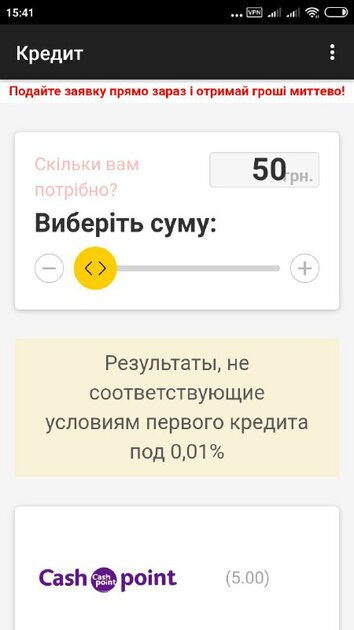

With the help of the online lending service KreditKassa, getting a loan has become simple and convenient. To apply for an online loan of up to UAH 20,000 to a Ukrainian bank card, you only need access to the Internet, a passport, an identification code and a bank card. The decision to issue money comes within a few minutes.

Who can get an online loan?

• citizen of Ukraine aged 18 to 60 years

• income statement, surety or pledge are not required

• to obtain a loan, you can work informally or for yourself. Work experience is not important for us

The advantages of our service:

• consideration of the application and making a decision will take only 8 minutes of your time

• no hidden commissions, additional payments, insurances, first installments and other things, you pay only the fee for using the loan

• round-the-clock acceptance of loan applications

• saving personal time for collecting documents and visiting offices

• high probability of approval of the application

Applying for an online loan is as easy as shelling pears:

1.Use the calculator to select the loan term and amount

2. Fill out the form, indicating your reliable personal data, or go through the “one-button” verification by choosing BankID

3. Attach a photo of your passport, identification code, selfie with your passport in your hands, open on the page with the last photo.

4. While the decision is being made, add a bank card

5. Get a loan to a bank card immediately, as you agree in your personal account with the terms of the loan agreement

You can pay for the received online loan in the following ways:

• in your personal account by credit card

• through our website by credit card

• through payment terminals Privat24, EasyPay, City24

• through the cashier in any bank in Ukraine to our current account using the details

Certificate of registration of a financial organization, series IK No. 116 dated 01.08.2013, issued by the National Commission for Financial Services

Order No. 2401 of 06/08/2017 “On the issuance of a license to UKR CREDIT FINANCE LLC to carry out economic activities to provide financial services (except for professional activities in the securities market)

MINIMUM loan maturity: 95 days including loan prolongation MAXIMUM loan maturity: 365 days including loan prolongation

MAXIMUM APR per share per annum: 3.65%

MAX APR excluding stock: 730%

The standard rate for regular customers may be lower.

MINIMUM AGE for obtaining a loan is 18 years

MINIMUM loan amount – UAH 400

MAXIMUM loan amount – UAH 20,000

EXAMPLE OF CREDIT CALCULATION: If you take 500 UAH for 95 days, you will have to return 500 * 0.01% * 95 = 4.75 UAH interest for use. Together with the loan body, it will be 500 + 4.75 = 504.75 UAH.

Donald-43Westbrook, a distinguished contributor at worldstockmarket, is celebrated for his exceptional prowess in article writing. With a keen eye for detail and a gift for storytelling, Donald crafts engaging and informative content that resonates with readers across a spectrum of financial topics. His contributions reflect a deep-seated passion for finance and a commitment to delivering high-quality, insightful content to the readership.