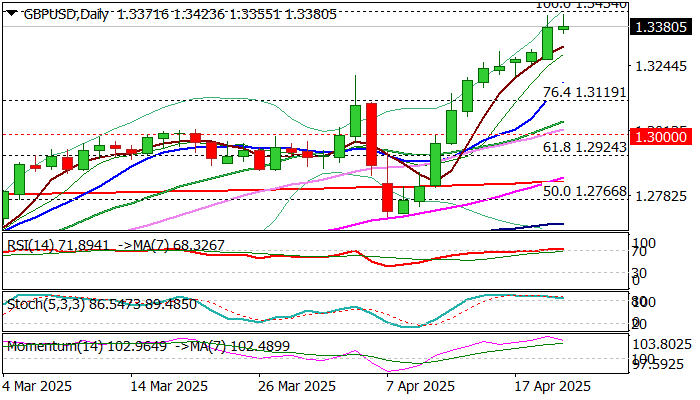

GBP/USD forecast: sterling pound seems fragile after the disappointing data of the United Kingdom

The GBP/USD fell below 1,3250 at Wednesday’s Asian session after registering daily losses on Tuesday. Although the torque experienced a rebound subsequently, the disappointing data on the purchasing managers index (PMI) of the United Kingdom limited the bullish potential.

The PMI S&P Global/Cips Composed in the United Kingdom collapsed to 48.2 in the preliminary estimate of April since 51.5 in March, highlighting a contraction in the business activity of the private sector. Read more…

GBP/USD Perspective: Alcistas face winds against key resistance but so far maintain control

The bulls show initial fatigue signs when approaching the key barrier in 1,3434 (maximum of 2024 of September 26) After repeated failure of maintaining profits above the 1,3400 zone. The overcompra conditions in the daily chart indicate that the recent eleven -day consecutive days could be losing impulse.

The falls have so far been superficial and the short -term action still lacks correction signals (the minimum requirement will be today’s closure) while traders hesitate to make a stronger benefits. Read more…

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.