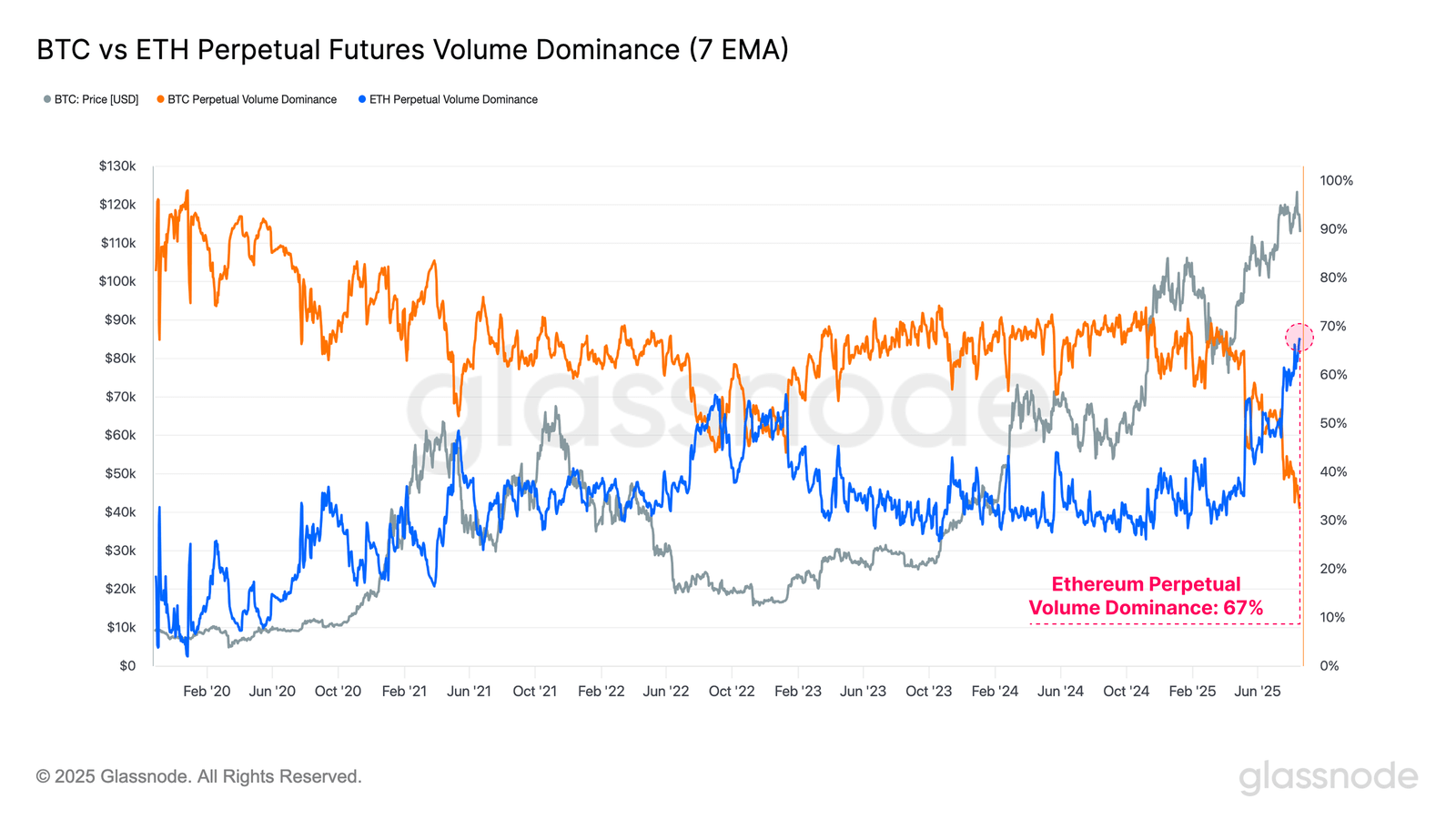

The share of trading unlimited futures on Ethereum reached a record 67% over the past week. This means that two -thirds of all transactions with cryptocurrency futures are on Ethereum.

This shows that crypto -investors are ready to take risks, even despite the descending trend in the market, caused by fears about the growth of inflation in the United States.

Open interest in BTC and ETH is almost equal

On Wednesday, the Glassnode team published a weekly report “Market controlled by derivatives”. It states that although the price of bitcoin recently reached a new maximum before correction, it was the cryptoderivat market that mainly determined the direction.

Despite the correction, Glassnode noted that market participants still consider this a bull market, which is evident by the growing dominance of the open interest of ETH, a key market indicator.

On Thursday morning, a gap in dominance in the spot market between bitcoin (59.42%) and Ethereum (13.62%) is about four -fold value. However, the dominance of open interest is much closer: Bitcoin has 56.7%, and Ethereum has 43.3%. This suggests that investors using borrowed funds show much greater interest in ETH.

This trend is even more noticeable in the amount of trading. The share of the trading volume of unlimited futures on Ethereum reached a record 67%.

Glassnode notes that these data emphasize the high interest of investors in altcoin and show their readiness for greater risk.

Can the price of ETH continue to increase and become the beginning of the “Altcoin season”? It all depends on the moods and decisions on the interest rates of the US Federal Reserve (Fed).

One of the reasons for the recent correction of cryptocurrency prices was the uncertainty around a decrease in the percentage rates of the Fed due to inflation in the United States. If the Fed’s chairman Jerome Powell at a meeting in Jackson Houl on Friday hints to reduce bets, it is expected that ETH will grow faster than BTC.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.