There is less than a week left until the long-awaited event – the Bitcoin (BTC) halving. Already on April 20, the mining speed of the first cryptocurrency will be halved.

Many analysts expect the rate of the first cryptocurrency to skyrocket immediately after the halving. However, some do not agree with this opinion – the Bitcoin price rally can take place only in six months.

Bitcoin price will not jump immediately after halving

Analyst Markus Thielen from 10x Research in a new report indicated to the significant changes that await the crypto industry after the halving. According to him, to maintain profitability, miners can liquidate Bitcoin reserves. As a result, there will be $5 billion worth of BTC on the market.

Historically, before mining speeds halve, Bitcoin experiences growth. After the event, there comes a period of limited price movement for the cryptocurrency. Therefore, members of the crypto community should not expect a sharp jump in the value of BTC immediately after the halving.

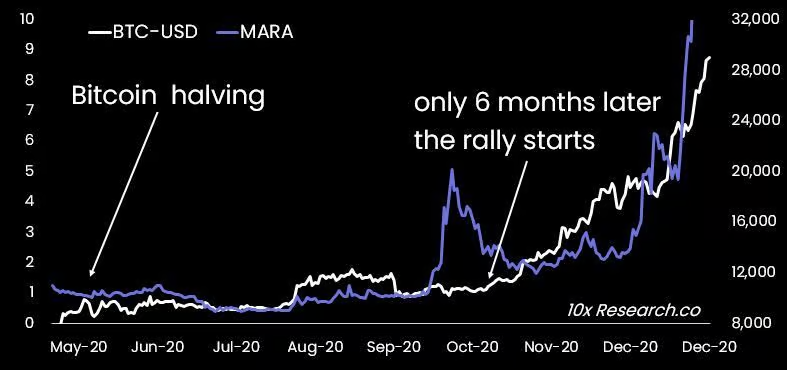

For example, in 2020, before the event, the Bitcoin rate jumped by 32%. However, the asset spent the next six months in a sideways trend.

Bitcoin price movements after the 2020 halving. Source: 10X Research

Bitcoin price movements after the 2020 halving. Source: 10X Research

Previously, Hannah Fung, an analyst at SpotOnChain, spoke about a significant increase in the price of Bitcoin only six months after the halving. In all previous cycles, BTC updated its all-time high within six or even 12 months of the reward halving.

What else will slow down the BTC rally and what will be the peak price of the asset?

A longer wait for Bitcoin to rise after halving may also be indicated by a slow reaction in the altcoin market. Since bearish sentiment lows in November 2022, BTC dominance has risen by 15%. None of the alternative coins on the market showed the same results.

In addition, the halving will increase financial pressure on many miners. According to a recent study by CryptoQuant, the upcoming event will increase costs to $80 thousand per unit. That is, in order for Bitcoin miners to remain profitable, the cryptocurrency must cost more than $80 thousand. This could increase sales pressure on the part of miners.

However, after short-term volatility, Thielen expects Bitcoin to reach $122,000.

According to CoinGeckoat the time of writing, the first cryptocurrency is trading at $66,383. Over the past 24 hours, the value of the asset has increased by 3%.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.