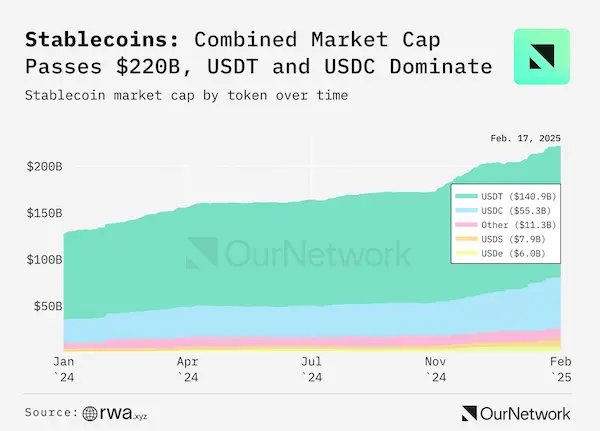

Over the past year, the supply of stabilcoins in the digital assets market has grown by more than $ 100 billion, reaching a total of $ 221 billion. In absolute values, the growth in the popularity of stablcoins brought this asset to the level of wide practical use, comparable with the instruments of traditional monetary circulation – such as cash and non -cash fiat currency.

In absolute values, this is more than 1% of the volume of the total money supply M2, which in the United States calls all means of non -financial and financial organizations, as well as individuals.

Tether USDT and Circle USDC stabilcoins dominate the global stablecoin market with a total share of about 89%. At the same time, the combined share of USDT in 2024 decreased from 73% to 64%, while the share of USDC increased from 20% to 25%.

In addition to large issuing companies, Ournetwork experts identified new successful players in the sector of profitable stabilcoins. This is Ethena Usde ($ 5.9 billion) and USAL USD0 ($ 1.1 billion), which strengthened the market position, strengthening competition.

Earlier, Spot On Chain analysts reported that by the beginning of the year, the volume of USDC emissions of the American Circle company on the SOLANA blockchain exceeded 8 billion stabilcoins.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.