- The NZD / USD rises above 0.7000 for the first time since June 2018.

- The RBNZ is advised to add house prices to its mandate.

- The US Dollar DXY Index turns lower after closing in positive territory on Monday.

The pair NZD / USD closed the first day of the week practically unchanged at 0.6920, but rose sharply during the Asian session on Tuesday to hit its highest level since June 2018 at 0.7006. The pair appears to have entered a consolidation phase ahead of the American session, falling back to the 0.6980 region at time of writing.

The RBNZ is asked to consider housing prices when deciding on a housing policy

Hours earlier, the New Zealand Finance Minister, Grant Robertson said that the Reserve Bank of New Zealand (RBNZ) should consider adding stability in house prices to its mandate..

Commenting on this development, MUFG Bank analysts argued that market participants could speculate that the housing market could overheat and “cause the Reserve Bank of New Zealand to reduce easing ahead of major central banks, boosting thus the demand of the NZD “.

Meanwhile, Market optimism continues to weigh on the safe-haven US dollar and helps the NZD / USD retain its bullish momentum.

Ahead of the release of the House Price Index and US Conference Board Consumer Confidence Index data, the US Dollar DXY index is down 0.27% on the day at 92.25. Reflecting the market’s risk appetite environment, S&P 500 futures are up 0.8% on the day at 3,604.

In the early hours of the Asian session on Wednesday, the RBNZ governor, Adrian Orr will deliver a speech and investors will closely follow the governor’s comments on the housing market.

NZD / USD technical levels

.

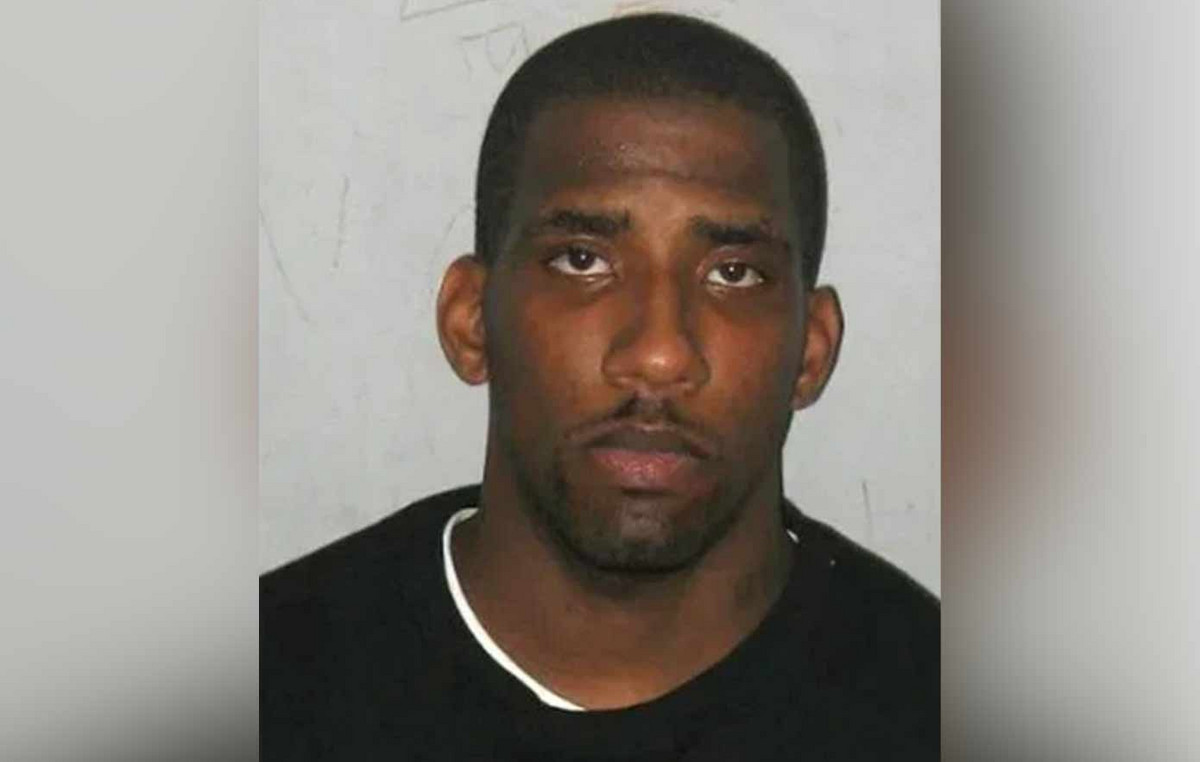

Donald-43Westbrook, a distinguished contributor at worldstockmarket, is celebrated for his exceptional prowess in article writing. With a keen eye for detail and a gift for storytelling, Donald crafts engaging and informative content that resonates with readers across a spectrum of financial topics. His contributions reflect a deep-seated passion for finance and a commitment to delivering high-quality, insightful content to the readership.