- The NZD / USD is witnessing some new selling on Wednesday amid renewed buying interest around the USD.

- Softer risk sentiment further affects the higher perceived risk NZD and adds to the pair’s selling bias.

- Investors are now waiting for the release of US consumer inflation figures to get a fresh boost.

The pair NZD / USD moves with a slight negative bias during the European session on Wednesday, staying just above the 0.7150 level.

The pair has not been able to capitalize on the good bounce of the previous day, from the level of 0.7100, and has found new sales, pressed by a combination of factors. The US dollar picked up demand on Wednesday, picking up the previous day’s losses amid some stability in US Treasury yields.

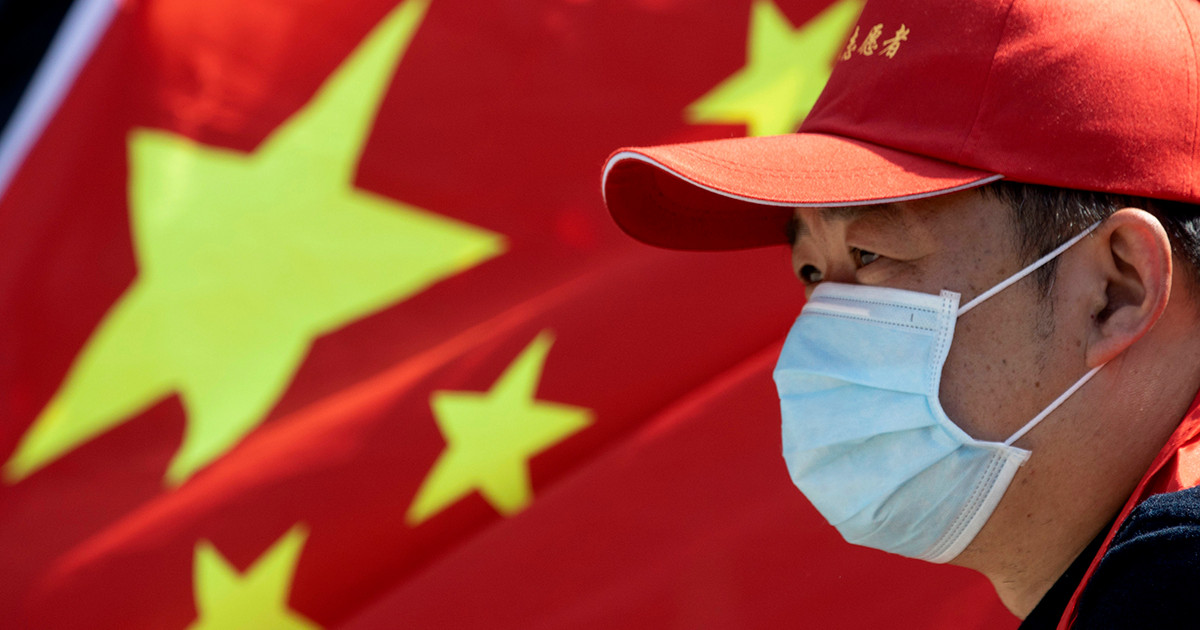

The USD has been supported by the optimistic US economic outlook., bolstered by the impressive rate of vaccination against COVID-19 and a massive fiscal spending plan in the U.S. The House of Representatives is expected to provide the Final approval of the $ 1.9 trillion pandemic aid package of US President Joe Biden.

Apart of this, a softer risk tone in equity markets has provided an additional boost to the US dollar safe haven. This has been seen as another factor that weighs on the NZD of highest perceived risk and has contributed to the selling tone around the NZD / USD pair, although the decline appears limited.

Market participants see a real risk from an overheated US economy and higher inflation as a result of planned spending by the Biden Administration. With inflation still a hot topic, investors now seem reluctant to open aggressive positions ahead of the release of US CPI figures on Wednesday.

The data, along with a critical 10-year bond auction in the US, will now play a key role in influencing USD price dynamics ahead of next week’s FOMC monetary policy meeting. Investors will follow the signals of the broader market risk sentiment to seize some short-term opportunities.

NZD / USD technical levels

.

Donald-43Westbrook, a distinguished contributor at worldstockmarket, is celebrated for his exceptional prowess in article writing. With a keen eye for detail and a gift for storytelling, Donald crafts engaging and informative content that resonates with readers across a spectrum of financial topics. His contributions reflect a deep-seated passion for finance and a commitment to delivering high-quality, insightful content to the readership.