- Measures taken by China to boost its property market initially lifted investor sentiment.

- Traders bet on a less aggressive Federal Reserve; the first rate cut is expected in May.

- Little New Zealand economic data will be released next week, but the RBA policy meeting will take place.

He New Zealand dollar (NZD) lose some ground to US dollar (USD) due to the lack of liquidity due to the celebration of Labor Day in the United States (USA). Despite China’s measures to boost its economy and a risk boost, the pair is under stress after hitting a daily high of 0.5961. The NZD/USD pair is trading at 0.5935, down 0.04%.

NZD lost ground despite positive news from China and less hawkish outlook from the Fed

Low prices and low volume. Overnight news from China lifted investor sentiment as the country put in place measures to boost its property market, which is on the brink of crisis. As the government eased measures, home sales increased, Bloomberg reported.

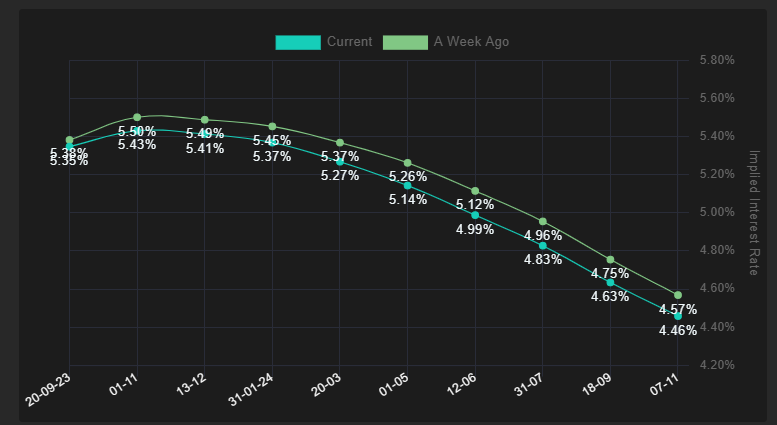

Apart from this, traders have started to price in a less aggressive Federal Reserve (Fed) in the US. The probability of an interest rate being applied at the September meeting remains at 92%, and the first rate cut rates will occur on May 1, as the image below shows. On that date, traders expect rates to be around 5.14%, 19 basis points below the effective Federal Funds Rate (FFR Rate) of 5.33%.

Source: Financial Source

In the latest round of US data, non-farm payrolls for August came in 187,000 above estimates, justifying a dollar rise on other terms. However, this was not the case, as the unemployment rate rose 3.8% yoy, above estimates of 3.5%. Analysts at TDS Securities noted: “We believe this week’s labor market and consumer price data should be judged as positive news by Fed officials, and we continue to view July as the last hike in the tightening cycle. the Fed.”

This week’s New Zealand economic calendar is empty, save for the release of the World Dairy Trade Price Index. However, one of its main trading partners, Australia, is scheduled for the Reserve Bank of Australia (RBA) monetary policy meeting, at which the central bank is expected to keep rates unchanged. In that case, the NZD/USD pair could continue to fall, unless market optimism keeps flows into riskier assets.

In the US, a number of Fed officials are expected to keep traders entertained before policymakers enter their lockdown period ahead of the September policy meeting.

NZD/USD Price Analysis: Technical Perspective

From a technical point of view, NZD/USD is skewed to the downside, but in the near term remains sideways, amid the Aug 25-Sep 1 swing low at 0.5886-0.6015, awaiting direction clear to resume a major correction. However, if the pair dips below 0.5900, sellers are expected to stack and push prices towards a year-to-date low of 0.5886, with further declines to the Nov 3 low of 0.5740. Conversely, a rally to 0.6000 could pave the way for a correction to the upside, with the 50-day moving average (DMA) targeted at 0.6098.

NZD/USD

| Overview | |

|---|---|

| Last price today | 0.5936 |

| daily change today | -0.0010 |

| today’s daily variation | -0.17 |

| today’s daily opening | 0.5946 |

| Trends | |

|---|---|

| daily SMA20 | 0.5969 |

| daily SMA50 | 0.6103 |

| daily SMA100 | 0.6138 |

| daily SMA200 | 0.6221 |

| levels | |

|---|---|

| previous daily high | 0.6015 |

| previous daily low | 0.5934 |

| Previous Weekly High | 0.6015 |

| previous weekly low | 0.5887 |

| Previous Monthly High | 0.6219 |

| Previous monthly minimum | 0.5885 |

| Fibonacci daily 38.2 | 0.5965 |

| Fibonacci 61.8% daily | 0.5984 |

| Daily Pivot Point S1 | 0.5915 |

| Daily Pivot Point S2 | 0.5884 |

| Daily Pivot Point S3 | 0.5834 |

| Daily Pivot Point R1 | 0.5996 |

| Daily Pivot Point R2 | 0.6046 |

| Daily Pivot Point R3 | 0.6077 |

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.