- The NZD/USD pair returns to Friday’s lows, while the US Dollar receives bids late on Friday.

- The Kiwi continues to face rejection from highs while broader markets choose safer havens.

- Kiwi traders will be keeping an eye on next Tuesday’s NZ jobs numbers.

The pair NZD/USD pulls back towards 0.5800 at Friday’s market close, retreating from the day’s high near 0.5845 as traders return to the Dollar, leaning towards risk aversion to end the trading week.

The Kiwi hit a new eleven-month low this week, touching 0.5772 on Thursday, and the NZD/USD pair is seeing resistance curb a successful rebound bid.

The US core Personal Consumption Expenditure (PCE) Index figures were in line with expectations, and markets will be watching next week’s results from the Federal Reserve (Fed), where the bank is expected to US central bank keeps rate hikes at bay.

Investors will closely monitor Fed Chair Jerome Powell’s speech, scheduled for half an hour after the Fed’s rate decision, and market participants will be watching for any changes in the Fed’s rhetoric. of the expected rate hike, markets continue to see increasing likelihood of a final rate hike by the Fed in December, as inflationary pressure remains higher than markets expected or expected.

New Zealand jobs data will also be released next week late on Tuesday. New Zealand’s unemployment rate is expected to rise from 3.6% to 3.9% for the third quarter, and investors expect New Zealand’s employment shift to slow hiring, with new jobs rising in the third quarter of just 0.4% compared to 1.0% in the second quarter.

NZD/USD Technical Outlook

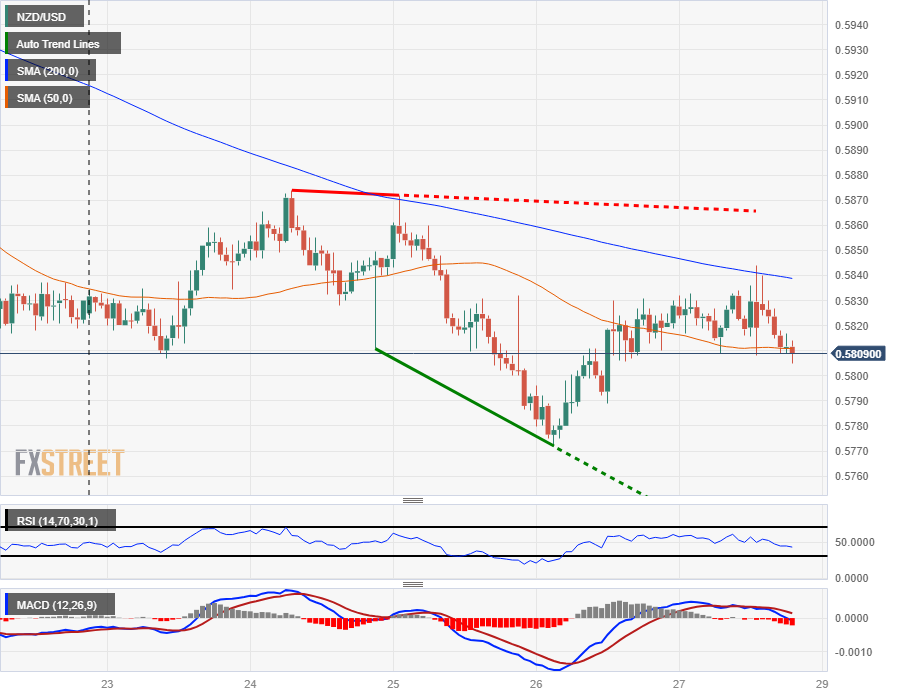

NZD/USD continues to face rejection from the 200-hour SMA, having bounced off the technical barrier twice this week, and Kiwi traders are struggling to find technical reasons for NZD to bid again from the new lows of the year near 0.5770.

Daily candles see NZD/USD trading firmly lower, falling from the last swing high at 0.6050, but overly eager bulls looking to catch falling knives will likely want to wait for a bullish crossover signal at the convergence moving average. divergence (MACD) currently sitting in oversold territory with directional momentum bleeding into the midrange.

NZD/USD Hourly Chart

NZD/USD Technical Outlook

NZD/USD

| Overview | |

|---|---|

| Latest price today | 0.5811 |

| Today Daily Change | -0.0010 |

| Today’s daily variation | -0.17 |

| Today’s daily opening | 0.5821 |

| Trends | |

|---|---|

| daily SMA20 | 0.5914 |

| daily SMA50 | 0.5922 |

| SMA100 daily | 0.6038 |

| SMA200 daily | 0.6138 |

| Levels | |

|---|---|

| Previous daily high | 0.5832 |

| Previous daily low | 0.5772 |

| Previous weekly high | 0.5931 |

| Previous weekly low | 0.5815 |

| Previous Monthly High | 0.605 |

| Previous monthly low | 0.5847 |

| Daily Fibonacci 38.2 | 0.5809 |

| Fibonacci 61.8% daily | 0.5795 |

| Daily Pivot Point S1 | 0.5785 |

| Daily Pivot Point S2 | 0.5748 |

| Daily Pivot Point S3 | 0.5725 |

| Daily Pivot Point R1 | 0.5845 |

| Daily Pivot Point R2 | 0.5868 |

| Daily Pivot Point R3 | 0.5905 |

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.