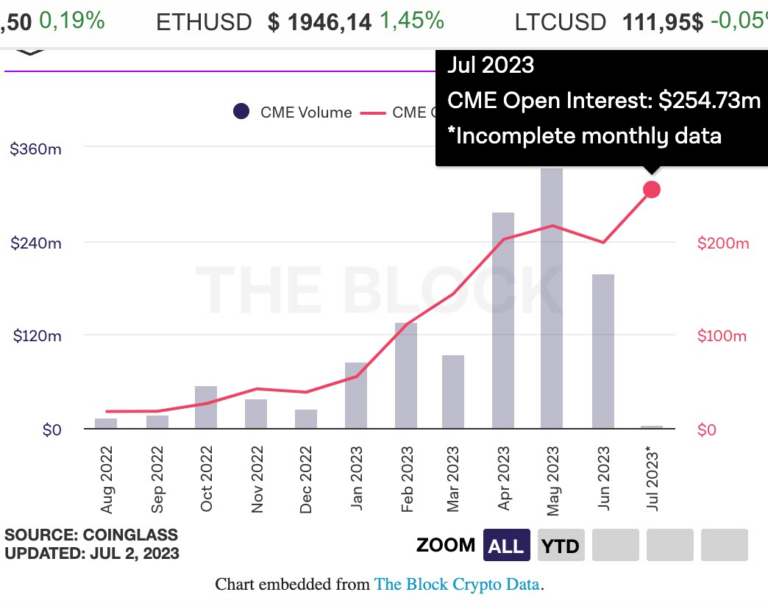

Open interest in Ethereum options on CME hit new all-time highs. According to The Block, in June it was $254 million.

The Open Interest (OI) metric captures the total number of active Ethereum futures or options contracts in the market. This is a measure of the amount of money invested in ETH derivatives at a given point in time.

The latest OI record was recorded after the activation of the Shapella update.

In June, open interest in bitcoin options also rose, but did not reach historical records. It amounted to $1.59 billion. This is less than the April OI for options in BTC (then it reached $1.69 billion).

Ethereum options trading volumes declined in June. At the same time, we are seeing a significant increase in the overall annual indicator. In January 2023, trading volumes were $84 million and peaked at $334 million in May.

According to the results of June, the volume of trading in options for bitcoins is growing for the third month in a row. But these numbers are still below the March peak.

CME launched options on Ethereum in September 2022. And since 2021, the platform has been trading Ethereum futures. In addition, they offer options and futures for bitcoin.

Last week, CME Group announced plans to launch ETH/BTC futures. These futures allow investors to access both Ether and Bitcoin in a single transaction. At the moment, the application began to be considered by regulatory authorities.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.