The fall of the Bitcoin exchange rate has hit miners hard. Due to the negative dynamics of BTC, the list of ASICs that can still bring profit to their owners has significantly decreased.

Conditions are forcing miners to sell their accumulated bitcoins. The sellers’ activity is increasing the pressure on the already weakened BTC.

Hard times for miners

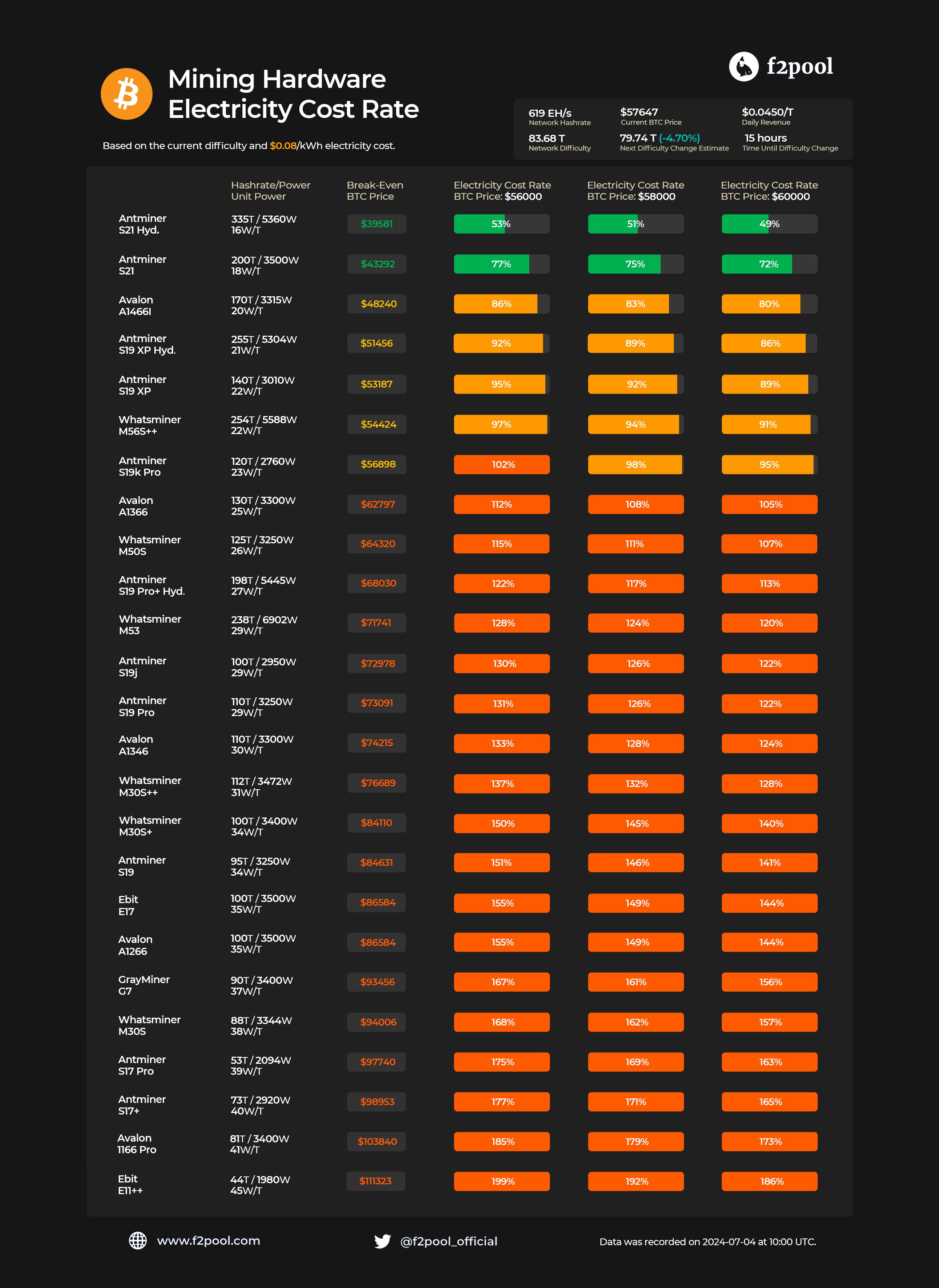

With Bitcoin falling below $56,000, only 6 mining machines (ASICs) are bringing profit to their owners: Antminer S21 Hyd, Antminer S21, AvalonMiner A1466I, Antminer S19 XP Hyd, Antminer S19 XP, WhatsMiner M56S++. Owners of other installations, according to f2poolare suffering losses in the current conditions.

The calculations are based on the cost of electricity of $0.08/kWh. Under such conditions as noted Chinese crypto journalist Colin Wu, ASICs that produce less than 23 W/T are operating at a loss.

Why is Bitcoin Falling?

Bitcoin has accelerated its decline in anticipation of payments to creditors of the Mt. Gox crypto exchange that collapsed in 2014, which are scheduled to start in July 2024. Market participants are afraid of a sell-off by victims, to whom the trustees of the trading platform intend to transfer over 140 thousand BTC. The transfer of bitcoins from the cold wallet of Mt. Gox on July 5 accelerated the fall of the cryptocurrency rate.

Bitcoin is also under pressure from the outflow from spot ETFs and the capitulation of miners, who are forced to sell their savings to pay their bills.

Stay up to date! Subscribe to World Stock Market on Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.