GBP/USD Russian mountain in the first quarter – Will the torque continue with the rebound in 2025?

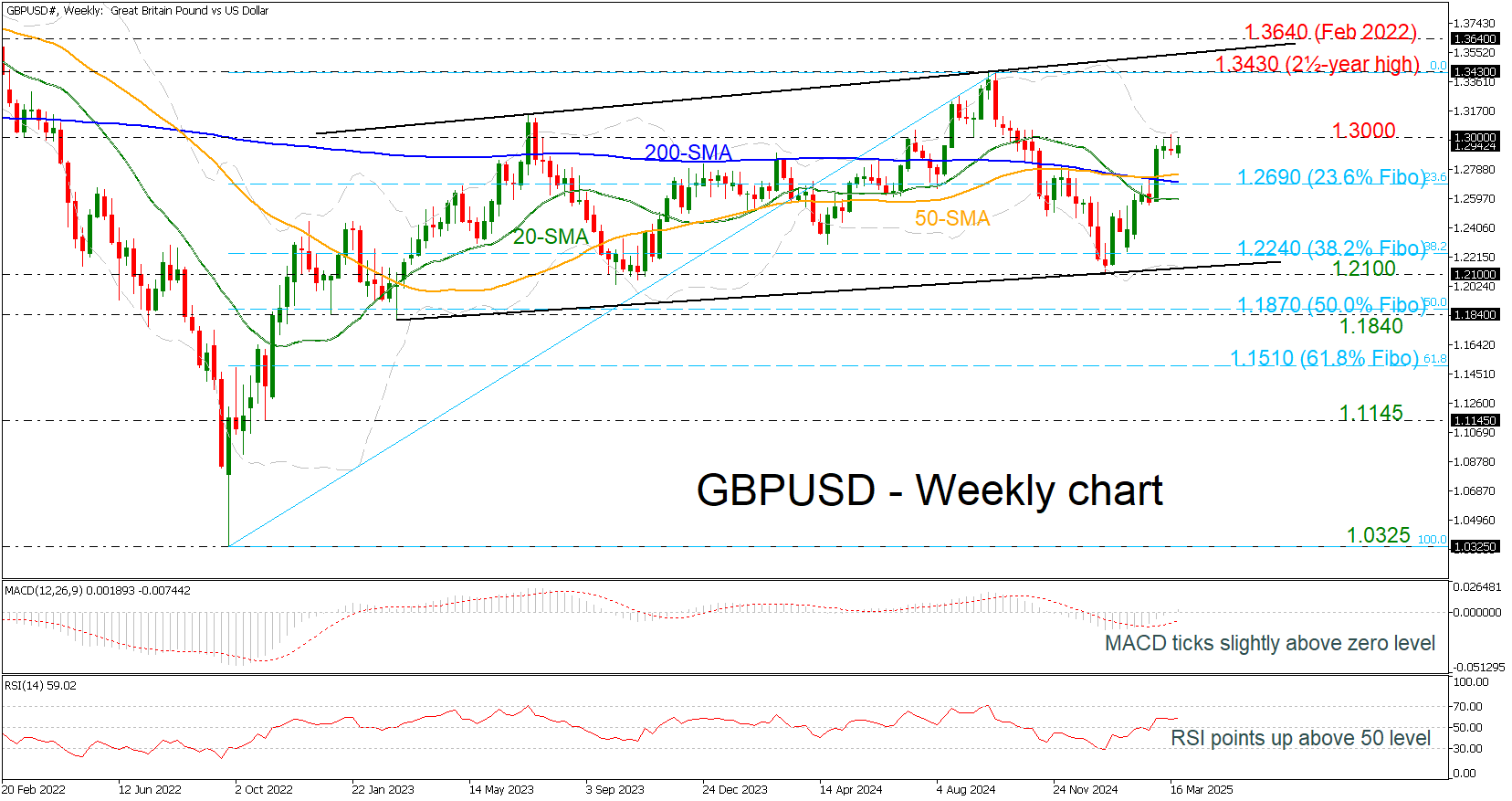

In the first quarter of 2025, the sterling pound experienced significant fluctuations against the dollar. The GBP/USD began the year in approximately 1,2500, fell to a minimum of 1,2100 on January 13 and shot at a maximum of 1,3014 in mid -March, having a general performance of 3.5% so far this year. This volatility was driven by a mixture of economic factors and policy decisions.

The Bank of England (BOE) played a fundamental role in the configuration of the pound movement. In February, the BOE reduced the interest rate at 25 basic points up to 4.5%. This movement aimed to boost economic growth amid inflation in deceleration and a contained domestic demand. While the reduction of rates provided some economic relief, it also contributed to the initial depreciation of the pound. Read more…

GBP/USD Forecast: The sterling pound fails to take advantage of optimistic data

The GBP/USD acquires a bullish impulse and closes in positive territory on Thursday. The pair remains in a consolidation phase about 1,2950 in the European session on Friday while the markets expect the next publication of the US key data.

The general weakness of the US dollar (USD) helped GBP/USD to win traction on Thursday, since the announcement of automotive tariffs by US President Donald Trump revived concerns about an economic deceleration. Read more…

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.