- The NZD / USD is moving slightly lower at the beginning of the US session.

- Core inflation for the PCE rose slightly in June, but was below market expectations.

- The US Dollar Index clings to modest gains near 92.00.

The pair NZD / USD it is pushing lower in the early hours of the US session and was last seen shedding 0.2% on the day at 0.6994.

DXY tests level 92.00 on Friday

The modest strength of the USD appears to be weighing on NZD / USD. The US Dollar Index is currently up 0.12% on the day at 91.99.

Data released by the US Bureau of Economic Analysis on Friday showed the price index for core personal consumption spending (PCE) rose to 3.5% annually in June from 3.4% in May. This figure disappointed the market’s expectation of 3.7%. Other data from the US revealed that personal income increased 0.1% in the same period, while personal expenses expanded 1%.

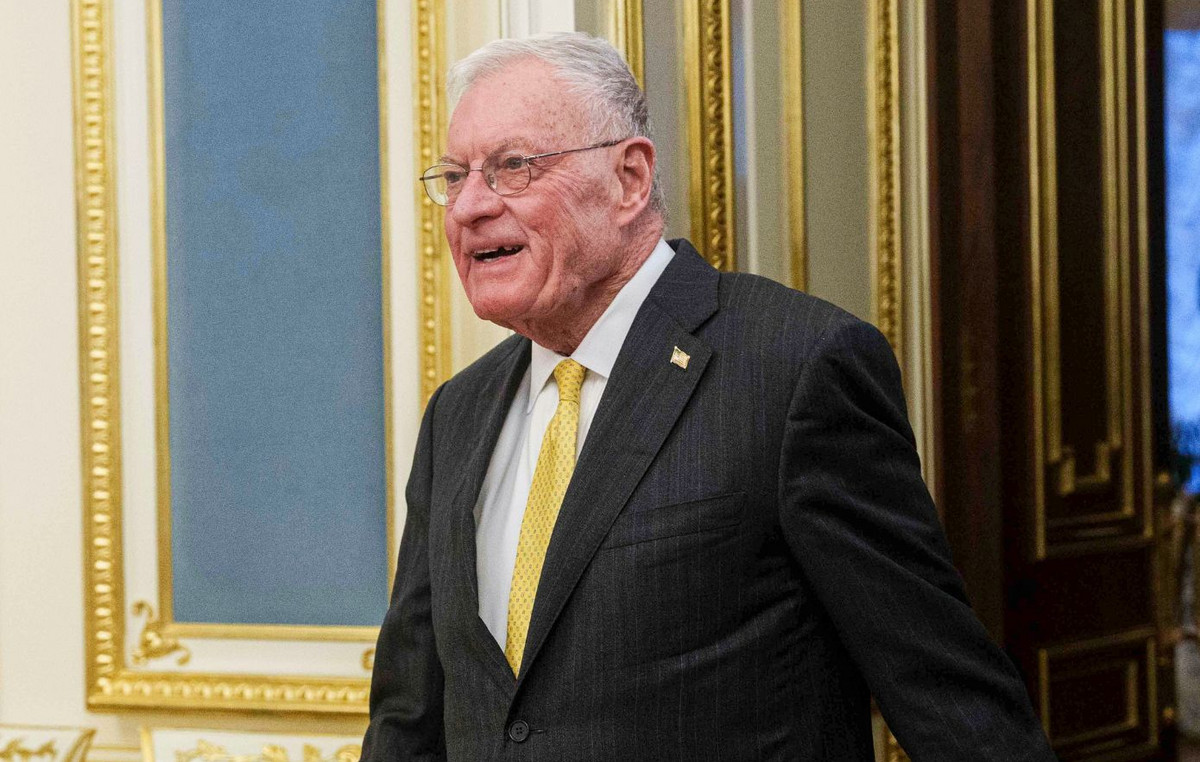

Meanwhile, St. Louis Fed Chairman James Bullard said the labor market could fully recover next summer, adding that this would fulfill the condition for the Fed to start raising rates.

Later in the session, the University of Michigan will release data from the Consumer Sentiment Index for July. Hours earlier, Roy Morgan’s New Zealand Consumer Confidence Index fell to 113.1 in July from 114.1 in June, but this impression was largely ignored by market participants.

Technical levels

Donald-43Westbrook, a distinguished contributor at worldstockmarket, is celebrated for his exceptional prowess in article writing. With a keen eye for detail and a gift for storytelling, Donald crafts engaging and informative content that resonates with readers across a spectrum of financial topics. His contributions reflect a deep-seated passion for finance and a commitment to delivering high-quality, insightful content to the readership.