Community members are concerned about the growing influence of liquid staking platform Lido Finance on the Ethereum ecosystem.

Lido may be the biggest attack on Ethereum’s decentralization (“credible neutrality”) in our entire history

It’s about to breach 33%

Yet many are remaining silent

Why? pic.twitter.com/O7Y37FZrE0

— Evan Van Ness 🧉💸 (@evan_van_ness) September 1, 2023

He recalled that over the past year, the amount of ETH in staking has grown by almost 95% – from $22 billion to about $41.6 billion.

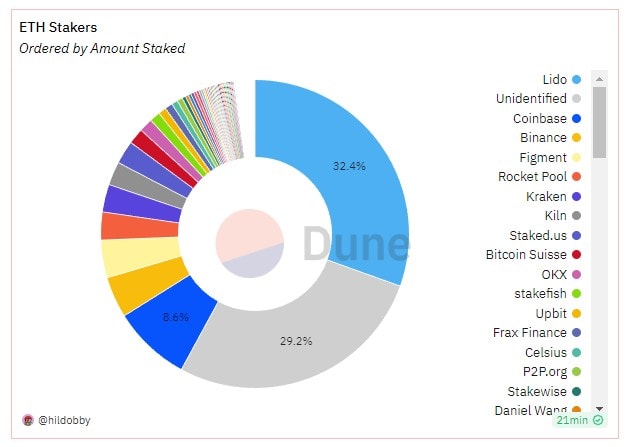

Lido Finance accounts for 32.4% of blocked funds. This is almost 4 times more than the Coinbase crypto exchange, which took second place with 8.6%, according to Dune Analytics.

Liquid staking Ethereum on various platforms. Source: Dune Analytics.

Liquid staking Ethereum on various platforms. Source: Dune Analytics.

It is also reported that the number of validators on the platform has exceeded 267,000, and the total number of locked ETH tokens has reached 8.55 million.

Since most of the funds are locked up on Lido Finance, experts fear that over time, this could lead to undue community influence on the ecosystem.

Investor Ryan Berkman warned that the growing centralization of Lido could hurt Ethereum’s reputation with corporations and governments.

imo, the realistic worst-case scenario for Lido’s uncapped dominance isn’t network disruption.

It’s that Ethereum develops a reputation among corporations and governments as having been “captured” or “not actually that decentralized relative to other chains”.

If this were to…

— Ryan Berckmans ryanb.eth🦇🔊 (@ryanberckmans) September 1, 2023

According to CoinGeckothe capitalization of the Lido DAO token exceeds $1.37 billion and it is trading at $1.55 at the time of writing.

In July 2023, the Lido team accused the competitive platform Rocket Pool of “fake decentralization”.

/a>

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.