future. That is why the cable went down quickly to the 1,3380 area in a relatively short period of time.

Now, what is really important here is that the market is going down after a final diagonal that was positioned in the fifth wave, something that we have been following closely with our members, and we already noticed this limited bullish potential in June. The final diagonals are known for being slow patterns, but once completed, they generally lead to an abrupt reversal – and that is exactly what we are seeing here. Read more…

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.