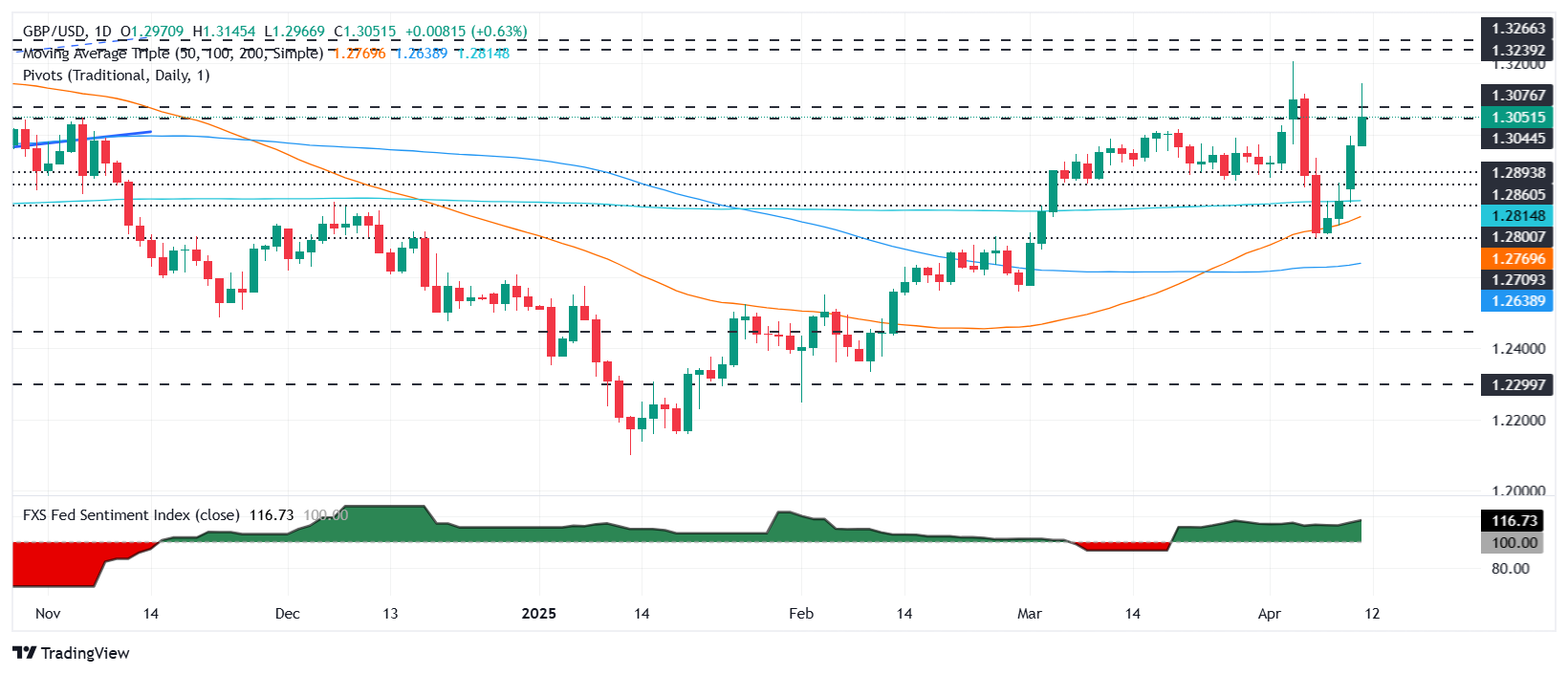

GBP/USD shoots above 1.3000 as China scale the commercial war with the US

The sterling pound (GBP) extends its profits against the US dollar (USD) as the commercial war between the US and China intensifies, with Beijing imposing 125% tariffs on US products. Commercial policies continue to boost price action, while economic data are in the background. At the time of writing, the GBP/USD quotes at 1,3067, rising 0.77%. Read more…

GBP/USD rises above 1,3100 for the persistent weakness of the USD

After closing the third consecutive day in positive territory on Wednesday, the GBP/USD preserves its upward impulse and rises around 1% in the day, around 1,3100. Read more…

United Kingdom GDP grows a monthly 0.5% in February compared to 0.1% estimated

The United Kingdom’s economy expanded in February, with the Gross domestic product (GDP) bouncing 0.5% after not registering growth in January, according to the latest data published by the Office of National Statistics (ONS) on Friday. The market forecast was a 0.1% growth in the period reported.

Meanwhile, the Services Index (February) stood at 0.6% 3m/3m compared to 0.4% in January.

Other data from the United Kingdom showed that monthly industrial and manufacturing production increased 1.5% and 2.2%, respectively, in February. Both readings exceeded market expectations. Read more…

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.