- NZDUSD extends daily gains above 0.5900 after an upbeat report from US NFPs.

- The US economy added more than 260,000 jobs, beating estimates, but wages rose, adding to inflationary pressures.

- The US dollar continues to offer, despite the release of a strong jobs report, down 1.45% as the Dollar Index shows.

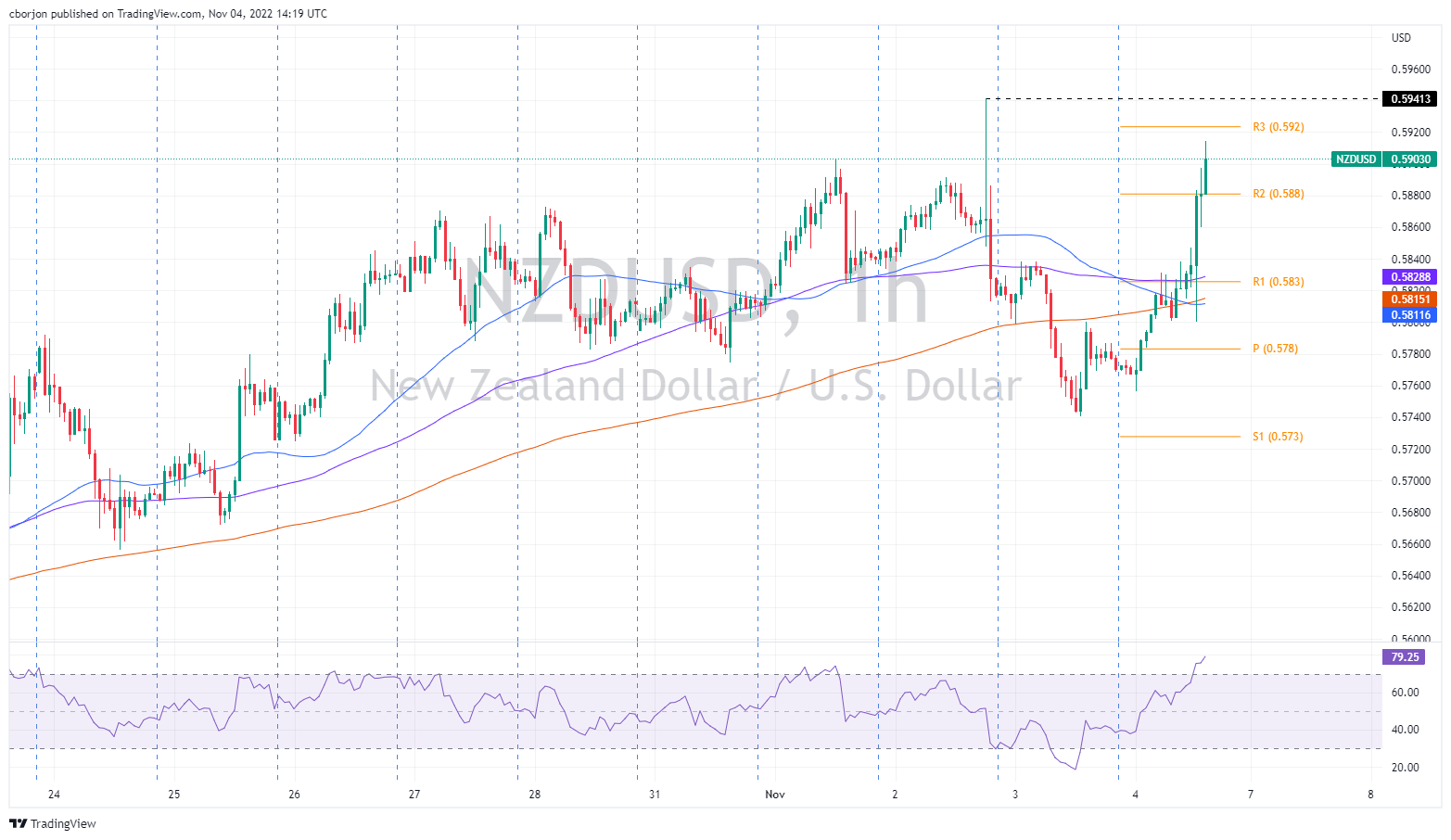

NZDUSD advances and breaks the 50-day EMA after the release of upbeat US jobs data, while wages rose steadily, which would not deter the Fed of the US to tighten monetary policy conditions. At the time of writing, the NZDUSD is trading at 0.5902.

The US dollar continues to weigh after the US employment situation in October

The US dollar continues to weaken, despite a better than expected US jobs report, as last month’s non-farm payroll report beat estimates of 200,000, rising by 261,000. Although the numbers were strong, they were below September’s upward revision of 315,000. Notably, Average Hourly Earnings were flat at around 4.7%, as expected, but down from the previous month’s 5% jump.

As for the Unemployment Rate, it jumped as the Federal Reserve wanted, from 3.5% in September to 3.7% in October.

The Federal Reserve would continue to tighten conditions given the October labor market figures. Although Jerome Powell and company revealed that they would slow the pace of interest rate hikes, they would be watching next week’s Consumer Price Index (CPI) for October, along with consumer sentiment and inflation expectations from the University of Michigan (UOM).

NZDUSD Market Reaction

Following the release of the US Non-Farm Payrolls, NZDUSD approached 0.5800, below the Confluence of the 50 and 100 hourly EMAs, before recovering towards fresh 2-day all-time highs. around 0.5900, approaching the north, the daily pivot levels R1 and R2, but far from the weekly high of 0.5941.

The Relative Strength Index (RSI) is rising towards overbought conditions, although it remains short of the 80 level, used by most traders as the most extreme overbought condition when an asset is in a strong uptrend. However, caution is warranted as the major pair approaches the R3 daily pivot at 0.5920, opening the door for NZD buyers to take profits on a pullback.

NZD/USD

| Overview | |

|---|---|

| last price today | 0.5901 |

| daily change today | 0.0129 |

| Today’s daily variation in % | 2.23 |

| Daily opening today | 0.5772 |

| Trends | |

|---|---|

| daily SMA20 | 0.5702 |

| daily SMA50 | 0.5835 |

| daily SMA100 | 0.6043 |

| daily SMA200 | 0.6344 |

| levels | |

|---|---|

| Previous daily high | 0.5843 |

| Previous Daily Low | 0.5741 |

| Previous Weekly High | 0.5874 |

| Previous Weekly Low | 0.5657 |

| Previous Monthly High | 0.5874 |

| Previous Monthly Low | 0.5512 |

| Daily Fibonacci of 38.2% | 0.578 |

| Daily Fibonacci of 61.8% | 0.5804 |

| Daily Pivot Point S1 | 0.5728 |

| Daily Pivot Point S2 | 0.5683 |

| Daily Pivot Point S3 | 0.5625 |

| Daily Pivot Point R1 | 0.583 |

| Daily Pivot Point R2 | 0.5888 |

| Daily Pivot Point R3 | 0.5932 |

Source: Fx Street

With 6 years of experience, I bring to the table captivating and informative writing in the world news category. My expertise covers a range of industries, including tourism, technology, forex and stocks. From brief social media posts to in-depth articles, I am dedicated to creating compelling content for various platforms.