The sterling pound wins against USD despite the confirmation of the commercial agreement between the US and Japan

The pound sterling (GBP) wins in front of its peers, except the antipodes currencies, Wednesday. The British currency attracts offers even when the Fiscal Risks of the United Kingdom (UK) have resurfaced, after the indebtedness of the Government of the National Statistics Office (ONS) on Tuesday.

The report showed that the Administration raised the second largest amount of funds since 1993 to mitigate the increase in debt costs, which accelerated due to the greater inflation. The increase in indebtedness in the United Kingdom paves the way for tax increases by the administration in its next autumn report. Read more…

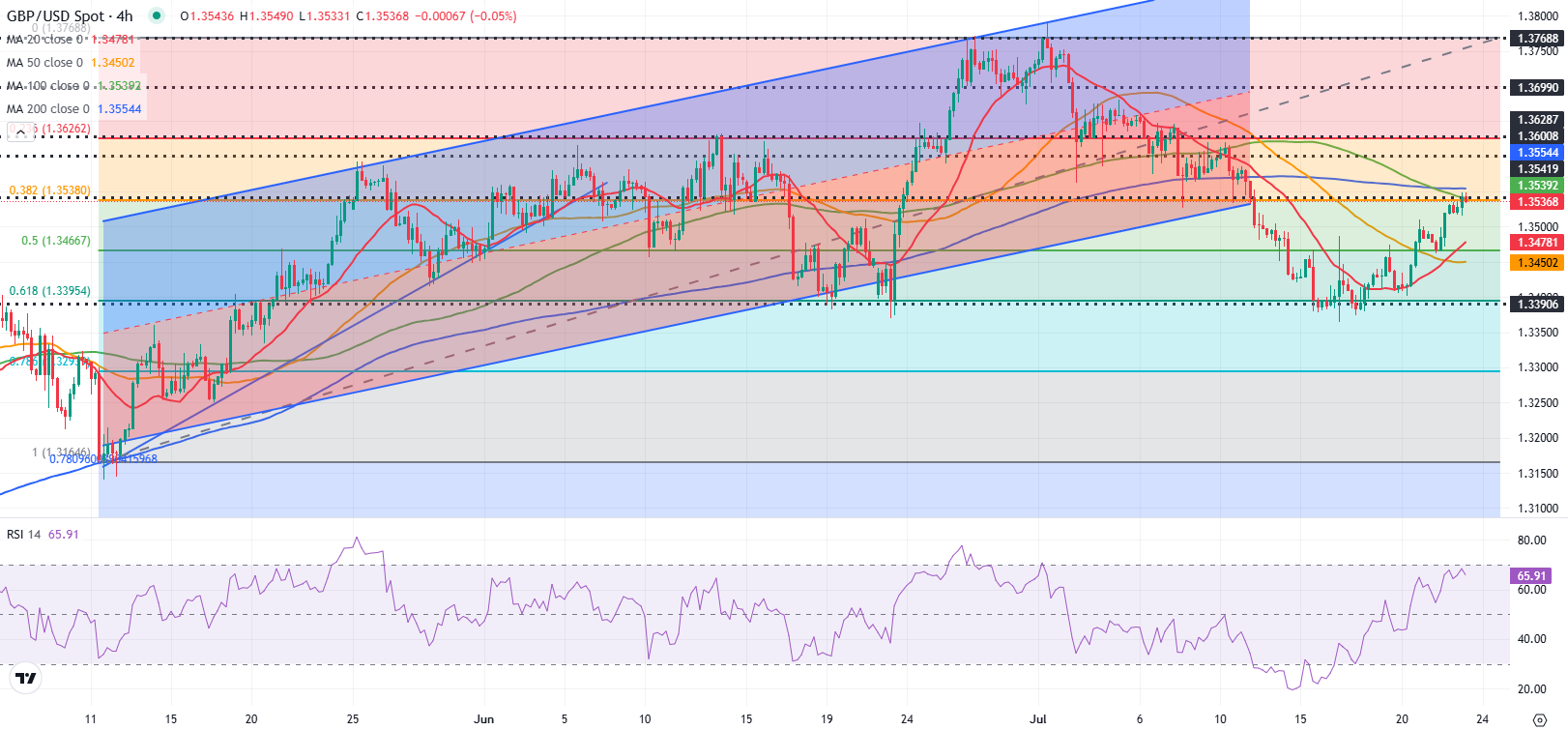

GBP/USD forecast: sterling pound seeks to stretch up with the improvement of the feeling of risk

The GBP/USD remains in a consolidation phase above 1,3500 after registering profits on Monday and Tuesday. The feeling of risk in improvement and the technical perspective suggests that the torque could stretch up in the short term.

The US dollar (USD) remained under sale pressure on Tuesday and allowed the GBP/USD to consolidate the profits of Monday. The uncertainty regarding the commercial relations of the United States with its main partners and the growing dispute between US President Donald Trump and the president of the Federal Reserve (FED) Jerome Powell made it difficult to find the USD. Read more…

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.