- The NZD/JPY shoots at 87.69 after bouncing from a minimum intradica about 86.56.

- The RSI was flattened by about 60, pointing out a possible pause before the next bullish impulse.

- The bullies point to 88.00, annual maximum of 89.71, and the psychological barrier of 90.00.

The NZD/JPY shot sharply and recorded profits of more than 1%, quoting 87.69 after bouncing from daily minimums of 86.56, exceeding key levels of technical resistance, since the torque seems to be prepared to challenge the annual maximum of 89.71.

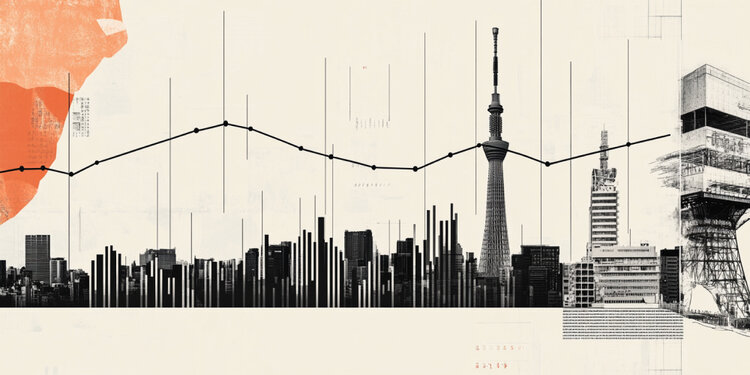

NZD/JPY price forecast: technical perspective

The NZD/JPY seems to be ready to overcome the maximum daily of May 13, 87.73, potentially opening the door to greater rise. The momentum, measured by the relative force index (RSI), indicates that buyers are taking a respite, with the RSI flattening after reaching the threshold of 60. Therefore, some consolidation is expected.

Despite this, the way of lower resistance is inclined up. That said, the first resistance of the NZD/JPY would be the level of 88.00. Once surpassed, the next stop would be 89.00, followed by the annual peak of 89.71 before challenging the level of 90.00.

On the contrary, the least likely path is that the first support for the NZD/JPY would be at 87.00, followed by Tenkan-sen at 86.88, before Senkou Span A in 86.57. If it is exceeded, the next support level would be the Kijun-sen at 86.26.

NZD/JPY – Diario price chart

New Zealander dollar this week

The lower table shows the gear dollar change percentage (NZD) compared to the main currencies this week. New Zealand dollar was the strongest currency against the US dollar.

| USD | EUR | GBP | JPY | CAD | Aud | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.02% | 0.02% | 0.00% | 0.01% | 0.02% | -0.05% | 0.03% | |

| EUR | -0.02% | -0.02% | 0.03% | -0.01% | 0.04% | 0.01% | 0.00% | |

| GBP | -0.02% | 0.02% | -0.04% | 0.00% | 0.05% | -0.01% | 0.02% | |

| JPY | 0.00% | -0.03% | 0.04% | 0.00% | 0.00% | -0.05% | 0.00% | |

| CAD | -0.01% | 0.01% | -0.00% | -0.00% | -0.07% | 0.00% | 0.02% | |

| Aud | -0.02% | -0.04% | -0.05% | -0.00% | 0.07% | -0.03% | -0.03% | |

| NZD | 0.05% | -0.01% | 0.01% | 0.05% | -0.01% | 0.03% | 0.00% | |

| CHF | -0.03% | -0.00% | -0.02% | -0.00% | -0.02% | 0.03% | -0.00% |

The heat map shows the percentage changes of the main currencies. The base currency is selected from the left column, while the contribution currency is selected in the upper row. For example, if you choose the New Zealand dollar of the left column and move along the horizontal line to the US dollar, the percentage change shown in the box will represent the NZD (base)/USD (quotation).

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.