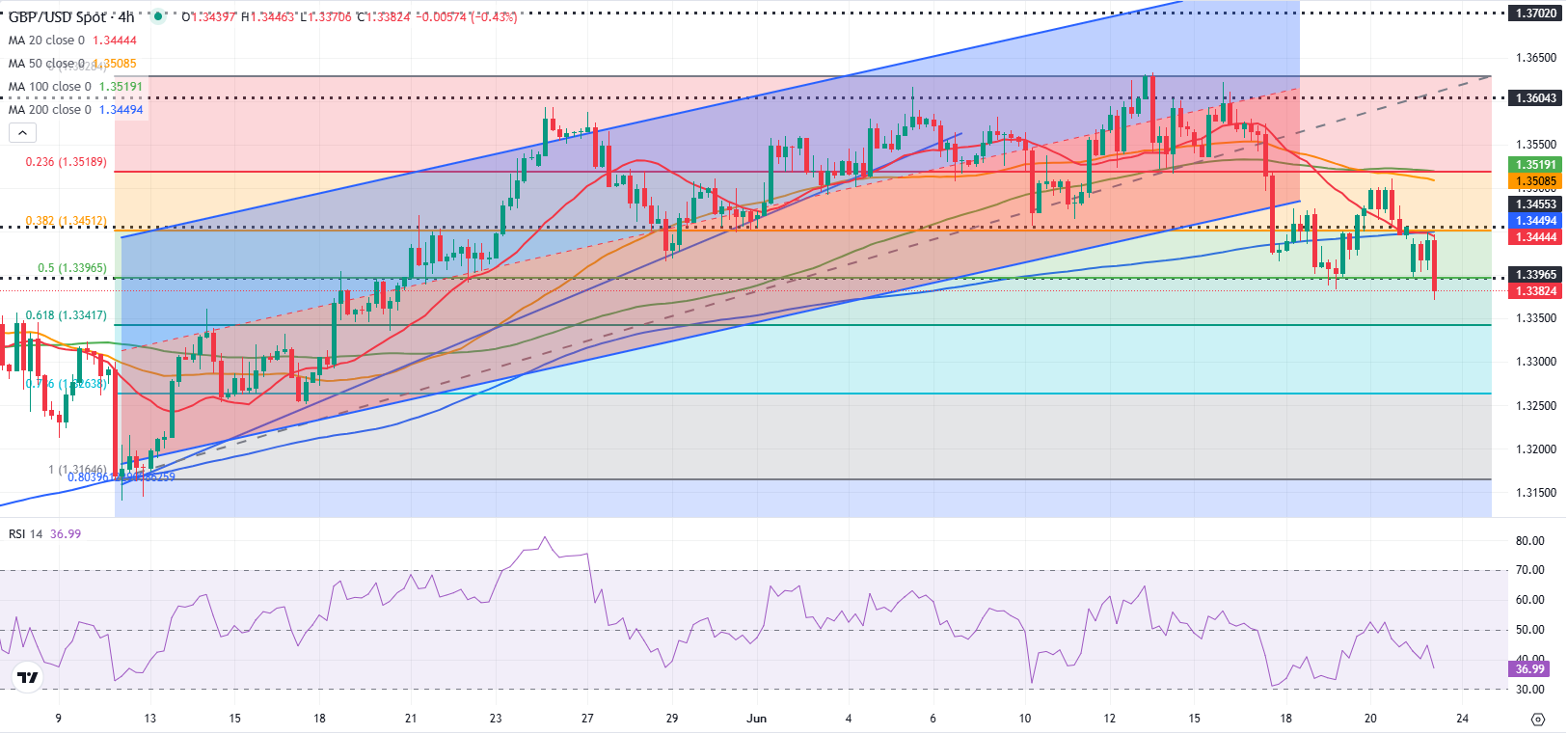

GBP/USD Prognosis: the bearish pressure intensifies as geopolitical tensions increase

After losing almost 1% in the previous week, The GBP/USD remains under bear. In the event that safe refuge flows continue to dominate the action in financial markets in the second half of the day, the torque could continue to spread.

The negative change in the feeling of risk helps the US dollar (USD) to overcome its rivals and weighs on the GBP/USD on Monday. Market participants are increasingly concerned about a conflict in expansion and dear in the Middle East after the United States’s decision to attack three nuclear facilities in Iran during the weekend. Read more…

GBP/USD Weekly Perspective: Comments from Powell and Bailey will boost the movements of the sterling pound after a week of roller coaster

The sterling pound (GBP) experienced a late recovery against the US dollar (USD) after GBP/USD torque ran to the monthly minimums below 1,3400. The price action around the GBP/USD par last week was dictated mainly by the ongoing developments related to geopolitical climbing between Israel and Iran, even when commercial uncertainties continued to persist.

The US dollar received a double impulse thanks to the reactivation of the demand for safe refuge, courtesy of the conflict in the Middle East, and the decision to maintain a hard line posture by the Federal Reserve of the US (Fed). Read more…

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.