GBP/USD shrugs before the unexpected fall of the United Kingdom GDP

The sterling pound has dropped slightly against the US dollar on Friday. The GBP/USD quotes 1,2928 in the European session, with a 0.13% drop in the day.

The economy of the United Kingdom barely registered growth in the second half of 2024, increasing 0.1% in the third quarter and staging in the fourth quarter. The new year has not brought improvements, since GDP contracted 0.1% m/m in January, after an increase of 0.4% in December and below the estimate of the market of 0.1%. The surprising contraction was driven by falls in the production and manufacturing sectors. The economy grew 0.2% in the three months to January, compared to 0.1% in the three months to December, but below the market estimation of 0.3%. Read more …

GBP/USD Forecast: The sterling pound struggles to benefit from optimism after the weak data of the United Kingdom

After closing slightly down on Thursday, the GBP/USD remains defensive and listed below 1,2950 in the European session on Friday. Although the short -term technical perspectives still do not point to an accumulation of bearish impulse, the torque could have difficulty starring in a rebound after the disappointing published data of the United Kingdom.

The data published by the United Kingdom National Statistics Office (ONS) showed early Friday that the Gross Domestic Product (GDP) of the United Kingdom contracted 0.1% in monthly terms in January. This reading followed the growth of 0.4% registered in December and was below the market expectation of an expansion of 0.1%. Read more …

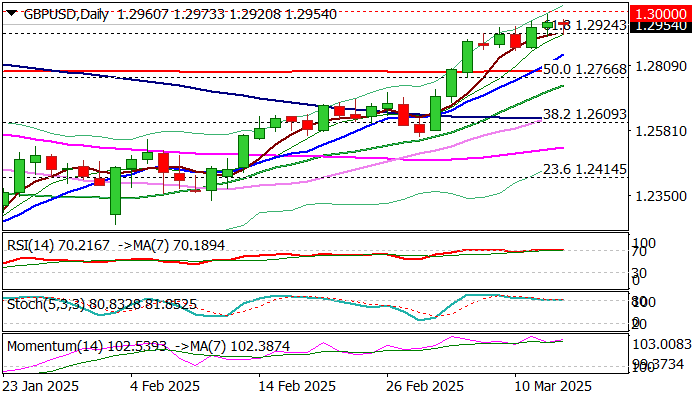

GBP/USD perspective: Alcistas pause under the 1.3000 barrier but maintain control

The cable dropped slightly on Thursday but remains constructive near a new maximum of several months (1,2989) and the psychological barrier of 1.3000.

The limited falls on Wednesday/today support this notion, since the weak dollar continues to support the progress of the pound, together with the daily bullish techniques (the last formation of the golden cross of 10/200DMA contributed to the upward perspective). On the other hand, the bulls may face more winds against, since daily studies are overcompraned and 1.30 marks a significant obstacle, which could limit and maintain short -term action in an extended consolidation. Read more …

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.