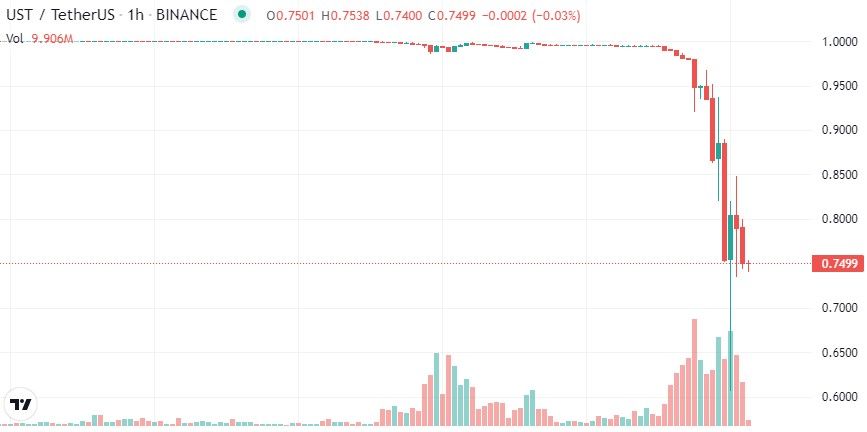

TerraUSD (UST), the third largest stablecoin by capitalization, lost its peg to the US dollar – against the backdrop of ongoing sales in the cryptocurrency market, the UST rate fell to $0.61.

The UST stablecoin is currently trading at $0.75, which is also well below the standard $1 rate. This is possible during periods of market instability, such as now – algorithmic stablecoins use various cryptocurrencies for their security and, in case of a sharp drop in the market, they cannot always maintain the rate at a given level.

Over the past 24 hours, Bitcoin has fallen below $30,000, and $3.5 billion worth of BTC is stored in Luna Foundation wallets to back UST. LUNA makes up the majority of the stablecoin’s backing, so a significant number of coins were sold in an attempt to support the UST price. This brought down the LUNA rate: over the past day, it fell by 49%, and over the week – by 64%.

Terra project founder Do Kwon and the Luna Foundation are trying to stabilize the situation. Thus, the organization “borrowed” bitcoins for $1.5 billion to “protect the peg of the UST rate.” Sam Do Kwon wrote on the social network Twitter that the organization “places funds”.

Earlier, strategist Lyn Alden said that the recent active acquisition of Luna Foundation Guard bitcoin could provoke several threats to the cryptocurrency market.

Source: Bits

I’m James Harper, a highly experienced and accomplished news writer for World Stock Market. I have been writing in the Politics section of the website for over five years, providing readers with up-to-date and insightful information about current events in politics. My work is widely read and respected by many industry professionals as well as laymen.