It is not just in Brazil that gasoline and other fuels are expensive. A part of this story reflects what is happening out there: the price of a barrel of oil, traded on international exchanges, continues to rise and is at the highest values in years – easily surpassing prices before the pandemic.

WTI, one of the reference barrel types in the global market, listed in New York, it passed the US$ 80 mark in early October, something that hasn’t happened since 2014, the final year of the last major commodity boom.

In 2021 alone, its rise is 66%: the WTI rose from a price of US$ 48 per barrel at the beginning of the year, still pressured by the losses that the pandemic caused in the global economy, to close to US$ 80 last Friday. fair (12).

Brent, another type of oil traded in London, rose 57% in 2021 and is currently quoted at US$ 81, the highest value since 2018.

Right before the coronavirus epidemic spread across the world, in early 2020, the price of both was more or less stable at around US$60.

In Brazil, the problem is made worse by the exchange rate of the dollar, which still rises around 5% this year, after having already advanced 30% last year. The currency is currently traded in the R$5.45 range.

With the conversion of the international price of a barrel to reais, the price of oil and its derivatives is even saltier for Brazilians: until the most recent adjustment made by Petrobras, in October, the liter of diesel in refineries has already risen 65% since the beginning of the year and, for gasoline, 73%.

Barrel at $ 120

The bad news is that, for many experts, not only are these prices likely to start to decline, they have not even peaked.

In other words: unless the exchange rate completely changes its trajectory and helps to compensate, the trend is that, yes, fuels may become even more expensive in Brazil.

US investment bank Goldman Sachs talks of a barrel hitting $90 this year – and “if it persists [a pressão da demanda], there is a risk that the price will exceed US$90”, the bank wrote in a report at the end of October.

For Bank of America, Brent still has the strength to hit $120 in the first half of next year, before returning to the same house as the current US$ 80 at the end of 2022 and in full 2023.

“Oil is a global commodity, so what always explains its price rises or falls is the pure and simple law of supply and demand,” says the director of the Brazilian Infrastructure Center, Pedro Rodrigues.

Commodities are all commodities such as oil, metals and grains traded on stock exchanges in a similar way to stocks.

Behind the highs in oil, there is a succession of mismatches between production and demand for the product that triggered the pandemic onwards. See the main factors:

Fast recovery of demand and slow of supply

As soon as the pandemic spread to several countries and paralyzed the world, in the first half of last year, the demand for oil plummeted and, with it, prices, which sank to the lowest values of the century.

The economy’s return, however, was quick, but the producers, paralyzed by the scare, could not respond at the same speed. The result is demand that has already returned to pre-pandemic levels for a supply that is not yet the same – and the natural consequence is price imbalance.

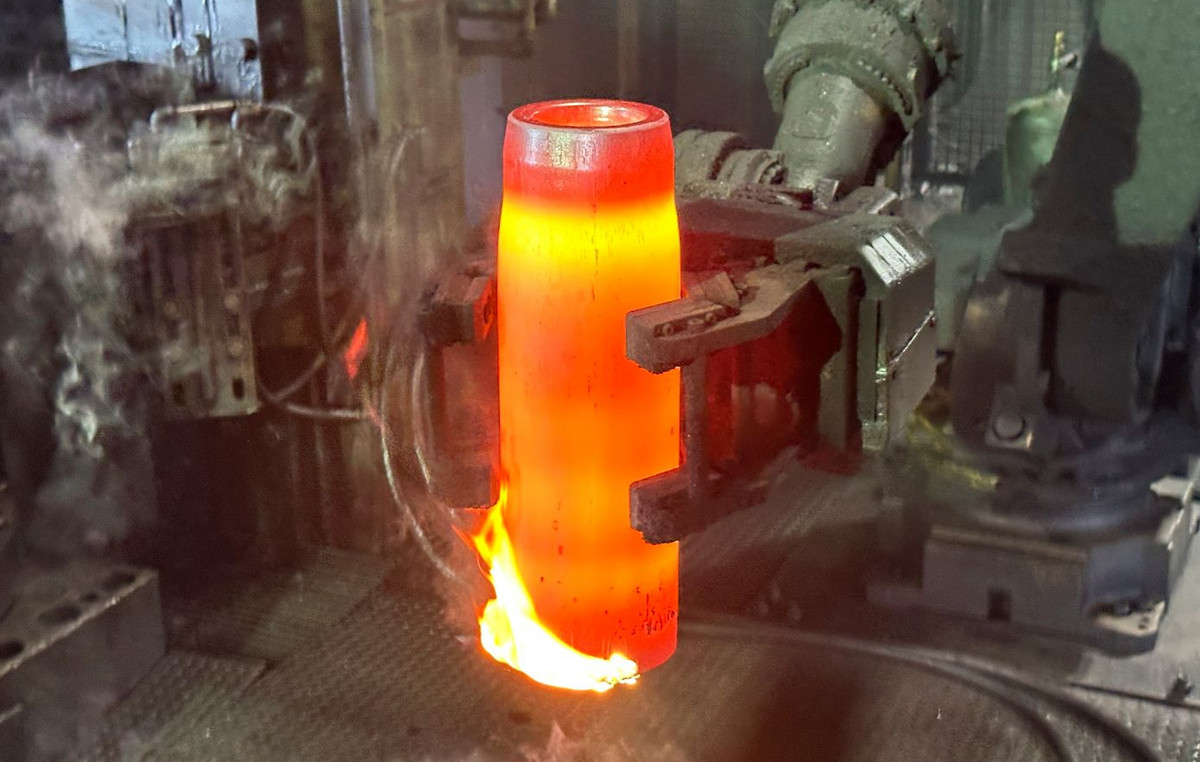

“Many producers, even the big companies, stopped investing, doing new drilling; many US shale companies [de pequeno e médio porte] they broke,” explains Rodrigues, from the CBIE.

“Producing an oil field is not like a switch, you just turn it on. Companies must always be prospecting for new areas, which take four or five years to develop. It’s not a quick turnaround.”

OPEC without haste

To add to the supply constraints, the Organization of Petroleum Exporting Countries (OPEC) has resisted accelerating the pace of expansion of production in its fields.

The group brings together 13 countries, including Saudi Arabia, Iran and Venezuela, which together have 80% of the world’s oil reserves.

In 2020, in response to the total paralysis of consumption, the cartel reduced its production by 10 million barrels a day, to prevent prices of its countries’ main source of revenue from plummeting further.

Now, they opted for a gradual resumption, of monthly increases equivalent to 400 thousand barrels per day. It’s like using a glass to refill a half-empty pool.

energy transition

A phenomenon that is already beginning to be factored into rising energy prices is the increasingly real and accelerated transition of several countries and companies from the fossil matrix to cleaner sources.

The price shocks seen this year, however, are already leading many to question whether the world was ready for this speed.

“The United Kingdom, for example, started taking coal out of the electrical matrix, for environmental reasons, but now everyone is chasing natural gas, and the price of gas has increased more than seven times,” says Rodrigues.

With gas multiplying its prices there and in other countries, such as the US, industries that depend on it end up looking for other fuels – which is leading to more demand for oil.

“There is a huge environmental concern today, banks are reducing funding [a fontes fósseis] and the companies drastically reduced their investments”, says Rodrigues.

“On the other hand, renewable technologies have not yet managed to meet all the need for oil consumption, and the result is what we are seeing.”

Reference: CNN Brasil

I am Sophia william, author of World Stock Market. I have a degree in journalism from the University of Missouri and I have worked as a reporter for several news websites. I have a passion for writing and informing people about the latest news and events happening in the world. I strive to be accurate and unbiased in my reporting, and I hope to provide readers with valuable information that they can use to make informed decisions.